The traditional high-fee advisor is a thing of the past.

It's time for a modern approach to wealth

management. We offer a low-fee, personalized

service for investing & planning.

Divider

This isn't a hobby. We obsess about client outcomes

Lisa Lisalinnenkohl28/01/2023

This is personal

Pure Portfolios is a fiduciary. Placing client interests

first isn’t a question; it is our standard.

If you’re tired of large profit-seeking investment managers, banks, brokers, and traditional financial advisors who don't prioritize you, you have come to the right place.

Investing

We use the latest technology to create a personalized strategy that will help manage risk, mitigate human bias, and boost tax-efficiency. We call it evidence-based investing.

Diversification

Most of our clients are retired (or about to retire) and can't stomach a massive portfolio drawdown. Our investment process is designed to build risk aware portfolios and mitigate downside market shocks.

Rules Based

Humans can make emotional decisions during times of market stress. We have a formulaic process for making portfolio adjustments that doesn't rely on gut instincts, human intuition, or short-term noise.

Risk Capacity

Good investing is not waiting until markets crash and then making adjustments. Prudent investing starts with identifying an investor's risk capacity and building a portfolio that reflects a range of acceptable outcomes.

Retirement

Retirement planning isn’t just about saving—it’s about creating a strategy to sustain your lifestyle and achieve your long-term goals. Our data-driven approach helps you optimize income sources, manage risks, and ensure financial confidence throughout retirement.

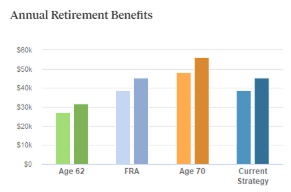

Social Security

Maximize your benefits by determining the best claiming strategy based on longevity, spousal benefits, and tax impact.

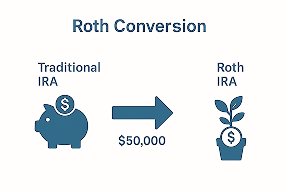

Roth Conversions

Strategically convert pre-tax assets to Roth IRAs to reduce future taxes and improve retirement cash flow.

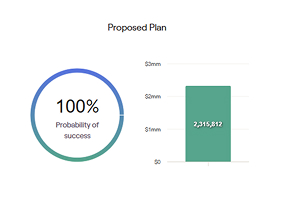

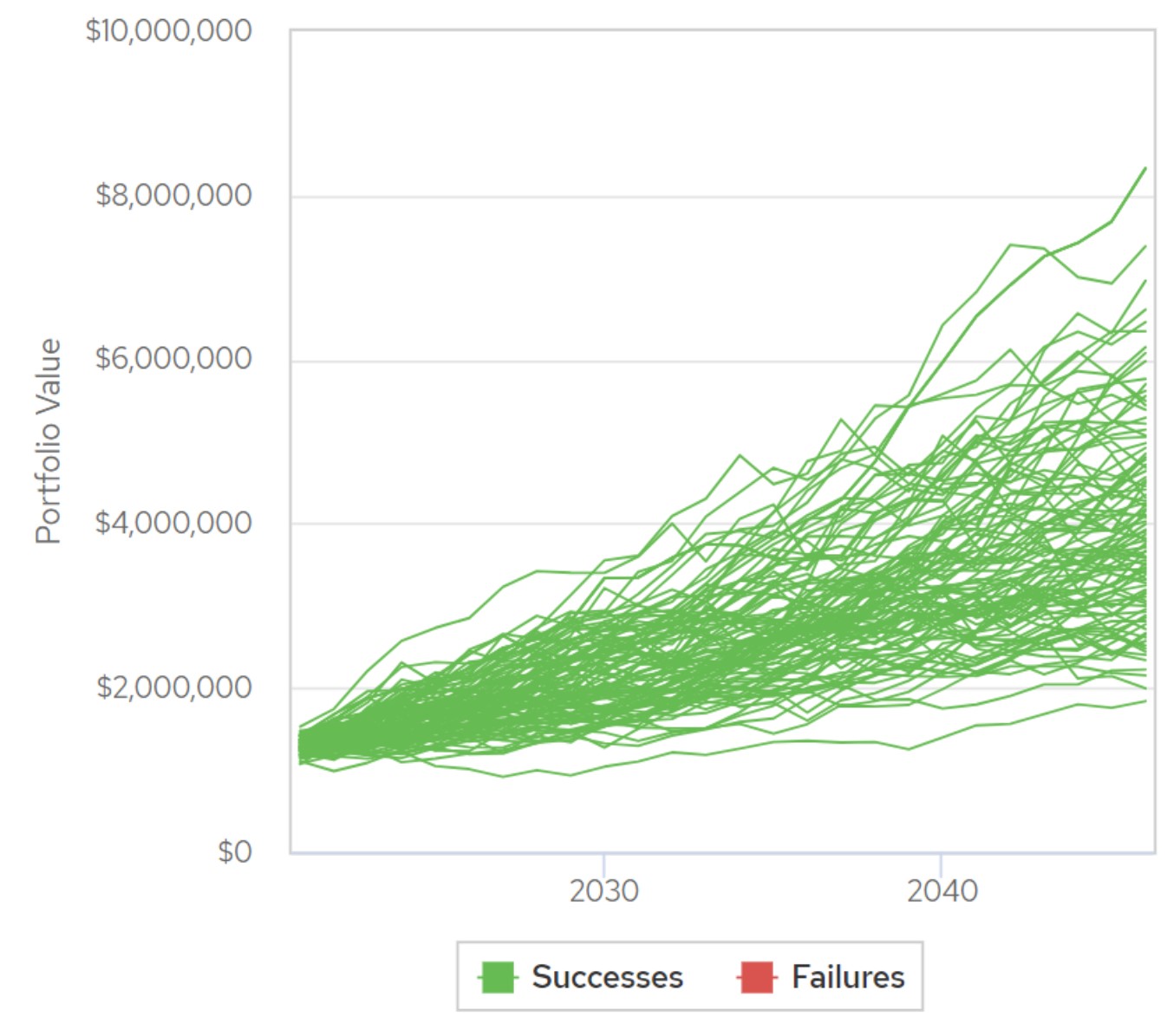

Monte Carlo

Use data-driven projections to test the resilience of your retirement plan under various market conditions.

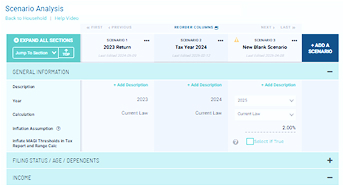

Taxes

Effective tax planning minimizes liabilities and maximizes after-tax wealth, ensuring you keep more of what you earn. Our proactive strategies help optimize investments, retirement withdrawals, and estate plans for tax efficiency.

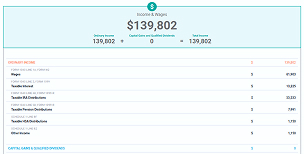

Holistiplan

Identify savings opportunities and optimize your tax strategy.

Tax-Efficient Investment Strategies

Optimize asset location, tax-loss harvesting, and charitable giving to minimize taxes and maximize after-tax returns.

Tax Projections

Model future tax liabilities to proactively plan for Roth conversions, withdrawals, and bracket management.

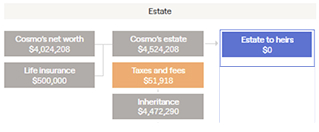

Estate

Estate planning ensures your wealth is preserved, protected, and passed on according to your wishes. We help you develop a strategic plan to minimize taxes, avoid probate, and provide for your loved ones with confidence.

Minimizing Estate Taxes & Probate

Structure your estate to reduce tax liabilities and streamline wealth transfer to heirs.

Charitable Giving Strategies

Maximize your impact while reducing taxes through donor-advised funds, qualified charitable distributions, and strategic gifting.

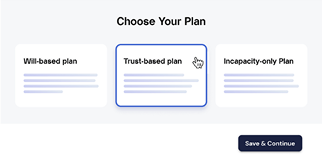

Estately

Utilize a digital estate planning tool to easily create wills, trusts, and healthcare directives for a seamless estate plan.

Other Stuff

We understand money can be confusing and questions will come up. Pure Portfolios acts as your financial concierge to help you make better decisions. Our same business day response times and trove of educational content is a call or click away.

Transparency

24/7 Access to your client portal to view portfolio holdings, transactions, and net-of-fee performance.

Responsiveness

You’re not talking to a robot, a real human will get back to you on the same business day.

Communication

We talk to you even when we’re not talking to you. We send a weekly newsletter with our blog, podcast and educational content in addition to our formal meetings.

Explore the next steps

Simplify your finances and solidify a plan that gets you where

you want to go.

Step 1

Fit Meeting

A quick introductory call to understand your financial goals, concerns, and whether we’re the right fit.

