“Investors’ mental models tend to be simple, based on recent history, an extrapolation of trends, and an overreliance on frameworks that worked recently.” – Dan Rasmussen, The Humble Investor

Most people set goals with a desired outcome in mind. Getting a promotion. Buying a new house. Retiring with X amount in assets.

Sometimes we get so enamored with outcomes, we can cut corners or overlook a sound process.

The medical student studying for the big exam. She skips a confounding portion of the curriculum, but still passes.

The athlete training for the final race. He gorges on hot dogs and cheeseburgers during pre-race training, which is off his regimented nutrition plan. He finishes first in the race despite his poor eating habits.

The pre-retiree in the final months on the job before putting a bow on a stellar career. She’s been downshifting portfolio risk, but can’t help chase high flying technology stocks to juice her investment returns. She finally retires with a bit more than her “retirement number” due to the high-risk bets paying off.

In each of our examples, our friends deviated from a sound process, but were rewarded in the end with a good outcome. This might be due to talent, luck, skill, or a combination thereof. Despite deviating from the plan, the reward was there at the end. This can lead to a dangerous conclusion…

“I can cut corners and still get a good outcome. It worked for me this time, why wouldn’t it keep working?”

This is our subconscious telling us a story. It’s likely we have no clue we are setting ourselves up for failure.

The poor behavior is confirmed by the good result. We will take the same shortcuts next time.

When markets are trending higher (think 2023, 2024), investors often take more risk, chase the hottest investment themes, shun risk management, and think the prosperous times will continue uninterrupted.

They are making a ton of mistakes, but an ascending market can hide a lot of warts. An investor doesn’t receive constructive feedback during a bull market. Worse yet, they receive misleading feedback in the form of market gains resulting in over-confidence and hubris.

As the saying goes, “everyone is a genius in a bull market.”

The investor gets a good outcome. The poor behavior is confirmed by the good result. They will take the same shortcuts during the next prosperous market cycle.

Then, the inevitable happens.

Spring 2025 hits. The S&P 500 craters 21% February 19th to April 7th.

The investors that were piling into the hottest corners of the market fared the worst.

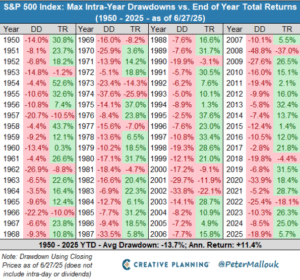

The wild ride of 2025 is hardly unprecedented. Since 1950, the average intra-year drawdown for the S&P 500 is ~14%…

Source: Creative Planning, Peter Mallouk

The above graph shows every intra-year drawdown for the S&P 500 since 1950 (DD, red) and the ending calendar year return (TR). When we zoom out and look at history, the wild ride of 2025 doesn’t seem so unprecedented. The average intra-year decline for the S&P 500 is ~14%.

Part of a sound process is gathering feedback and course correcting.

If good market environments offer zero feedback or misleading feedback, bear markets offer golden feedback.

Bear markets (-20% drawdowns) can provide lessons about our investment personality, where the landmines are hiding in our portfolio, and the soundness of our information filters.

We’ve outlined several questions and exercises to help you prepare for the next difficult market environment…

Preparation Beats Prediction

Building a sound portfolio starts today, not making a bunch of reactionary changes during a sell-off. Stop making predictions, listening to talking heads on TV about what happens next. It makes no sense to try to get more when you are not optimizing what you’ve already got. Construct a risk aware portfolio that can hold up during every market environment.

Pay Attention to Drawdown

There are many ways to track risk, in my opinion, drawdown is the most impactful (it’s also simple). As an investor, you want to understand when the S&P 500 is down -20% in two months, how does your portfolio hold up?

Crisis Investing Works

It’s okay to be pessimistic, it’s not okay to stay a pessimist. There are few fat pitches in investing, one of them is putting capital to work when it feels the worst.

Turn off the TV

If you’re an emotional wreck during a market sell-off turn off the TV, shut off your phone, and get off social media. If you want to dive into previous market selloffs, recessions, etc. engaging with history is a better exercise.

Honest Self-Assessment

How did you emotionally hold up? Were you seeking opinions that validated your own? Did you make emotional decisions? In a world where nothing is stable or dependable and anything can happen, the first rule of the road is to be honest with ourselves about our limitations and vulnerabilities.

Landmines

Do you know where the pain is in your portfolio? Exotic mutual funds, concentrations, risky bets, having multiple accounts spread across various institutions, make it extremely hard to measure where the risk is hiding in your portfolio. You want to understand exactly where the potential landmines are lurking. We call it risk awareness, intentional risk, or calculated risk. When you can identify risk, we can better offset or hedge in other areas.

The good news? You get a mulligan (golf term for a do-over). The market bounced back as quickly as it sold off. This is highly unusual, but it’s also a golden opportunity. Don’t let the opportunity go to waste. Building a sound, risk aware portfolio starts today.

A good investor will obsess over the process and live with the outcome. An amateur investor will obsess about outcomes with little regard for process.

If you were uncomfortable during the last market sell-off, click here to learn more about how Pure Portfolios mitigates risk during difficult markets, takes emotion out of the investment process, and builds risk aware portfolios for retirees.