The year was 2007. Bob had been with the same company for 30 years. He had diligently saved throughout his career, paid off his house, and sent two kids off to college. Now it was time to retire.

Bob didn’t want a lavish or extravagant retirement. He had always lived within his means. Bob envisioned his days being spent on the golf course, hanging out with friends & family, and some modest travel.

Like most people transitioning into retirement, Bob was worried he could run out of money. Although he had saved $1,000,000 in his 401k, a stock market crash or a large unforeseen expense could derail his plan.

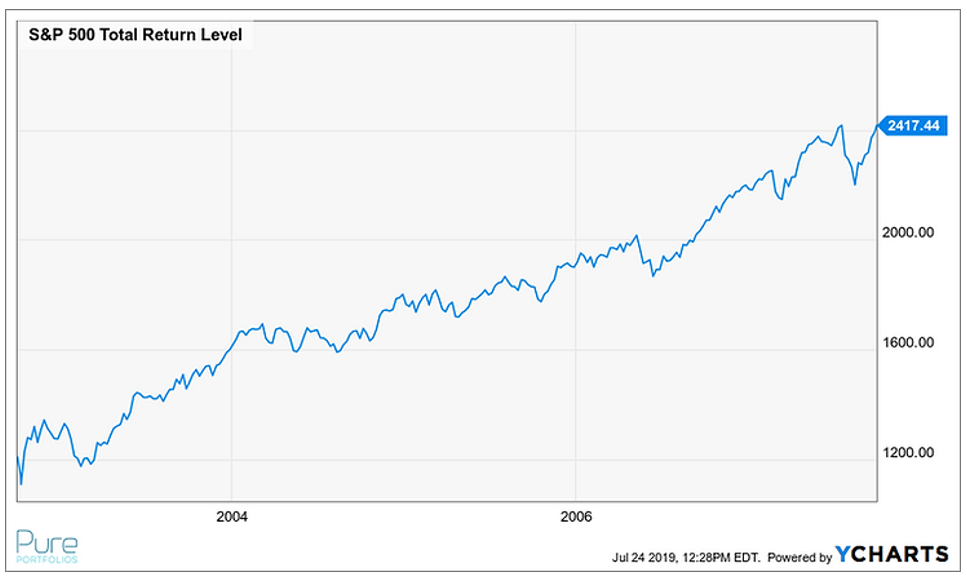

Adding another wrinkle, the U.S. equity market was trading at all-time highs. This made Bob very nervous, but he needed his nest egg to grow to fund his lifestyle.

The above graph shows the S&P 500 from 2002 to 2007. The S&P 500 reached a new all-time high right as Bob was retiring.

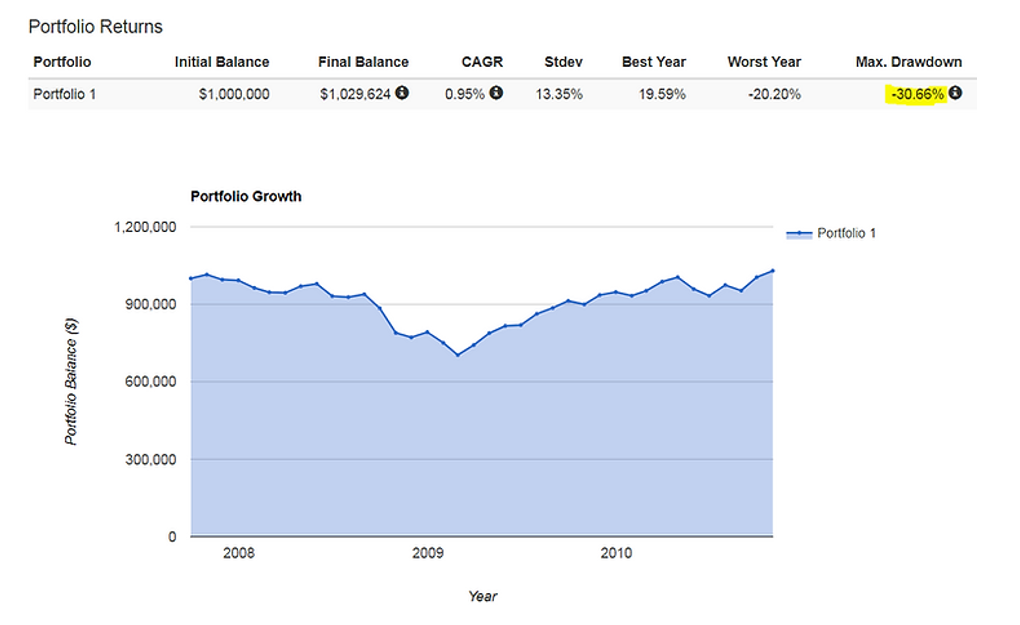

Bob eventually settled on a 60% U.S. Stock / 40% U.S. Bond allocation:

Unfortunately for Bob, things were about to get weird…

Source: Portfolio Visualizer

The above graph shows Bob’s 60/40 portfolio three months into his retirement (January 2008). It certainly wasn’t the best start, but hardly catastrophic.

Source: Portfolio Visualizer

The above graph shows Bob’s balance one year after his retirement (October 2008). His patience is being tested, he’s watching the market every day, and losing sleep about being able to fund his retirement.

Source: Portfolio Visualizer

The above graph shows Bob’s balance three years into his retirement (October 2010). He’s finally back above his initial investment, but it hasn’t been a smooth ride. At the lowest point, Bob’s portfolio was down over $300,000!

According to U.S. Census data, ~10,000 Americans turn 65 every day. That’s roughly 20% of the workforce entering or embarking on retirement. Many pre-retirees/retirees share the same concerns as Bob; U.S. markets at all-time highs, running out of money, unforeseen expenses, etc.

What can we learn from Bob’s experience?

- Find out the annual return you need to achieve your retirement goals. Ideally, you would need a 0% return which essentially means you don’t need the financial markets to achieve your retirement objectives. In other words, you wouldn’t need to take any risk to achieve a favorable outcome. On the other hand, if you need a 25% annual return to make your plan work, you might need to drastically cut expenses, sell real estate assets, or work longer.

- Markets make all-time highs again and again. It’s not a reason to make drastic allocation decisions like shifting to 100% cash or waiting for the market to crash. Find a portfolio that mirrors the way you feel about risk. You’re more likely to stick to the strategy when things get difficult.

- Have a strategy to manage risk. Buy and hold (staying the course) works for some people, but it doesn’t always make sense for pre-retirees/retirees. There are a whole lot of investors that have been spoiled by the last 10 years of virtually uninterrupted gains. This can lead to a false sense of security or a notion that investing is “easy”. Have perspective and a risk management strategy in place to avoid destructive emotional decisions.

Time is your friend, but it isn’t always on your side. Luck plays an understated role in financial outcomes. We can help mitigate random surprises by obsessing about the things we can control; investment expenses, taxes, risk management, behavior, and financial planning.

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com