Step 2

Discovery

We’ll gather key documents and details about your current financial picture, including assets, income, and goals.

Step 3

Crunch the

Numbers

Our team analyzes your current portfolio, evaluates risks, and identifies opportunities for improvement.

Step 4

Actionable

Advice

We present clear recommendations tailored to your goals, including next steps to optimize your financial future.

What are Pure Portfolios’ fees?

We believe the “all-in” cost of investment management

is too high. We are here to shake things up.

Management Fee 0.65%

* for qualified investors with $1M, custom portfolios with individual stocks and bonds are available starting at 0.80%

Our aim is to provide low-fee advice, delivered by humans. We do this by in-sourcing the investment

management. We do not allocate client assets to expensive third-party managers, mutual funds, or hedge funds.

We believe an advisor’s fee structure should encourage transparency and accountability. For qualified investors,

we align our management fees with investment performance, creating a clear line between our compensation

and a client’s investment outcome.

Cut through the B.S.

Unfiltered commentary. Simple language.

Actionable steps.

From the latest market trends to planning tips, our weekly newsletter includes podcasts, writings, and educational videos that provide a clear-cut, unbiased outlook to help you make better money decisions.

About Pure Portfolios

Tired of your conflicted, high-cost advisor? There is a better way.

We created an offering that fills the gap between the cookie-cutter service of a robo-advisor and the high-cost traditional advisor. If you want advice but don’t want to pay a premium, you’ve come to the right place.

Sunday Coffee Reads

4576 Weeks to Live

“Remembering that you are going to die is the best way I know to avoid the trap of thinking you...

Read More

The World’s Worst Investor

“Humans have something weird in their DNA which prohibits them from adopting good ideas easily.” – William Green, Richer, Wiser,...

Read More

A Simple Case for Gold and Bitcoin

“The debt is not going to be balanced. The annual deficit seems to be getting worse and worse. And if...

Read More

Recession Signals that are Flashing Red

“There are decades when nothing happens, and weeks when decades happen.” – Uday Kotak, founder of Kotak Mahindra Bank The...

Read More

International Diversification: Looking Beyond the S&P 500

“Valuation changes rewarding cheap stocks and punishing expensive ones is one of the most powerfully recurring features of global equity...

Read More

Turn Off the TV

“Our obsession with being informed makes it hard to think long-term. We spend hours consuming news because we want to...

Read More

Pure Portfolios’ April 2025 Market Commentary

Markets declined by ~13% in April before recovering to end the month nearly flat. This marked one of the largest...

Read More

Does it Still Make Sense to Own Bonds?

“Bonds as an asset class will always be needed, not just by insurance companies and pension funds, but by aging...

Read More

Closest Thing to a Fat Pitch in Investing

“Interest rates go up and down, stock markets boom and bust, but human psychology never changes. I believe that studying...

Read More

Tariff Talk: Client Q&A on Market Impact and Economic Risks

“The higher returns to quantitative investing accrue from the abnormally bad behavior of humans at times of crisis.” – Dan...

Read More

Is Your Retirement Plan Ready for Market Volatility?

Market uncertainty is the rule—not the exception. Interest rate hikes, inflation pressures, and political noise aren’t going away anytime soon....

Read More

Pure Portfolios’ March 2025 Market Commentary

In Pure Portfolios’ March 2025 Commentary, Chief Investment Officer, Nik Schuurmans unpacks the growing disconnect between investor sentiment and market...

Read More

5 Tasks to Add to Your Spring Cleaning List

Springtime signals renewal—a perfect opportunity not only to clean your home but to tidy up your finances as well. Add...

Read More

Why This Correction Hits Harder

“In investing and life, you will make better decisions if you assume you are wrong and try your best to...

Read More

Global Markets are Telling a Different Tariff Story

“Tariffs are a tax on business that get eaten by the consumer.” – Cullen Roche, Pragmatic Capitalism We won’t pretend...

Read More

Fully Invested, Light on Cash

“My most important discovery—a finding that changed the course of my career—is that the future is far less predictable than...

Read More

Pure Portfolios’ February 2025 Market Commentary

In Pure Portfolios’ February 2025 Commentary, Chief Investment Officer, Nik Schuurmans covers headline risk, AI trade fatigue, seasonality, corporate credit...

Read More

Avoid RMD Pitfalls: Smart Strategies for Retirees

If you’re nearing retirement or already enjoying it, you’ve likely heard about Required Minimum Distributions (RMDs). But for many, the...

Read More

Myth Busting: What the Government Cannot Do

“Stories are always more powerful than statistics.” – Morgan Housel, Same as Ever There’s lots of wild theories rolling around...

Read More

The Best Age to Start Social Security

When it comes to retirement, few decisions feel as weighty as when to claim Social Security. Do you take it...

Read More

Err on the Side

“Most people make their investment decisions on the basis of an unreliable hodgepodge of half-baked logic, biases, hunches, emotion, and...

Read More

Pure Portfolios’ January 2025 Market Commentary

In Pure Portfolios’ January 2025 Commentary, Chief Investment Officer, Nik Schuurmans covers the illusion of diversification, the Deep Seek disruption,...

Read More

Estate Planning 101: Should You Choose a Will or a Living Trust?

Estate planning might not be the most exciting topic, but it’s one of the most thoughtful ways to protect your...

Read More

No One Learns Anything in a Bull Market

“Mistakes present a choice: whether to update your ideas, or ignore the failures they’ve produced and keep believing what you’ve...

Read More

Don’t Believe Everything You Hear on Tariffs

“Everybody talks about tariffs as the first thing. Tariffs are the last thing. Tariffs are part of the negotiation. The...

Read More

Will Outsized U.S. Stock Returns Continue?

“When something is on the pedestal of popularity, the risk of a decline is high. When people assume — and...

Read More

Pure Portfolios’ December 2024 Market Commentary

In Pure Portfolios’ December 2024 Commentary, Chief Investment Officer, Nik Schuurmans reflects on a year of market resilience and the...

Read More

Pure Portfolios’ 2024 Client Letter

As we approach the year’s end, we at Pure Portfolios want to take a moment to thank you for your...

Read More

Tis the Season for Wall Street Forecasting VIII

“A decade ago, I made a goal to read more history and fewer forecasts. It was one of the most...

Read More

Pure Portfolios’ 2024 Reading List

“Books and doors are the same thing. You open them, and you go through into another world.” – Jeanette Winterson,...

Read More

Pure Portfolios’ November 2024 Market Commentary

In Pure Portfolios’ November 2024 Commentary, Chief Investment Officer, Nik Schuurmans, covers how the market tends to overshoot post-election, how...

Read More

Reckless Government Spending: How it Could Impact Your Investments

“We are going to be broke really quickly unless we get serious about dealing with our spending issues.” – Paul...

Read More

Could Future S&P 500 Returns Be Lower?

“History doesn’t repeat, but it often rhymes.” – Mark Twain Anyway you slice it, the S&P 500 is historically expensive....

Read More

Pure Portfolios’ October 2024 Market Commentary

In Pure Portfolios’ October 2024 Commentary, Chief Investment Officer, Nik Schuurmans, covers asset class returns & falling inflation, how often...

Read More

Consumer Sentiment and S&P Returns

“There is a very thin line between confidence and arrogance.” – Adam Peaty, Olympic swimmer What comes first, confidence or...

Read More

The Danger of Recency Bias in Investment Decisions

“Why would I own anything other than the S&P 500?” “I’m thinking of putting my entire retirement nest egg in...

Read More

Fed Cuts and Mortgage Rates Higher?

“Just wait until the Fed cuts, the housing market is going to get white hot.” – random real estate agent...

Read More

Let’s Freak Out About the Election (Seriously)

We have penned blog after blog how elections are a non-event in the grand scheme of your investment portfolio. We...

Read More

Pure Portfolios’ September 2024 Market Commentary

In Pure Portfolios’ September Commentary, Chief Investment Officer, Nik Schuurmans, covers the Fed pivot & future S&P 500 returns, softening...

Read More

What’s NOT Going to Change in 10 years?

“When you have something that you know is true, even over the long term, you can afford to put a...

Read More

This Market Signal is Flashing Red

“If the average investor allocation to equities is abnormally high, then prices are probably abnormally high–the market’s probably expensive.” –...

Read More

Pure Portfolios’ August 2024 Market Commentary

In Pure Portfolios’ August Commentary, Chief Investment Officer, Nik Schuurmans, covers rate cuts & future returns, the quiet comeback of...

Read More

Rate Cuts and Stock Returns

“Whoever controls the volume of money in any country is absolute master of all industry and commerce.” – James A....

Read More

Characteristics of a Bull Market

“Bull markets ignore bad news, and any good news is reason for a further rally.” – Colm O’Shea, professor at...

