“The last leg of a bull market always ends in hysteria; the last leg of a bear market always ends in panic.” – Jim Rogers, investor

We are officially in a bear market.

Shoulder tap a stranger on the street and they’ll tell you it’s going to get worse.

I’d wager if you took a sampling of 100 random investors, most could craft a elaborate narrative on the upcoming recession and what it means for stock prices.

It certainly could get worse, but the herd’s consensus is a bit too tidy for me.

To quote our friend Bob Farrell…

“When everyone agrees, something else happens.”

Look, I understand why people are beaten down. 2022 has been a difficult year. It turns out unchecked inflation and rising interest rates are bad for all asset classes.

The counter is that we’ve already experienced a decent amount of pain. There’s quite a bit of misery priced into financial markets.

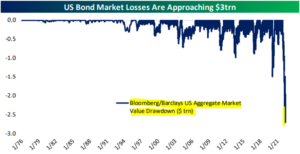

The U.S. Bloomberg/Barclays US Aggregate Bond Market Index has shed $3 trillion of value…

Source: Bespoke Investment Group

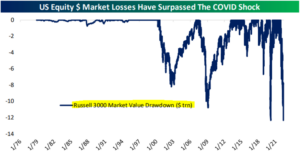

U.S. equity investors (measured by the Russell 3000) have lost $12 trillion of value in 2022…

Source: Bespoke Investment Group

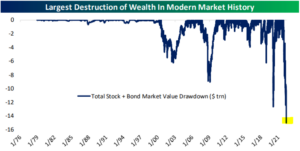

Add the two together and you have the largest destruction of wealth in modern history.

Source: Bespoke Investment Group

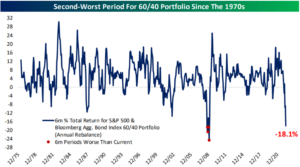

The popular 60% stocks/40% bonds portfolio is down 18.1% (as of 6/17/22), which is the second worst period since the 1970s.

Source: Bespoke Investment Group

It’s no wonder consumer and investor sentiment is in the dumps.

We aren’t trying to make anyone feel bad, rather highlighting there’s a ton of bad news priced into financial markets.

The Fed keeps talking about executing a “soft landing.” I would argue we’ve already experienced a crash and burn.

How much worse can it get?

Who knows, it’s possible things get worse before they get better.

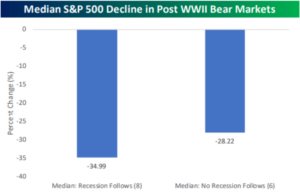

Source: Bespoke Investment Group

The above graphic shows the median S&P decline for bear markets with (left) and without (right) a recession (post World War II). As of this writing, the S&P is down ~22% year-to-date. You can see bear markets with a recession historically post steeper declines.

We turn our attention to how markets perform after falling into a bear market.

Once we hit the bear market threshold (-20%), future returns for the S&P 500 are quite good…

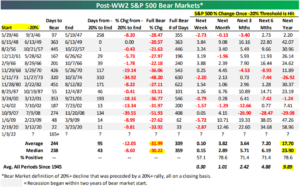

Source: Bespoke Investment Group

The above graphic shows every bear market post-WWII (left column) with future S&P 500 returns over various time periods (right columns). The average decline for a bear market is ~32%, indicating we might not have hit bottom. However, future returns are overwhelming positive once the S&P enters a bear market, posting average returns of ~18% one year later.

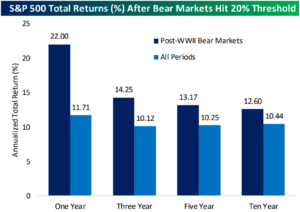

Source: Bespoke Investment Group

The above graph shows S&P 500 returns after the index falls 20% (post WWII). Historically, investing when market conditions are poor has been a successful strategy. Unfortunately, many investors decide to throw in the towel rather than putting money to work.

Yes, 2022 is bad.

Yes, people feel like $%&^.

Yes, it could get worse before it gets better.

Yes, the current environment is a pessimists delight.

Yes, every person you know says it’s going to get worse.

But, they’re fighting 76 years of empirical evidence and market history.

There’s a myriad of bad news priced into financial markets.

What if things get *gulp* better?