“People talk about this concept like foreign countries can just choose not to do business with the U.S. Dollar. Sure, they can. In doing so, they’d lose their largest customer.” – Cullen Roche, Orcam Group.

On April 4th 2023, a former president said the dollar is collapsing.

Mainstream news outlets are doing segments on the end of dollar dominance.

The Brazilian Premier is calling for the end of dollar denominated trade.

The French President wants to reduce dependency on the dollar.

Brazil, Russia, India, China, and South Africa are reportedly working on a new currency to replace the dollar.

It’s beyond my pay grade to make absolute proclamations on global payments, trade, and reserve currency status. However, we can look at the facts to unpack a narrative that seems to flare up every few years.

Is there merit to the “end of King dollar talk” or is it nonsense?

First off, predictions of the greenback’s demise is hardly a new thing…

Source: Brent Donnelly, Michael Antonnelli

The above article is from 1975 outlining the Organization of Petroleum Exporting Countries (OPEC) plan to de-link from the U.S. dollar.

Source: The Economist

The above article is from 2004 warning of the potential loss of the reserve currency status of the dollar.

Source: ForeignPolicy.com

The above article from 2009 attempts to debunk the “countries are conspiring to dump the dollar” narrative that emerged coming out of the Great Financial Crisis.

Source: Fox Business

The above captures the latest version of the greenback’s predicted dethroning.

———————————————————————————————————————————–

Why does this narrative keep rearing its head? Here are some of the popular theories…

- Weaponization of the USD i.e. shutting out hostile governments from the United States financial system

- Fiscal recklessness – record U.S. budget deficits

- Monetary policy shenanigans – Federal Reserve creating boom & bust cycles through their manipulation of interest rates

- The emergence of Bitcoin and other digital currencies

- Political dysfunction (debt ceiling circus, etc.)

To be fair, many of these developments have merit. It’s possible the U.S. dollar could lose its status as the global reserve currency.

However, these massive inflection points often take decades or even centuries.

In our opinion, the death of the dollar is greatly exaggerated.

——————————————————————————————————————————-

Natural fluctuations in exchange rates shouldn’t be confused with the emergence or demise of any currency. For example, the U.S. dollar appreciated vs. a basket of global currencies during the Fed’s aggressive tightening campaign in 2022. This year, the greenback has depreciated vs. the same basket of global currencies.

Such currency movements are normal and should not be confused with the demise of anything…

Source: CNBC

The above chart shows the U.S. dollar index, which measures the greenback vs. the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc. Despite the dollar’s decline vs. a basket of currencies, the greenback is still higher than any point during the past four years.

There’s a misconception that the bulk of trade occurs between countries. Headlines such as “China reduces trade with the United States” are common, but show a misunderstanding of how trade works.

Individuals and corporations make up the bulk of trade. Rational humans are free to trade in whatever currency that suits them. Governments might engage in trade for national security or defense purposes, however, this still involves private business (think Boeing, Lockheed Martin, Northrop Grumman, etc.).

Donald J. Bourdreaux of the Hinrich Foundation sums this up nicely…

“The very notion of ‘international trade’ causes us to miss the essential reality of trade, which is always flesh-and-blood individuals bargaining and exchanging with each other in ways that each person judges to be in his or her best interest.” (source: Countries Don’t Trade by Donald J. Bourdreaux).

In other words, individuals, corporations, and governments choose to trade & hold U.S. dollars. There’s nothing stopping them from trading in other currencies.

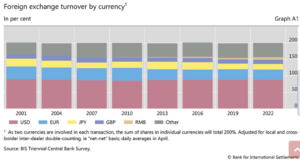

The below chart shows foreign exchange turnover over the past 20+ years…

Source: Bank for International Settlement, BIS Triennial Central Bank Survey, Jeffrey Kleintop

The above graph shows foreign exchange turnover (buying/selling of foreign currency) for the U.S. dollar (USD, red), Euro (EUR, blue), Japanese Yen (JPY, yellow), British Pound (GBP, purple), Chinese Yuan (RMB, beige), and all other currencies (gray). The US dollar was involved in nearly 90% of global foreign currency (FX) transactions, making it the most traded currency in the world. Notice how stable the dollar’s transaction volume (red) has been over the past 20 years.

———————————————————————————————————————————–

Why is the American dollar the world’s reserve currency? There are a few main reasons…

Liquidity – it’s easy to convert dollars to other currencies. The greenback is readily accepted as a medium of exchange.

Capital Markets – the United States is home to highly functional capital markets. According to Marc Chandler, Strategist at Bannockburn Global Forex, $7.5 trillion of currency flows through U.S. markets per day. For context, global trade is less than $30 trillion per year.

Stability – time & again, when the $%&* hits the fan, investors want to own U.S. dollars & assets (look no further than the above chart showing the $’s rise in 2022).

American Consumer – We buy a ton of stuff and foreign companies want to sell to the U.S. consumer.

Cullen Roche of Orcam Capital thinks the American consumer is the driving force behind the dollar’s reserve currency status…

“The main reason the USD is the world’s reserve currency isn’t because of ‘petro dollars’ and Bretton Woods. The U.S. consumer is the wealthiest in the world and foreign countries import dollars in exchange for doing business with the world’s biggest consumer.”

Innovation – American innovation and entrepreneurial spirit is alive and well. Foreign investors want to own and do business with American companies. Make no mistake, every country wants to create their own Apple, Amazon, and Google.

Military Might – the United States has the most advanced & potent military on the planet.

Jared Dillion of “The Daily Dirtnap” points to the open seas as a reason the dollar isn’t going anywhere.

“It is not going to happen anytime soon, and the only way it does happen is if the United States loses a naval war.”

——————————————————————————————————————————-

The bottom line is the U.S. economy is extremely productive compared to other foreign economies. Back to our friend Cullen Roche who proclaims…

“The United States is outrageously productive and wealthy compared to foreign countries. It’s not a conspiracy theory. The U.S. economy is just better than all the others. By a lot.”

Let us know what you think about the U.S. Dollar’s reserve currency status at insight@pureportfolios.com

Thanks for reading!