Read More

Market Correction Reflection

“The purpose of volatility is to make people make stupid decisions.” – Jared Dillion, The Daily Dirt Nap Yen carry...

Read More

Pure Portfolios’ July 2024 Market Commentary

Last month, we highlighted the historical gap between U.S. large cap stocks and smaller companies. July saw a massive reversal...

Read More

What Should Retirees Pay Attention To?

“The information you consume each day is the soil from which your future thoughts are grown.” – James Clear, Atomic...

Read More

Picking Individual Stocks is Hard

“Owning individual stocks invites infinitely more behavioral hurdles than a simpler strategy. It’s easier to ignore index funds and ETFs....

Read More

Unprecedented Uncertainty

“It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes.” – Charlie Munger, Co-founder of...

Read More

Pure Portfolios’ June 2024 Market Commentary

In Pure Portfolios’ June 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, covers U.S. large cap extremes relative to small...

Read More

Tale of Two Markets

“What you see is not what others see. We inhabit parallel worlds of perception, bounded by our interest and experience....

Read More

Probable Probabilities

“The biggest risk is always what no one sees coming, because if no one sees it coming, no one’s prepared...

Read More

The Longest Drawdown in Recent History

“Bonds as an asset class will always be needed, not just by insurance companies and pension funds, but aging boomers.”...

Read More

Pure Portfolios’ May 2024 Market Commentary

In Pure Portfolios’ May 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, covers retailers reducing prices, gold’s sneaky good run,...

Read More

To Convert or Not Convert? Roth is the Question

Just as diversification is important in investing, it’s equally important in retirement planning. By diversifying your assets across different types...

Read More

Principled Investing

“The dead outnumber the living fourteen to one, and we ignore the accumulated experience of such a huge majority of mankind...

Read More

The Benchmark Fallacy

“The highest form of wealth is the ability to wake up every morning and say: ‘I can do whatever I...

Read More

Understanding Safe Withdrawal Rates

One of the key considerations in retirement planning is determining a safe withdrawal rate – the pace at which you...

Read More

Pure Portfolios’ April 2024 Market Commentary

In Pure Portfolios’ April 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, unpacks intra-year S&P 500 drawdowns, stubborn inflation, the...

Read More

Rush to Riches

“Slow success builds character. Fast success builds ego.” Ratan Tata, former chair of Tata Group A young golfer approaches her...

Read More

Markets After Major Geopolitical Events

“The world changes. This is the biggest problem in markets.” – Bill Miller, former chairmen of Legg Mason Capital Management...

Read More

Hot Themes and Future Returns

“I didn’t learn anything. I already knew I wasn’t supposed to do that.” – Stanley Drunkenmiller, after losing $3 billion...

Read More

Can the Market Predict the Next President?

“If you mix your politics with your investment decisions, you’re making a big mistake.” – Warren Buffett, Berkshire Hathaway It...

Read More

Pure Portfolios’ March 2024 Market Commentary

In Pure Portfolios’ March 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, unpacks high yield credit spreads, elevated U.S. stock...

Read More

Estimating Future Equity Returns

“We deceive ourselves when we believe that past stock market return patterns provide the bounds by which we can predict...

Read More

The Resilience of the U.S. Economy

Let’s go back to summer of 2022. It wasn’t a matter of if a recession was coming, rather a matter...

Read More

Why Not Go All-In on the S&P 500?

“I might just put my money in the S&P 500 and call it good. “ – anonymous prospective client The...

Read More

Pure Portfolios’ February 2024 Market Commentary

In Pure Portfolios’ February 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, unpacks the struggles of rate sensitive assets, why...

Read More

The Most Valuable Financial Advisor Task

“Investors are always searching for good ideas, when what they need are good habits.” – Jason Zweig, Wall Street Journal...

Read More

Is There Such a Thing as “Safe” Stocks?

“People want to believe that this time is different, that there’s something new under the sun, and through their own...

Read More

How High Interest Rates Impact Financial Decisions

“Invest in preparedness, not prediction.” – Morgan Housel, Collaborative Fund Financial planning is important because it helps clients understand where...

Read More

Pure Portfolios’ January 2024 Market Commentary

In Pure Portfolios’ January 2024 Market Commentary, Chief Investment Officer, Nik Schuurmans, covers January performance and what it could mean...

Read More

Bitcoin: Understanding the Digital Asset

“You can’t stop things like Bitcoin. It will be everywhere, and the world will have to re-adjust. World governments will...

Read More

Cash is Not a Long-term Investment

“In investing, what is comfortable is rarely profitable.” – Robert Arnott, founder of Research Affiliates Cash is comfortable. It’s also...

Read More

How to Create a Realistic Budget

“The budget is not just a collection of numbers, but an expression of our values and aspirations.” – Jacob Lew...

Read More

The Why in Diversify

“Diversification means always have to say you’re sorry.” – Brian Portnoy, founder of Shaping Wealth “Why do we own these...

Read More

December 2023 Market Commentary

In Pure Portfolios’ December 2023 Market Commentary, Chief Investment Officer, Nik Schuurmans, covers the market climbing the wall of worry,...

Read More

Pure Portfolios’ 2023 Client Letter

There’s an old parenting quip, “the days are long, but the years are short.” The saying can be attributed to...

Read More

Pure Portfolios’ 2023 Reading List

“In my whole life, I have known no wise people who didn’t read all the time — none, zero. You’d...

Read More

Tis the Season for Wall Street Forecasting Pt. VII

“The need for certainty is the greatest disease the mind faces.” – Morgan Housel, from his new book, “Same as...

Read More

This is Why We Invest: Long-Term View on Markets

“Pessimists sound smart. Optimists make money.” It’s easy to get sucked into what could go wrong. In the digital age,...

Read More

November 2023 Market Commentary

In Pure Portfolios’ November 2023 Market Commentary, Chief Investment Officer, Nik Schuurmans, covers the ‘Three Headed Monster’; the 10-year Treasury...

Read More

Latte with Nik: If I Didn’t See It, I Wouldn’t Believe It

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both...

Read More

Wall Street is Bearish: That’s a Good Thing

“The best way to tell when a trend is going to reverse is when it fills up with a-holes.” –...

Read More

October 2023 Market Commentary

“The era of optimism dies in a crisis, but in the dying it gives birth to an era of pessimism.”...

Read More

The Fed Could be in the Bottom of the 9th

“We believe we are in a new era for fixed income in which bonds offer significantly more value.” – Vanguard...

Read More

The Recession that Never Came

“It’s the economy, stupid.” – James Carville, political analyst Go back to any point in 2022. You’re likely to find...

Read More

The Investor Mindset: Fixed vs. Growth

“Self-control is a key to investing success, but so is fending off self-delusion.” – Jason Zweig, Wall Street Journal &...

Read More

When Safe Assets Become Risky

“There is no such thing as a riskless hedge against inflation.” – Edgar Fiedler, economist and former U.S. Assistant Secretary...

Read More

September 2023 Market Commentary

“If I depended on economic forecasts, I don’t think we’d make any money.” – Warren Buffett, Berkshire Hathaway In Pure...

Read More

Starting Yield and Future Bond Returns

“Remember how excited people were about bonds when rates were under 1%? You see how bearish people are about bonds...

Read More

Hot 2024 Presidential Election Talk

“If you mix your politics with your investment decisions, you’re making a big mistake.” – Warren Buffett, Berkshire Hathaway Benjamin...

Read More

Past Performance and Investment Decisions

“My investment plan was built with the assumption that I would experience a number of both bull and bear markets...

Read More

August 2023 Market Commentary

“You should follow price. Quit trying to be an expert, follow prices and follow trend.” – Jerry Parker, Chesapeake Capital...

Read More

The Big Short’s, Big Short

“Everything I do in investing is just very different.” – Michael Burry, famous investor featured in “The Big Short” Michael...

Read More

The Plight of the Dividend Investor

“If company management can’t think of anything else to do with their money, they should pay dividends. If they have...

Read More

Is the Market Detached from Reality?

“Wealth isn’t primarily determined by investment performance, but by investor behavior.” – Nick Murray, finance author & speaker The U.S....

Read More

The Loneliest Trade

“If it’s obvious, it’s obviously wrong.” – Stanley Druckenmiller, former founder of Duquesne Capital Most investors know about the sterling...

Read More

July 2023 Market Commentary

“One lesson I learned is to make fewer decisions. Sometimes the best thing to do is nothing.” – Lou Simpson,...

Read More

The Retirement Propaganda War

“I’ve found that investors who rely on crystal balls frequently wind up with crushed glass.” – Martin Zweig, famous investor...

Read More

Juicy Money Market Yields Won’t Last

“The Fed’s ability to raise and lower short-term interest rates is its primary control over the economy.” – Alex Berenson,...

