Financial Planning

We believe a well-rounded partnership doesn't start and end with portfolio management.

Our financial plans are a collaborative reflection of your life’s work.

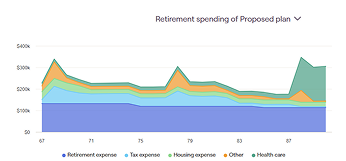

Retirement

Retirement planning isn’t just about saving—it’s about creating a strategy to sustain your lifestyle and achieve your long-term goals. Our data-driven approach helps you optimize income sources, manage risks, and ensure financial confidence throughout retirement.

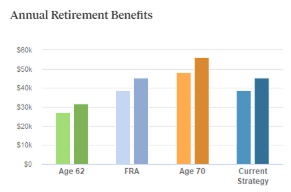

Social Security

Maximize your benefits by determining the best claiming strategy based on longevity, spousal benefits, and tax impact.

Roth Conversions

Strategically convert pre-tax assets to Roth IRAs to reduce future taxes and improve retirement cash flow.

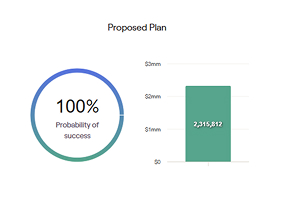

Monte Carlo

Use data-driven projections to test the resilience of your retirement plan under various market conditions.

Taxes

Effective tax planning minimizes liabilities and maximizes after-tax wealth, ensuring you keep more of what you earn. Our proactive strategies help optimize investments, retirement withdrawals, and estate plans for tax efficiency.

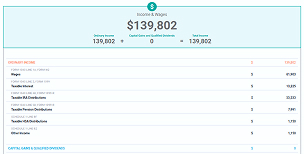

Holistiplan

Identify savings opportunities and optimize your tax strategy.

Tax-Efficient Investment Strategies

Optimize asset location, tax-loss harvesting, and charitable giving to minimize taxes and maximize after-tax returns.

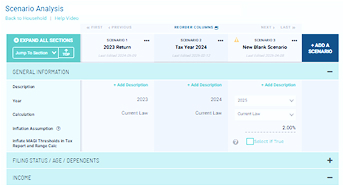

Tax Projections

Model future tax liabilities to proactively plan for Roth conversions, withdrawals, and bracket management.

Estate

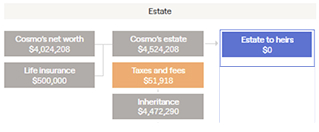

Estate planning ensures your wealth is preserved, protected, and passed on according to your wishes. We help you develop a strategic plan to minimize taxes, avoid probate, and provide for your loved ones with confidence.

Minimizing Estate Taxes & Probate

Structure your estate to reduce tax liabilities and streamline wealth transfer to heirs.

Charitable Giving Strategies

Maximize your impact while reducing taxes through donor-advised funds, qualified charitable distributions, and strategic gifting.

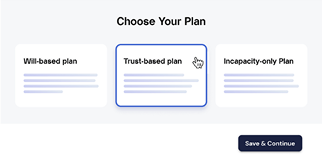

Estately

Utilize a digital estate planning tool to easily create wills, trusts, and healthcare directives for a seamless estate plan.

Cash Flow

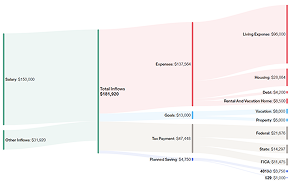

We integrate cash flow analysis into your financial plan, providing clarity on your finances, identifying opportunities, setting realistic targets, and optimizing resources to achieve your goals.

Income & Expense Tracking

Visualize where your money is coming from, and how much is going out.

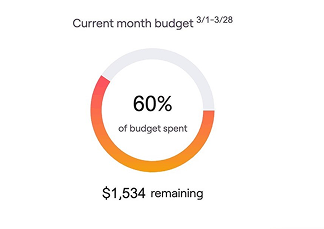

Budgeting

Align your budget with financial goals, tracking progress and opportunities.

Cash Flow Projection

See comprehensive projections and develop strategies to optimize your cashflow.

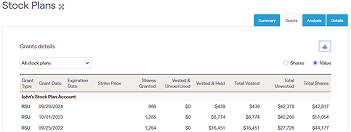

Equity Comp

We help you optimize your stock options and equity awards, aligning them with your financial goals, managing risks, navigating tax implications, and maximizing wealth-building opportunities.

Stock Plan

Clearly see your stock options, vesting schedules, and market value.

Track Your Equity Compensation

Easily track your stock grants.

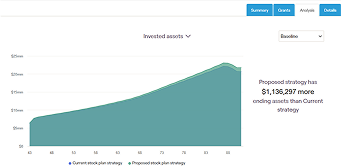

Clear Strategy

Visualize the benefits of our proposed strategy compared to your current approach.

Sunday coffee reads

Unfiltered commentary. Simple language.

Actionable steps.

From the latest market trends to planning tips, our weekly newsletter includes podcasts, writings, and educational videos that provide a clear-cut, unbiased outlook to help you make better money decisions.

Ongoing planning

Life is fluid and so is financial planning.

Your financial plan is never a finished product. We make sure your plan reflects reality. Every time we meet, we will review and make updates accordingly.

Think of your plan as a decision center. Planning for early retirement? Unsure when to take Social Security? Thinking of buying a second home? Decisions like these should not be made in a silo. See what’s possible in the context of your financial plan.

Take the next steps

Talk to one of our professional planners.

Many of our clients come from other advisors for a reason.

If you have concerns about your current advisor or need a second opinion, let’s chat and see if Pure Portfolios is a good fit.