“History reminds us the event that often derails financial markets is seldom the one investors saw coming.” – Pure Portfolios 2019 Year-end Commentary

The past month has been rough. Financial markets went from pure bliss to sheer panic in less than 30 days. The depth of the drop is concerning, but not out of the realm of previous market movements. It’s the swiftness of the drop that’s unnerving.

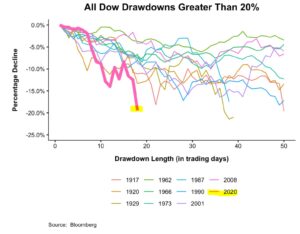

Source: Bloomberg, Michael Batnick

The above graph shows Dow drawdowns of >20% since 1917. Expensive markets tend to fall quickly, but the 2020 version is rewriting the record books.

Such violent moves can bring about strong emotions with more questions than answers. We offer some guidance to help you recognize, acknowledge, and address common challenges investors face during difficult market environments.

Some of these items will help you recognize blind spots. Others, will have you better prepared for the next market event. For some, it will have you questioning your entire investment program. It’s never too late to plug a leak.

Portfolio Construction

How the portfolio is constructed is the most important input when dealing with a difficult market. There are two major pitfalls that rear their ugly head when things turn. These incorrectly capture how the investor feels about risk, and fake diversification.

1. Arbitrarily identifying as a “60/40” or “moderately aggressive” investor and NOT understanding the range of potential outcomes. A better way would be to select a portfolio based on a real, tangible range of outcomes. The below example shows a $1,000,000 portfolio with a 60/40 allocation (equities/fixed income). The portfolio suffered a $289,000 drawdown between Oct. 15th, 2007 & March 2nd, 2009. How would that sit with you?

2. We have cautioned against hedging equities with assets that behave similarly during times of stress. We call it turning safe into risky, owning assets that produce small gains and huge losses, and hedging equities with equities. It’s fake diversification and can blow up in your face. Look no further than Monday’s (3/9) action…

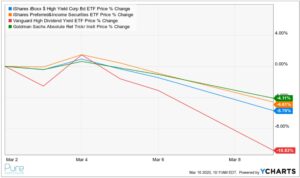

Source: Ycharts

The above graph shows high yield bonds (blue), preferred stocks (orange), high dividend-paying stocks (red), and a hedge fund index (green) that are often positioned as diversifying assets. There is no free lunch in investing, the higher yield or return profile comes with a cost of additional risk.

Bull markets have a way of making us feel invincible. Clipping outsized returns year after year validates our approach to investing. This can lead to a faulty conclusion about the risks we are taking. During times of market bliss, everything seems to be working in the investor’s favor. Legendary investor Bernard Baruch offered some advice on this point, “become more humble as the market goes your way.”

If you’re looking at your investment statement and have a pit in your stomach, you or your advisor probably miscalculated your risk score and/or littered your portfolio with fake diversification.

Be Honest with Yourself

You could be invested incorrectly for an entirely different reason. Fooling yourself into believing you were a risk-seeking investor when in actuality you’re not. Watching your buddies make money in financial markets hand over fist while you’re clipping 2% in a government bond portfolio isn’t fun. You shouldn’t be reintroduced to your risk tolerance during times of market panic. Stay true to who you are.

Amazingly, the “I’d like to make money every year, but not lose anything,” mantra is still alive and well. I’ve seen balanced investors wish for more upside during good market environments, but become puzzled when their portfolio suffers any setback during unprecedented falls in equity markets. Investing doesn’t work that way. If you’re squirming over a 5% portfolio loss, you’re invested incorrectly.

Take the Low-Hanging Fruit

My thoughts on financial and investing topics are plastered all over the internet. Naturally, this leads people to ask me all sorts of questions, especially about what’s next for the stock market. I’m happy to offer my thoughts, but one situation really gets me going. The conversation usually goes something like this (my thoughts in parentheses)…

I work with a broker at XYZ Wall Street bank (red flag). I think I pay around 1% (red flag). I own some mutual funds and other random stuff (red flag). My broker keeps telling me to stay the course and this is a buying opportunity.

Look, get the basics right first. Quit working with salespeople. Find a professional fiduciary advisor with credentials (CFA, CFP, CIMA to name a few). Understand how they manage portfolio risk. Pay attention to your all-in cost of investing. Chances are you’re paying unnecessary capital gains and taxes on investment income. Get rid of those expensive mutual funds. This isn’t 1980.

Tightening up the inputs you can control is going to matter much more in the long run than what the market does for the rest of the month.

Recency Bias

It’s human nature to put greater value on recent events when making decisions or forming opinions.

The U.S. stock market goes up for a decade.

“I don’t see anything that can derail U.S. stocks. In fact, I’m selling my bonds and loading up on the S&P 500.”

The U.S. market craters ~20% over less than three weeks.

“I think this is going to get much worse. Let’s look at selling some of my U.S. stocks.”

Recognize when you might be letting recent events influence your decision making. For better or worse, evaluate how your actions today might influence your long-term plan. Even better, establish a process or framework for making portfolio changes during difficult times (a crappy plan is better than none at all).

We know the past month has been difficult. This is why we write. We want to help people achieve better financial outcomes. Read our content and apply it to your unique circumstance. If you don’t have a plan, build one today. If you have one, tighten it up.