Read More

Hey Retirees, the 4% Rule is Back

“At the end of the day, it’s not a normal condition to have interest rates at zero.” – Lloyd Blankfein,...

Read More

June 2023 Market Commentary

“The idea that a bell rings to signal when to get in or out of the market is simply not...

Read More

When a Bear Becomes a Bull

“When investors get negative on the market and put 50% in cash, many times it’s just about when the market...

Read More

Can AI Pick Investments?

“Some people call this artificial intelligence, but the reality is this technology will enhance us. So instead of artificial intelligence,...

Read More

Mega Cap Fueled Rally

“The market is being driven by the performance of only 7 stocks!” – Everyone Yes, it’s true. The S&P 500’s...

Read More

May 2023 Market Commentary

“Timing crashes is impossible. If you require a forecast for your investment thesis to do well, then you’re doing it...

Read More

How Much Cash is Too Much?

“You make most of your money in a bear market, you just don’t realize it at the time.” – Shelby...

Read More

Falling Inflation and Stock Returns

“The complaints about how sticky inflation has been nearly matches the claims that it was transitory back in 2021.” –...

Read More

The U.S. Debt Ceiling

“I think it’s ridiculous – it’s always resolved, not that it’s a 100% chance, but I think it gets resolved.”...

Read More

Market Expectations are Everything

“The past wasn’t as good as you remember. The present isn’t as bad as you think. The future will be...

Read More

April 2023 Market Commentary

“If you want to call it a bear market, it looks as savage as a koala. If you want to...

Read More

The Demise of King Dollar

“People talk about this concept like foreign countries can just choose not to do business with the U.S. Dollar. Sure,...

Read More

Back to Back Calendar Year Losses for Stocks

“In my experience, most people who are lucky enough to sell something before it goes down get so busy patting...

Read More

The Market is Quietly Stacking Up Wins

“It’s just that most people see what they want to see. We pride ourselves on living in reality.” – J.C....

Read More

March 2023 Market Commentary

“History provides crucial insight regarding market crisis; they are inevitable, painful, and ultimately surmountable.” – Shelby M.C. Davis, philanthropist and...

Read More

Bond Returns Following Difficult Years

“It’s not that I’m so smart; it’s just that I stay with problems longer.” – Albert Einstein Bonds could use...

Read More

Not a Typical Bank Failure

“This isn’t just one stupid bank making bad decisions. This is a real economic problem where the clients at Silicon...

Read More

The Biggest Heist No One is Talking About

“Banks do not create money for the public good. They are businesses owned by shareholders. Their purpose is to make...

Read More

February 2023 Market Commentary

“The main purpose of the stock market is to make fools of as many people as possible.” – Bernard Baruch,...

Read More

Retirees: More is the Enemy of Enough

“Don’t risk what you have and need for what you don’t have and don’t need.” – Warren Buffett There’s a...

Read More

Assets That Could Hold Up During a Recession

“Fear, greed and hope have destroyed more portfolio value than any recession or depression we have ever been through.” –...

Read More

Six Investing Lessons from 2022

“I have civilized my own subjects; I have conquered other nations; yet I have not been able to civilize or...

Read More

January 2023 Market Commentary

“In investing, what is comfortable is rarely profitable.” – Robert Arnott, Research Affiliates Pure Portfolios’ Chief Investment Officer, Nik Schuurmans,...

Read More

U.S. Debt Ceiling Fiasco: Big Risk or Big Nothing?

“Playing political football with a vote to raise the nation’s debt ceiling has become as predictable as a Twitter rant...

Read More

The Perception of Risk

Quick question, which below stock market graph would you deem more risky? Graph A or B? Graph A Source: Koyfin,...

Read More

Investment Themes by Decade

“Owning US tech was the trade of the last decade. Look forwards not backwards. That trade is over. What will...

Read More

December 2022 Market Commentary

“With every investment we become richer or wiser, never both.” – Bill Duhamel, investor Pure Portfolios’ Chief Investment Officer,...

Read More

Santa Claus Rally, Fact or Fiction?

“The real rally could come not from Santa Claus, but from Federal Reserve Chairman Jerome Powell, who will decide how...

Read More

Pure Portfolios’ 2022 Reading List

“Reading a book isn’t a race – the better the book, the slower it should be absorbed.” – Naval Ravikant,...

Read More

Tis the Season for Wall Street Forecasting Pt. VI

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” – John...

Read More

November 2022 Market Commentary

“As crisis is comprised of danger and opportunity, those who sense change in the early stages will tend to have...

Read More

Top 5 Pure Portfolios’ Blogs: Turkey Edition

“Thanksgiving is a joyous invitation to shower the world with love and gratitude.” – Amy Leigh Mercree We take a...

Read More

Avoiding the Extremes

“You should obsess over risks that do permanent damage & care little about risks that do temporary harm, but the...

Read More

Mid-Terms and Markets

“Historically, investors overestimate the impact of political parties, Presidents, and legislation. Even if one was to correctly forecast a political...

Read More

When the Fed Pivots

“History never repeats itself, but it does often rhyme.” – Mark Twain There have been 85 cycles where the Fed...

Read More

October 2022 Market Commentary

“If everyone is thinking alike, somebody isn’t thinking.” – General Patton Pure Portfolios’ Chief Investment Officer, Nik Schuurmans, talks...

Read More

Silver Linings in a Dismal Year

“It’s not just good news that causes bear markets to end, but better-than-expected news that is simply less bad.” –...

Read More

Surprised by Surprises

“The correct lesson to learn from surprises is that the world is surprising.” – Morgan Housel, The Collaborative Fund Unprecedented....

Read More

Year of the 180

“Most investors tend to project near-term trends – both favorable and adverse indefinitely into the future.” – Seth Klarman, famous...

Read More

September 2022 Market Commentary

“My first boss told us, what’s obvious is obviously wrong. It’s already reflected in security prices. The world changes. And...

Read More

The Market Could Be Wrong About Inflation

“I don’t mind going back to daylight savings time. With inflation, the hour will be the only thing I’ve saved...

Read More

Fighting the Urge to Throw in the Towel

“If a topic makes someone feel emotional, they will rarely be interested in the data. This is why emotions can...

Read More

Where to Find Investment Income

“Big banks, highly leveraged casinos, do whatever they can to keep the cost of their gambling as cheap as possible.”...

Read More

August 2022 Video Commentary

Pure Portfolios’ Chief Investment Officer, Nik Schuurmans, talks the Fed’s Jackson Hole meeting, yield curve, strength of the U.S. dollar,...

Read More

Intra-Year Market Declines

“The last leg of a bull market always ends in hysteria; the last leg of a bear market always ends...

Read More

Calling Market Inflection Points

“You make most of your money in a bear market, you just don’t realize it at the time.” – Shelby...

Read More

The Biggest Risk to Retirees Revisited

“The most important part of a plan is planning on your plan not going according to plan.” – Morgan Housel,...

Read More

July 2022 Market Commentary

“It would be silly to expect every bear market to turn into the Great Depression. It would be equally wrong...

Read More

Signs of a Market Bottom

“History doesn’t repeat itself, but it often rhymes.” – Mark Twain I post my blog every week on LinkedIn. Last...

Read More

Which Asset Class Has it Right?

“Majority opinion can give any market movement considerable momentum that keeps it going in the same direction. Majority opinion is...

Read More

Recession Obsession

“When y’all think they going to announce that we going into a recession?” – Cardi B, famous hip hop artist...

Read More

June 2022 Market Commentary

Pure Portfolios’ Chief Investment Officer, Nik Schuurmans, talks bear markets, bond yields, prospects of a recession, and much more. ...

Read More

Bear Market Blues, How Much Worse Can it Get?

“The last leg of a bull market always ends in hysteria; the last leg of a bear market always ends...

Read More

Just How Bad is Inflation?

The inflation report on 6/10/22 caused shockwaves across financial markets. The Consumer Price Index (CPI) print surprised on the upside,...

Read More

Sniffing Around for Investment Opportunities

“Cash shouldn’t be looked at as a burden or drag on your portfolio. It should be viewed as a weapon...

Read More

May 2022 Market Commentary

Pure Portfolios’ Chief Investment Officer, Nik Schuurmans, talks factor performance, global markets, the Fed’s balancing act, and cracks in U.S....

Read More

Investment Royalty to Punching Bag

“Cathie Wood’s stubborn reluctance to accept reality is starting to look less and less like an investment advisor and more...

Read More

Fighting the Market-Timing Urge

“If a topic makes someone feel emotional, they will rarely be interested in the data. This is why emotions can...

Read More

Market Sell-Off: The Good & Bad

“Everything feels unprecedented when you haven’t engaged with history.” – Kelly Hayes, author The daily flow of negative headlines, market...

