You have a huge landscaping project in front of you. While you’ve done some basic lawn care in the past, this project will require the expertise of a seasoned professional.

Upon completion of an exhaustive due diligence process, including cost estimates, draft plans, and timeline, you hire Butch & Co. and are ready to get started. You feel great about your decision.

On the morning of the project, you hear the work crew pull-up. Right on schedule. So far, so good. Peering outside your bedroom window, you see a completely different company unloading equipment. You rush outside to let the crew know they’ve made a mistake.

“I’m sorry, but I think you’ve got the wrong house.”

“This is the place. I know you hired Butch & Co. for the job, but they outsource the work to our company, Chester, Inc. We’ll send you an invoice once the work is done.” – Chester project manager.

“But I already paid Butch & Co. for the work!”

The Chester project manager shrugs and turns his attention to his crew.

You sit there in a daze wondering what just happened. How could I hire a company to do a job and they outsource the work, but I foot the bill for everything?

Welcome to the trend in wealth management. However, there’s no work crew that shows up at your door with an invoice. In fact, you’ll never see the charges if you don’t know where to look. You also get the privilege of paying the stealth fee every year.

Here’s how it works…

When you engage a financial advisor for services rendered, there are two types of approaches to managing the investment piece: in-sourcing, & outsourcing.

The “in-sourcer” manages the assets in-house. You hire them to invest the money and that’s what they do. They use low-cost ETFs (Schwab, Vanguard, iShares, S&P, etc.), individual stocks & bonds to build the portfolio. In our example, Butch & Co. would go ahead and finish the landscaping job and you would pay one invoice.

The “outsourcer” passes off their investment responsibility to a third-party. This could be an active mutual fund, separately managed account (SMA), turnkey asset management program (TAMP), or another manager (hedge fund, private equity, etc.). This would be akin to hiring Butch & Co., and having Chester, Inc. do the actual work. You get the “privilege” of paying for both.

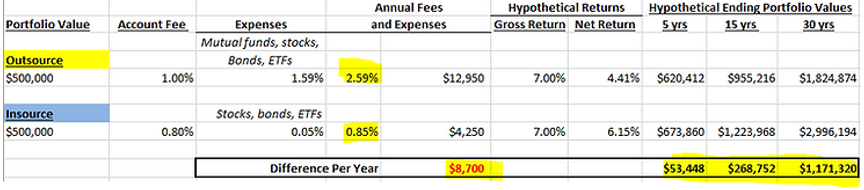

We recently met with a prospective client that thought their current advisor was charging “about 1%”. Upon review, the advisor was using a third-party (TAMP) to manage the money to the tune of 1.5% per year! This was on top of the advisor’s 1% fee for handing off the funds to another firm (all-in, the client was paying 2.59% per year!).

The above spreadsheet shows the impact of outsourcing the investment management. Our prospective client was unknowingly paying ~$8,000 per year to a third-party to manage the money. The fee drag over 30 years was well over $1,100,000!!! (poor decisions compound too!).

Proponents of outsourcing investment management will proclaim advisors add value beyond the portfolio (financial planning, estate & tax guidance, budgeting, etc.). I agree 100%. But if that’s the case, why charge a fee based on assets under management (AUM)?

According to Michael Kitces (author of Nerd’s Eye View blog & financial planning expert) & Cerulli, 54% of CFP financial planners outsource investment management (they expect this trend to accelerate).

My objection is twofold:

I have no issue with a financial advisor/planner outsourcing their investment responsibility, and not charging a fee based on managing the money (% of assets). In practice, I find this is rarely the case. Many advisors are happy to clip a 1% AUM fee for serving as a middle person.

The cost of the external manager (mutual fund, SMA, TAMP, etc.) is rarely disclosed to the client and they often have no idea they’re footing the bill. I can’t tell you how many times prospective clients tell me they’re paying around “1%”, only to find out their actual fee is much higher.

I have been very public in my opposition to outsourcing investment responsibility in an effort to raise client awareness…

The above tweet engages Michael Kitces on the increasing trend of advisor outsourcing.

Are you paying a financial advisor for services NOT rendered?

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com