“When y’all think they going to announce that we going into a recession?” – Cardi B, famous hip hop artist

Forecasting the next recession has become a national pastime.

I’ve heard a recession is coming next week, month, the first quarter of 2023. Some say we are already in a recession.

Let’s break it down.

What is a Recession?

According to Investopedia, a recession is a significant decline in economic activity. Historically, a recession has been defined as two consecutive quarters of negative Gross Domestic Product (GDP) growth.

The National Bureau of Economic Research (NBER) officially declares recessions. The NBER doesn’t subscribe to the two consecutive quarters of negative growth approach. The NBER defines a recession as “a significant decline of economic activity spread across the economy lasting more than a few months.”

Talk about subjective!

In my opinion, a cleaner and more accurate definition of a recession is consumers and market participants change their appetites for risk.

During good economic times, a rational person might decide to embrace risk.

“Let’s take out a loan, buy a parcel of land, and build some luxury condos.”

During a recession, the same rational person might decide to shun risk.

“Let’s hunker down. I don’t want to take risk in this environment.”

Changes in risk appetites can help us understand how good times often sow the seeds of trouble in the future.

Our May 1, 2019 post, “Stability Breeds Instability,” touches on this phenomenon…

“Stability breeds instability is the idea that as people feel good about current economic prospects they tend to consume, take on debt, speculate, etc. The risk-seeking behavior can create imbalances or excess leading to economic instability.”

Each recession is unique, but the root cause often comes from reckless capital allocation during good times.

There’s an old banker quote that sums this up nicely…

“The worst loans are made during the best times.”

Why are People Enamored with Recession Talk?

1. Looking to find common ground or break the ice? Drop some hot recession talk.

The economy and financial markets affect virtually everyone. Talking about the economy is akin to strangers talking about the weather.

2. People love to talk about train wrecks. It makes for more interesting conversation.

Here’s a snip from our July 22, 2021 post, “Intoxicated with Pessimism,”…

“Tell someone that everything will be ok and they’ll shrug you off. Tell someone they’re in danger and they’ll hang on your every word.” – Morgan Housel

The financial media feeds off this human quirk. Remember, they are incentivized to get you to click, read, and watch. It’s not an accident that the majority of news coverage, financial and otherwise, is negative.

3. People want to feel in control. The thinking is that someone out there knows what happens next. This often leads down a path of seeking narratives that jive with their view of the world. If a person is pessimistic by nature, they seek out others who share their gloom.

How Does a Recession Impact Stock Prices?

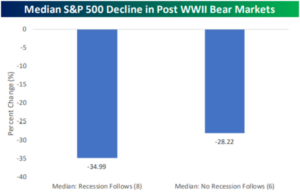

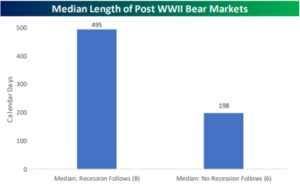

We can look at recent history (post WWII) to evaluate bear market returns during a recession vs. no recession.

Source: Bespoke Investment Group

The above chart shows median S&P 500 returns during a bear market (defined by a -20% drop) with a recession (left bar) and without a recession (right bar).

Source: Bespoke Investment Group

The above chart shows median length of a bear market with a recession (left bar) and without a recession (right bar).

Based on the 14 bear markets post WWII, it would seem recessions can cause stocks to fall further and the pain to last longer (for additional context, check out Pure’s June Market Commentary video).

In summary…

• People like to talk about recessions because economic activity and the stock market affect virtually everyone.

• In our opinion, a recession is simply a change in consumers’ and market participants’ risk appetites.

• Based on recent history, recessions can make stock market drops steeper and last longer.

For more reading on how you can navigate difficult market environments, check out…

Mitigating Damage without Playing the Market Oracle