Read More

Sell in May and Enjoy the Day?

“In real-time, every crisis feels like the worst thing ever. In hindsight, every crisis is an obvious buying opportunity.” –...

Read More

April 2022 Market Commentary

Trying to make sense of the economy and markets? We’ve got your back. Pure Portfolios’ Chief Investment Officer talks...

Read More

What Does Peak Inflation Look Like?

“Every administration thought they had power to end inflation but they really didn’t. I think now you can see that...

Read More

Does it Still Make Sense to Own Bonds?

White-hot inflation. Rising interest rates. Tanking bond prices. The popular consensus is that investors should abandon their bond allocation. It’s...

Read More

March 2022 Market Commentary

“The main purpose of the stock market is to make fools of as many people as possible.” – Bernard Baruch,...

Read More

What’s the Bullish Case for Stocks?

“Tell someone that everything will be ok and they’ll shrug you off. Tell someone they’re in danger and they’ll hang...

Read More

Mitigating Damage without Playing the Market Oracle

“Imagine thinking you could predict when you would sprain your ankle or get in a car crash. Instead, develop the...

Read More

What Are the Odds of a U.S. Recession?

“Being scared of everything is a symptom of being addicted to comfort.” – Orange Book, @orangebook on Twitter Post World...

Read More

February 2022 Market Commentary

What the heck is going on in financial markets? In the below month-end video recap, Pure Portfolios President & CIO...

Read More

Checking Up on Pandemic Darlings

“What a year this week has been.” – unknown A handful of stocks couldn’t miss. The pandemic changed the way...

Read More

How to Solve the Inflation Problem

“Anyway you calculate it, inflation is WAY above the Fed’s target because of high demand.” Cullen Roche, Discipline Funds The...

Read More

Waiting for the “All-Clear” Investment Signal

“If you want to make the wrong decision, ask everyone.” – Naval Ravikant, author and investor I want to wait...

Read More

How High Can Bond Yields Go?

“It’s not a normal condition to have interest rates at zero.” – Lloyd Blankfein, former Goldman Sachs CEO The Fed...

Read More

What Goes Up, Must Come Down

“All past market declines look like opportunities, all future market declines look like risks.” – Morgan Housel, author and investor...

Read More

Throw Away the Old Playbook

“Much of the confusion about the current state of the economy has its origin in people trying to apply classic...

Read More

Managing Market Volatility

“Volatility gets you in the gut. There’s no question that when prices are jumping around, you feel different from when...

Read More

Pure Portfolios’ 2022 Client Letter

2022 was the year of the opposite. Every market trend and economic reality we’ve known to be true the last...

Read More

How Does this Bull Market Stack Up?

“Everyone is a genius in a bull market.” Mark Cuban, entrepreneur and owner of the Dallas Mavericks. There’s no shortage...

Read More

Pure Portfolios’ 2021 Client Letter

2021 marks the five-year anniversary of Pure Portfolios (see The Story of Pure Portfolios). We are grateful for the client...

Read More

Pure Portfolios’ Best of 2021

“A fit body, a calm mind, a house full of love. These things cannot be bought — they must be...

Read More

Tis the Season for Wall Street Forecasting Pt. V

“I am skeptical about stock market forecasting by anybody, and particularly by bankers.” Benjamin Graham, famous investor Historical evidence shows...

Read More

Sniffing All-Time Highs and Nobody is Happy

“We locked down the economy for 18 months, spent ~$14 trillion, and now my margarita costs 30% more.” – Cullen...

Read More

What is the Right Stock Allocation for Retirees?

“The trouble with retirement is that you never get a day off.” – Abe Lemons, college basketball coach It’s a...

Read More

How to Reduce Capital Gains in your Portfolio

“A fine is a tax for doing something wrong. A tax is a fine for doing something right.” Anonymous You...

Read More

Not All Indexing is Good

“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap...

Read More

Worried About Inflation? You Might Own These Assets

“Inflation sparks heated debates because everyone spends their money differently so there’s no single inflation rate — your inflation may...

Read More

When Was the Last Time you Changed your Mind?

“If I were tasked with building the ultimate human investor, being able to change one’s mind would be the number...

Read More

How Does a Fed Taper Affect Market Volatility?

“Our discussions of the economy may sometimes ring in the ears of the public with more certainty than is appropriate.”...

Read More

Is There Ever a Good Reason to Panic Sell?

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” Peter Lynch,...

Read More

Is a Roth Conversion Right for You?

To convert or not to convert? Too often investors want to convert to a Roth IRA without fully understanding the...

Read More

Is Market Volatility Still Elevated?

“Volatility gets you in the gut. There’s no question that when prices are jumping around, you feel different from when...

Read More

Can Stocks Get Cheaper and Go Higher?

“History shows us, over and over, that bull markets can go well beyond rational valuation levels as long as the...

Read More

Why are ETFs Tax-Efficient?

“Those of you who make investments outside of any retirement accounts are absolutely crazy if you are using actively managed...

Read More

An Investor’s Two Most Powerful Weapons

“It might make sense to hedge some of your equity risk.” – Toby Weber, Pure Portfolios “I’m 72 years old....

Read More

Why Trend Following Could Make Sense for Retirees

“To be uncertain is to be uncomfortable, but to be certain is to be ridiculous.” – Michael W. Covel, American...

Read More

The Untold Story of Pure Portfolios

August 2021 marks the five-year anniversary of Pure Portfolios. This is the untold story of how we launched. The Build-Up...

Read More

Taking Cues from the Market

“In the end, how your investment behaves is much less important than how you behave.” – Benjamin Graham, famous investor...

Read More

Intoxicated with Pessimism

“Optimism sounds like a sales pitch. Pessimism sounds like someone is trying to help you.” – Morgan Housel, The Collaborative...

Read More

Avoiding Stupidity is Underrated

“All I want to know is where I’m going to die, so I’ll never go there.” – Charlie Munger, Berkshire...

Read More

It’s Been Too Easy

“Expectation is the root of all heartache.” – William Shakespeare Under promise, over deliver. The universal mental shortcut for managing...

Read More

Retirement Simplicity is Beautiful

“Life is really simple, but we insist on making it complicated.” – Confucius, Chinese philosopher My morning inbox routine, delete,...

Read More

Not So Obvious

“Hindsight is 20/20.” – Richard Armour, American comedian What was unclear 12-18 months ago, looks clear as day now. I...

Read More

Predicting Irrational Beasts

“We are emotional, irrational beasts who are emotional and irrational in predictable, pattern-filled ways.” – Chris Voss, author of Never...

Read More

Internal vs. External Focus

“Do not let what’s out of your control interfere with all the things you can control.” – John Wooden, legendary...

Read More

The Difference Between Amateur and Professional Investors

“Amateurs believe that the world should work the way they want it to. Professionals realize that they have to work...

Read More

What the Treasury Market is Saying About Inflation

“Inflation is when you pay $15 for a $10 haircut you used to get for $5 when you had hair.”...

Read More

Shrinking Life Cycle of an S&P 500 Company

“I’d rather be partly great than entirely useless.” – Neal Shusterman, American author & writer. Let’s face it, it’s fun...

Read More

The Best Predictor of Stock Returns is Amazingly Simple

“The price of equity is determined in the same way that the price of everything is determined – via forces...

Read More

The Biggest Risk to New Retirees

“Consider two degenerate gamblers flipping a quarter for $100 per flip. One of the gamblers has heads and the other...

Read More

What’s in a Bear Market?

“I’m an optimist, both as a person and an investor. It’s a big mistake to be pessimistic as long as...

Read More

Higher Capital Gains Tax and Stock Returns

“You watch…taxes are going to go up and the market will tank.” – I’ve been told this 5x in the...

Read More

No Such Thing as Passive Investing

“This is the single worst time to be a passive investor since they started passive investments. The S&P 500 index...

Read More

Spectacular Implosion

“How did you go bankrupt?” “Two ways. Gradually, then suddenly.” – Ernest Hemingway, The Sun Also Rises. It takes talent...

Read More

The Identity Leak

“Keep your identity small.” – Paul Graham, famous investor. I was an average high school basketball player. Good enough to...

Read More

Not Buying What the Fed is Selling

The Fed was on autopilot. Its forward guidance made clear that market participants could set their watches to four interest...

Read More

The New Age Investor

“Behind the recent surge in retail investing is a younger, often new-to-investing, and aggressive cohort not afraid to employ leverage.”...

Read More

Beating the Bubble Horse

“I’m just waiting for the bubble to pop.” – Anonymous potential client Have you ever met the type that thinks...

Read More

Perspective on Rising Bond Yields

“Bonds are dead.” – Warren Buffett via CNBC The recent uptick in yields has the reignited the “bonds will get...

