“There’s always a bull market somewhere” – Jim Cramer, CNBC Mad Money

This marks the first and last time we quote Jim Cramer. He spews mostly nonsense and 99.9% of the investing public would be better off tuning him out. However, there’s some truth to his trademark sign-off… “There’s always a bull market somewhere.”

During the tech bubble of the early 2000s, fixed income posted three straight years of nearly double digit returns (2000, 2001, 2002).

During the Financial Crisis of 2008, domestic and foreign investment grade bonds posted mid-signal digit returns. Gold provided a safe-haven returning roughly 5%.

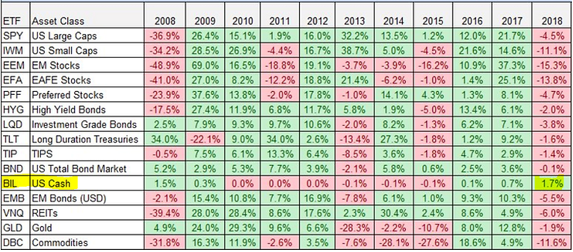

In 2018, there was no place to hide. Bonds were mostly negative for year (although they had a year-end rally). Gold was negative for the year and followed a similar return path as bonds. Cash was the only major asset class to post a positive return for the year.

Source: Pension Partners

The above graphic shows asset class returns measured by popular ETFs. Other than cash, 2018 (far right column) was a sea of red for all major global asset classes. This was quite literally the opposite of 2016 and 2017.

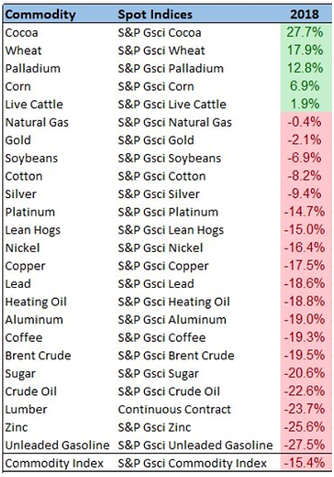

Source: Pension Partners

The above graphic shows an array of commodity returns in 2018, including precious metals.

Source: Pension Partners

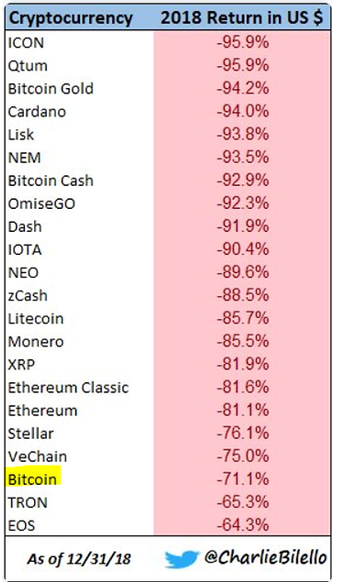

The euphoric rise of every major cryptocurrency crashed to a halt in 2018.

Source: Pension Partners

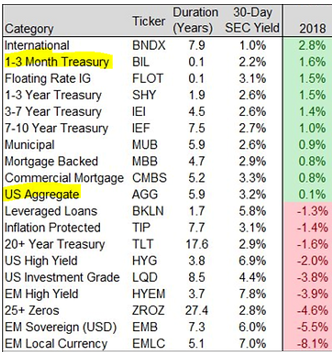

Bonds did their best to rally toward the end of year, but still were a mixed bag. Investors gravitated toward high quality vs. lower quality/speculative issues.

Source: Pension Partners

Source: Pension Partners

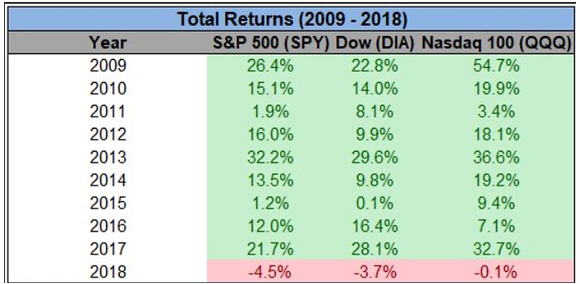

All good things come to an end. It feels like the U.S. markets were down more than 4.5% due to the violent ~20% move in Q4.

What did we learn?

- 2018 was an odd year on many levels (market swings, politics, global markets)

- Diversification did not work in 2018. In our opinion, this is an exception to a sound investment principle

- Cash is the safest asset to hold in the short-term, but it’s the riskiest in the long-term (due to loss of purchasing power)

- Healthy markets go up and down, it’s okay to play defense during poor market environments

- Bonds might be boring, but you will be glad to own them if things get worse

Make sure to tighten up the things you can control. In other words, take the low hanging fruit.

Let’s make 2019 a great year!