Read More

Bitcoin, What Of It?

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must...

Read More

Investing at All-Time Highs

In the early years of the smartphone, it was quite common to carry a personal cell and a work cell....

Read More

Is the 4% Rule Dead?

Mental shortcuts or heuristics are used to make quick decisions, either because of time constraints or to simplify a complex...

Read More

Is Inflation Coming?

The health and wellness gurus will tell you that they meditate for two hours, exercise, and eat egg whites all...

Read More

Monte Carlo Analysis: Worthless or Worthwhile?

“Oh, Monte Carlo, I’ve done that. It’s worthless!” “This simulation is the greatest thing ever!” “I don’t know what I’m...

Read More

Is Your Portfolio Drunk or Sober?

“Take calculated risks. That is quite different from being rash.” – George S. Patton Let’s say I’m invited over to...

Read More

The Blue Wave and Stock Returns

““We are beginning to see trends that people tend to fear what they are exposed to in the media. Many...

Read More

Getting a Fat Pitch and Not Swinging

“Amateurs think the world should work the way they want it to. Professionals realize that they have to work with...

Read More

What is Your “Enough?”

“Mo money, mo problems.” – Notorious B.I.G Unless your name is Jeff Bezos, most of us will never be the...

Read More

Investing in a 0% World

“Zero rates aren’t a new normal; they’re just normal in Japan.” – Verdad Capital That didn’t last long. After four...

Read More

Good from Far, but Far from Good

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead...

Read More

Scratching Your Degenerate Itch

“Bad bets sometimes pay off.” – Marty Rubin, Canadian Author There’s been a stir in financial media about Robinhood traders...

Read More

Investing Cash in a Runaway Market

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost...

Read More

The Brilliance of “I Don’t Know”

“We cherish not only answering every question, but also being quick-witted. The answer has to be produced in the shortest...

Read More

I Keep Coming Back to One Question

“We have to practice defensive investing, since many of the outcomes are likely to go against us. It’s more important...

Read More

Mitigating Damage without Placing a Trade

“We will all feel pain in the next recession or stock market drop, but what can we do now to...

Read More

Does Your ESG Approach Pass the Smell Test?

I was perusing my LinkedIn feed when a particular post caught my eye. For the record, I have no clue...

Read More

Municipal Magic

“You can take advantage of pockets of opportunity in what people don’t want.” – Jeff Gundlach, DoubleLine CEO We’ve been...

Read More

Waking up After a Yearlong Coma

“Every once in a while, the market does something so stupid it takes your breath away.” – Jim Cramer The...

Read More

The Plight of an All-Equity Investor

“The stock market is the story of cycles and of the human behaviour that is responsible for overreactions in both...

Read More

What’s Your Silver Lining?

The days blend together. I feel like Bill Murray in the movie Groundhog Day. I’m working at my makeshift office...

Read More

Bear Market Rally or Did We Hit Bottom?

“A cycle like this does not end with a mere month-long correction. A real bear market is only over when...

Read More

Bear Market Assessment: What We Got Right & Wrong

Lawrence Hamtil runs a wealth management firm in Overland, KS. He posted the above self-assessment on Twitter on his portfolio...

Read More

Some Things Will Never be the Same

“Sometimes it’s the bad things that happen to us that become the catalyst for the good things to happen to...

Read More

Where Do We Go From Here?

“There’s clearly an indication that a systematic government-led approach using all tactics and all elements available seems to be able...

Read More

Bear Market Blind Spots

“History reminds us the event that often derails financial markets is seldom the one investors saw coming.” – Pure Portfolios...

Read More

The Market is Talking. Are You Listening?

“It’s OK to not have an opinion on topics you don’t know anything about. And I don’t know anything about...

Read More

What’s Your Process for Making Portfolio Changes?

“To get something done a committee should consist of no more than three people, two of whom are absent.” –...

Read More

Are Low Yields a Good Reason to Shun Bonds?

“I don’t get why anyone would buy a 10-year bond yielding 1.5%” – Former Colleague Low bond yields are the...

Read More

How to Tell if your 401(k) Plan is Hot Garbage

We are conditioned to sock away money for retirement ASAP. You should save at least 10% of your income. By...

Read More

Random $#%&

“No matter how sophisticated our choices, how good we are at dominating the odds, randomness will have the last word.”...

Read More

The Amazing Run of U.S. Tech Stocks

Friend: “I need to buy more QQQ.” Later that day, while on a call… “Tech stocks make me nervous. I...

Read More

Do You Have an Information Filter?

“Thirty years ago the best investors had the biggest funnels of information. Today the best investors have the best filters...

Read More

Want Dividend Yield? Here’s Where to Look…

“As far as dividend yields go, the UK, Italy, Spain, and Singapore all offer dividend yields north of 4%, while...

Read More

What Does the SECURE Act Mean for You?

On December 20th, 2019, President Trump signed the Setting Every Community Up for Retirement Enhancement Act (SECURE Act). The SECURE...

Read More

Pure Portfolios 2020 Client Letter

It seems like yesterday that we left the corporate suits behind to launch Pure Portfolios. We are forever grateful to...

Read More

Pure Portfolios’ Best of 2019

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead...

Read More

Tis the Season for Wall Street Forecasting Pt. III

“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.” – Lao Tzu The annual charade of Wall...

Read More

Did Investors Experience a Golden Decade?

If 2000-2009 was the “lost decade” for U.S. equity markets, 2010-2019 might be dubbed the blissful Goldilocks decade. But just...

Read More

It’s Time to Dump the Broken Risk Questionnaire

What would you do if your investment lost 20%? A) Buy more B) Sell C) Do nothing You’ve probably seen...

Read More

Portfolio Lay-Ups for Year-End

“Some taxpayers close their eyes, some stop their ears, some shut their mouths, but all pay through the nose.” –...

Read More

What to Make of the “Election Uncertainty” Talk?

“To be absolutely certain about something, one must know everything or nothing about it.” – Henry Kissinger I can’t go...

Read More

What’s Your Different Kind of Wealth?

“That man is richest whose pleasures are cheapest.” – Henry David Thoreau Most people associate wealth with large bank accounts,...

Read More

“I’ll Just Buy Amazon Stock”

I was sipping on a watered-down passion fruit iced tea waiting for my 1 o’clock to arrive. I had never...

Read More

Your Wealth Manager Just Posted Record Profit Margins

“Your margin is my opportunity.” – Jeff Bezos, Amazon It was a dreary fall evening. It must have been a...

Read More

Can High Dividend Stocks Replace Paltry Bond Income?

“We should target high dividend payers because bond yields are offering nothing.” – Random investors everywhere. U.S. bond yields have...

Read More

What is the Impact of Retiring in a High-Income Tax State?

Much goes into crafting a detailed retirement plan. We account for income, expenses, unexpected healthcare events, annual home maintenance, travel,...

Read More

Could the 2020 Election Derail the Stock Market?

Everywhere we turn people are convinced the presidential election adds a layer of uncertainty to the financial markets. Depending on...

Read More

Predicting the Next Recession

If we tracked the most commonly asked client question over the past six months, a variation of “when is the...

Read More

Are you Paying for Services NOT Rendered?

You have a huge landscaping project in front of you. While you’ve done some basic lawn care in the past,...

Read More

Should I Just Buy the S&P 500 in Retirement?

We were sitting outside on a beautiful late summer Portland day. I was having a spirited conversation with a retired...

Read More

Is Anyone Bullish on the Stock Market?

We shared a laugh about how easy it was to come up with a list of potential landmines for the...

Read More

Should you Act on Big Down Market Days?

“Well, that escalated quickly.” – Ron Burgundy, Anchorman It should be obvious by now that presidential tweets are untradable, unpredictable,...

Read More

Simple Doesn’t Sell

“Complexity gives a comforting impression of control, while simplicity is hard to distinguish from cluelessness.” – Morgan Housel, The Collaborative...

Read More

Is Your Wealth Manager Overweight Equities?

“Pay attention to what they do, not what they say.” – Anonymous I was perusing a research note from another...

Read More

How Common are 5+% Pullbacks?

A client asked me what our crystal ball was saying after the turmoil this week. It’s impossible to know what...

Read More

How I’m Personally Invested

I give people advice about what to do with their money. Therefore, you have a right to know how I...

Read More

All-Time High Retirement

The year was 2007. Bob had been with the same company for 30 years. He had diligently saved throughout his...

Read More

Fool Me Once, Fool Me A Billion Times

“You don’t have to be the biggest to beat the biggest.” – Ross Perot Raymond owns a small independent advisory...

Read More

The Fed’s About-Face

Just a year ago, the consensus was for the Federal Reserve to methodically increase interest rates to “normal” levels. As...

Read More

The Most Interesting Charts in the World

Our inbox is bursting with mid-year reviews, commentary, and predictions for the rest of the year. The blitz of content...

Read More

The Unspoken Costs of a Doomsdayer

My Uncle Joe is absolutely convinced the market is going to crash. He’ll seek me out at family gatherings and...

Read More

Fee Schedule Trickery

“Everything should be made as simple as possible, but no simpler.” Albert Einstein The further removed we get from the...

Read More

Should You Only Own U.S. Stocks?

Many U.S. based investors believe so. In the investment universe, “Home Bias” is a term used to describe the tendency...

Read More

Citywire Q&A with Nik Schuurmans

Pure Portfolios was recently featured in Citywire’s RIA “My Model Portfolio” series that ran in May’s print version and is...

Read More

So Much for Rising Rates

The cycle ended with hardly a peep, but it looks like the Fed is done increasing rates. Source: YCharts The...

Read More

Better Decisions with Sound Financial Planning

I used to have a healthy disdain for financial planning. I viewed it as data entry; type numbers into a...

Read More

Does your Portfolio Make the Grade?

“I already have a financial advisor managing my money.” That’s a good thing, right? Depends on the advisor. It can...

Read More

Millennial Advice from a Millennial

The millennial generation is defined to those born between 1981-1996. In other words, if you’re between 22-37, you’re a millennial...

Read More

Stability Breeds Instability

“Trump will fire off a tweet and tank the economy.” “The yield curve inversion all but guarantees a recession is...

Read More

Do You Need a Trust?

People set up Trusts to minimize estate taxes, avoid probate, and seamlessly transfer assets to their heirs. Simply put, a...

Read More

The One-Page Challenge

According to a 2018 Cerulli study, 42% of investors either believe their financial advice is free or they have no...

Read More

Calling it off with 5-2 Offsuit

You’re mentally exhausted. It’s getting late and you’re on the tail end of a 12-hour marathon poker session. You’re down...

Read More

Mr. Bond and Mr. Market

Mr. Bond has been in a dark place. He’s back on the bottle, hasn’t showered in days, and has been...

Read More

Ultimate Transparency

Free from pretense or deceit Easily detected or seen through Readily understood Characterized by visibility or accessibility of information especially...

Read More

What I’ve Learned Over My 15 Year Career

We started every day the same. Our team of “financial planners” gathered in a vast conference room with a sprawling...

Read More

BBB Rated Movie

“U.S. corporate debt has climbed to roughly 46% of gross domestic product, the highest on record” – Rachel Louise Ensign,...

Read More

How to Punt Stacks of Cash to Uncle Sam

“The collection of taxes which are not absolutely required, which do not beyond reasonable doubt contribute to the public welfare,...

Read More

Let’s Talk Stock Buybacks

“I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than...

Read More

Trend is Your Friend, An Alternative to Buy & Hold

“We’ve extended the analysis to every asset class where we could get our hands on the numbers and investigated the...

Read More

Mutual Fund Owners, Check Your 1099s

“It’s really hard to make an argument for mutual funds in a taxable investment account.” – Meb Faber, Cambria Funds...

Read More

Weirdness without Parallel

One of the funny things about the stock market is that every time one person buys, another sells, and both...

Read More

The Best of Bogle

“I will create value for society, rather than extract it.” John C. Bogle, Founder of The Vanguard Group On April...

Read More

The Most Dangerous Thing II

“Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.” – Jason Zweig, Author...

Read More

2018: No Place to Hide

“There’s always a bull market somewhere” – Jim Cramer, CNBC Mad Money This marks the first and last time we...

Read More

Take the Low-Hanging Fruit

The market carnage to close out 2018 carries an important reminder. Investing is hard. Performance comes and goes. The last...

Read More

Tis the Season for Wall St. Forecasting Pt. II

“Never make predictions, especially about the future.” – Casey Stengel, Legendary Baseball Manager. This might be my favorite topic to...

Read More

Don’t Be Afraid of the ‘R’ Word

“Fear, greed, and hope have destroyed more portfolio value than any recession or depression we have ever been through.” –...

Read More

Let’s Talk Yield Curve Inversion

Picture a veteran stock broker roaming the halls of a investment advisory firm. His shirt is stained with coffee. From the...

Read More

Is the Santa Claus Rally Real?

I know a financial advisor who loves to talk about the Santa Claus rally every December. He has an outstanding...

Read More

Planning for the Ugly

“Telling people to “ignore the noise” or “think for the long-term” does not help in the moment unless you’ve set...

Read More

The Most Dangerous Thing

“All other creatures use their intelligence to survive. We use ours to destroy ourselves.” – Marty Rubin, Author We worry about stock...

Read More

No Hunt for Red October

In the 1990 war thriller “The Hunt for Red October” Sean Connery plays the role of Marko Ramius, a Soviet Union...

Read More

Being Told to “Stay the Course”

“Volatility in the up direction is not a problem, it’s only downward volatility that offers discourse.” – Coreen T. Sol,...

Read More

Back to Back Negative Return Years for Bonds

“Bonds as an asset class will always be needed, and not just by insurance companies and pension funds, but by...

Read More

Stock Returns in Midterm Election Years

“The real players in the global economy are consumers and producers (business). Politicians and regulators are similar to referees, which can influence short...

Read More

The Best Question You Could Ask

“People ask me my forecast for the economy when they should be asking me what I have in my portfolio....

Read More

Investor Anxiety: Signs You’re Invested Incorrectly

“A reasonable-level of anxiety is a sign that you take investing seriously and are on guard against complacency and overconfidence....

Read More

Persistence of Performance

“This year’s top-performing mutual funds aren’t necessarily going to be next year’s best performers. It’s not uncommon for a fund...

Read More

Fed Hikes and Bond Prosperity

“The Federal Open Market Committee (FOMC) has considerable control over short-term rates. We have much less influence over long-term rates,...

Read More

U.S. and Everyone Else

“Emerging market economies have long grappled with the challenges posed by large and volatile cross-border capital flows.” – Jerome Powell,...

Read More

Solving the Social Security Equation

“Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would...

Read More

Fees Tied to Performance is Gaining Momentum

“The investment industry has long offered clients fees that have nothing to do with performance. That’s changing, but not nearly...

Read More

Is Your Asset Location Costing You?

“You must pay taxes. But there’s no law that says you gotta leave a tip.” – Morgan Stanley Most investors...

Read More

Ignoring Good Advice

“Small, seemingly insignificant steps completed consistently over time will create a radical difference.” – Darren Hardy, author of The Compound Effect...

Read More

The Housing Cycle

“Housing is often found at the heart of financial crises”– Fed Chair, Jay Powell summer of 2017 We are not...

Read More

When it’s Broken, Don’t Fix it

“The most important thing you can have is a good strategic asset allocation mix. So, what the investor needs to...

Read More

The New S&P 500

We recently came across a do-it-yourself (DIY) investor, let’s call him Cecil. Cecil firmly proclaims he hates technology stocks and doesn’t feel...

Read More

Q2: Risk On?

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost...

Read More

Sucker Dividend Yields

“One thing everyone should know about dividend yield is this: it doesn’t tell you much. It doesn’t give you clues...

Read More

“How Often Do You Look at My Portfolio?”

“I was going to be a sales person representing that I managed the portfolio. I couldn’t live with that.” –...

Read More

Cash is a Weapon

“Hold some cash in reserve to take advantage of future opportunities.”– Seth Klarman, author of Margin of Safety. An underrated...

Read More

Loose Bubble Talk

“I’m hard-pressed to recall when any sort of bubble was accurately identified in real-time on the cover of a major...

Read More

Beware of the Lazy 60/40

“A traditional static indexing approach leaves an investor overweight the riskiest assets at the riskiest times and underweight those low...

Read More

Unwinding a Variable Annuity

“Variable annuities are the cigarettes of the investment world, which has hidden its curse for decades.” – Ken Fisher, Fisher...

Read More

Turning Safe Into Risky

“The more expensive debt becomes, the less weak corporations will be able to maintain the illusion of health.” Trevor Noren,...

Read More

Less Obvious Mistakes

“Getting rich is one thing. Staying rich is quite another.” – Morgan Housel, The Collaborative Fund We are often asked...

Read More

Hedge Fund Hold Up

The return of market volatility has increased the interest in alternative asset classes. A quick rundown of Barron’s You Make...

Read More

Sell in May and Go Away

They’ve done studies, you know. 60% of the time, it works every time.”– Brian Fantana, Anchorman: The Legend of Ron...

Read More

Portfolio Audit

We hunt the internet for the best value. We read online reviews before making a purchase decision. We compare the...

Read More

8 Signs Your Family Will Fight Over Your Estate

This is a guest post from our estate planning partner Everplans. In our effort to provide value beyond investment management,...

Read More

Q1 in Pics: The Dust Settles

“The S&P 500 hasn’t seen a down quarter since Q3 2015. The S&P has also seen positive returns in 19...

Read More

My Advisor Doesn’t Charge Me a Fee

I’ve heard a variation of the above statement five times within the last year. I’ve had enough. You know the...

Read More

The Mystic of Rising Interest Rates

“Nobody likes high interest rates.” – Chanda Kochhar, CEO of ICICI Bank Interest rate prognostications have taken on a life...

Read More

Decoding Your Brokerage Statement

“Your brokerage statements suck” – Barry Glassman, Glassman Wealth The way we consume information has been turned upside down with...

Read More

Want More Yield On Cash?

The most common question we have received in the past nine years goes something like this; “How can I generate...

Read More

Tariff Gamesmanship?

On March 1, 2018 President Trump unexpectedly announced tariffs on imported steel and aluminum. The threat of a global trade...

Read More

Gems from Buffett’s 2017 Letter

“There are three ways to go broke: “ladies, liquor and leverage”– Warren Buffett, quoting Charlie Munger during a recent CNBC...

Read More

Back to Normal

“If you believe markets are mean-reverting, higher returns and lower volatility today may equal the opposite in the future. We...

Read More

International Developed: What Do You Own?

“Gold jacket, green jacket…who gives a $%&!”– Happy Gilmore We have heard them called foreign equities, global markets, international developed,...

Read More

Warm & Fuzzy Financial Services Ads

I watch quite a bit of golf in my spare time. PGA Tour, Champions Tour, Korn Ferry, LPGA, it doesn’t...

Read More

What’s Attractive in this Environment?

Looking back at 2017, the resounding theme from our clients has been disbelief around the perplexing nature of the runaway U.S. equity...

Read More

Over-Diversification

“Your portfolio is a bowl of soup of random investments, seemingly cobbled together over time.” Meb Faber, Cambria Investments We...

Read More

Why Clients Fire their Advisor

Change is hard. Humans like patterns, routines, and familiarity. This is especially true when dealing with sensitive issues like financial...

Read More

What Happens After a +25% Year?

I have an evening routine of perusing Twitter for market research nuggets. I email myself interesting articles to read the...

Read More

What’s All This Volatility Talk?

“When you compare the fundamental risks that we see all around the globe with the lack of volatility in our...

Read More

Pure Portfolios 2017 Client Letter

In the spirit of the great Warren Buffett’s annual shareholder letter, we feel it’s important to share not only our...

Read More

Following the Herd: Short-Term Bonds

The current tightening cycle has so far been reminiscent of its mid-2000s counterpart. At the time, Federal Reserve Chair Alan...

Read More

Tis the Season for Wall Street Forecasting

“It’s not easy to be as bad as they are. They are much worse than random chance alone would predict.” Salil...

Read More

Introducing Everplans

“In a moment of crisis, the last thing a family should be doing is worrying or being hassled about paperwork....

Read More

Delusional Return Expectations

“Returns expectations are simply too high. It means that many will face a shortfall when they come to realize their...

Read More

Forget the Fed. Focus on Coordinated Global Tightening

2017 has been a great year for investors. Global equities are higher. Volatility is non-existent. Heck, even left-for-dead fixed income...

Read More

Signs of a Market Top? Valuation

We continue our series featuring data from VR Research on “characteristics of a market top.” The summary is broken down...

Read More

Meet the Story-Based Advisor

We recently stumbled across a tongue and cheek article that decoded real estate agent listing language. For example, describing a...

Read More

Naked Performance

“I’ve been crushing it in the stock market this year. I’m up 45%.”– Random Dude How many times have you...

Read More

Naked Performance

“I’ve been crushing it in the stock market this year. I’m up 45%.”– Random Dude How many times have you...

Read More

Signs of a Market Top? Investor Sentiment

VR Research published a graphic on its Twitter account showing the characteristics of a “market top.” The summary is broken...

Read More

Avoiding the Dividend Trap

“In a taxable account, dividends could have cost you anywhere from 0.3% to over 3.0% in returns PER YEAR since...

Read More

Does a Robo-Advisor Make Sense for You?

“One of the challenging things in this industry now is you’ve got a lot of the old-way-to-invest type of firms coming...

Read More

Death of the Fixed 1% Fee

“One of the biggest problems I have with the flat-fee structure is that it does implicitly incentivize a culture of...

Read More

What Happens if the U.S. Goes to War?

“Rising overseas tensions usually don’t cause economic slumps or bear markets… but it’s not unheard of.”– Ben Levisohn, Barron’s The CFA...

Read More

Risky Business of High Yield

With corporate leverage continuing to surge—on record pace again in 2017—the threat of the “zombie” bubble popping appears increasingly real.–...

Read More

When Times Are Bad Pt. 2

“The stock market is a battlefield. Always remember to survive in the game first. Only those that survive the battle...

Read More

The Age-Based Portfolio

“You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready,...

Read More

Should I Borrow Against my Portfolio?

“We were dramatically pushed to put these on all of our client accounts.”– Steven Dudash, former Wall Street broker. Traditionally...

Read More

Should I Consolidate My Assets?

“The ability to simplify means to eliminate the unnecessary so that the necessary may speak.”– Hans Hofmann. Having multiple investment...

Read More

Hedging Equities with… Equities?

In response to the financial crisis, investment managers scrambled to find alternative strategies to soften total portfolio risk during extreme...

Read More

Money Quotes

Over the 4th of July weekend I made it a point to unplug and reflect. I do some of my...

Read More

Fear Sells. Don’t Buy It.

I have a close relative that is debating taking a new job. The new position would be more favorable from...

Read More

The Bond Market Doesn’t Believe the Fed

“Just remember that 10 of the last 13 Fed hiking cycles have been miscalculations that ended in recession.”– David Rosenberg,...

Read More

Valuation Matters, Except When It Doesn’t

“The market can remain irrational longer than you can remain solvent.” John Maynard Keynes, Economist The Shiller price to earnings...

Read More

Drive Your Managed Portfolio into the Ground

“Invert, always invert.” – Charlie Munger, the Vice Chairman of Berkshire Hathaway and Warren Buffett’s partner. Munger borrowed the idea...

Read More

The Rise of the Call Center Advisor

“If I were a single-digit millionaire tossed out of the “paradise” of private banking, I’d walk away from that bank...

Read More

The Danger of Mixing Politics and Investing

A dark cloud of geopolitical uncertainty hangs over the global equity markets (see our rational for investing in gold). Even...

Read More

The Allure of Gold

“I think that the 5-year bear market in gold is over and that we’re in the beginning of a new...

Read More

Exchange Traded Funds Are (Mostly) Good

“The flow of money into ETFs doesn’t represent some mad rush to a specific asset class or sector; it’s simply...

Read More

What is Evidence-Based Investing?

“As Upton Sinclair said, it’s difficult to persuade even the most intelligent people to accept the evidence if they’re financially...

Read More

Hard Ball Questions to Ask Your Advisor

A Google search for “Questions to Ask Your Financial Advisor” will yield an abundance of articles ranging from exhaustive to...

Read More

Don’t Underperform Yourself

Prolonged bull markets can lead to false confidence for do-it-yourself investors, financial advisors, and professional institutional money managers. After all,...

Read More

Pure Q1 Recap in Pics (and a few words)

We are trying something new to convey our view of the world to our readers. We have heard feedback from...

Read More

Advantages of Working with Independent Firms

The perception exists that investing money with large, established firms is the conservative route. The explosive growth of the independent...

Read More

Mismanaged Bond Portfolios Are Costly

Fixed income investing used to be much easier. An investor could clip 5% return in their sleep without taking much...

Read More

Does Dollar Cost Averaging Work?

There are two types of Dollar Cost Averaging (DCA). Automatically saving in your employer’s 401(k) is the good version. The...

Read More

What Are You Paying for Wealth Management?

Time and again I speak with investors who have no clue what their advisor is charging them. CFA Institute published...

Read More

Google “Bond Bubble” For a Laugh

The term “bubble” is bothersome when describing bonds. Investors are not clamoring to buy 10-year U.S. Treasury bonds with the...

Read More

Pessimism Reigns Supreme

We talk to clients and potential investors daily. We listen to market experts and consume pages of investment research. It’s...

Read More

Simple Beats Complex

Perception exists within wealth management that complex equals smart and simplistic equals dull. This is especially evident in the hyper-competitive...

Read More

Bob Farrell’s 10 Rules of Investing

I have never been a big fan of rigid rules, but every now and again we revisit brilliance that transcends...

Read More

The Future of Wealth Management