“I’m just waiting for the bubble to pop.” – Anonymous potential client

Have you ever met the type that thinks everything is in a bubble?

Market goes up. Bubble.

Real estate prices go higher. Bubble.

Bonds? Perpetual bubble.

It reminds me of Oprah handing out cars on her show. “You get a car!” “You get a car!” and “You get a car!”

Instead of cars, these serial whistleblowers hand out the market bubble label. Anything with a ticker symbol gets a bubble.

In my opinion, the use of the label “bubble” is in a bubble. If something goes higher and we disagree or don’t understand the price action, it’s automatically a bubble.

Going with the “everything is a bubble” approach is simple. It doesn’t take much thought. This is consistent with human nature. We’ll do anything to conserve energy and apply mental shortcuts to complex topics.

This can lead to missed opportunities, extreme dispositions (sitting in all cash waiting for the bubble to pop), and entrenched viewpoints.

On the flip side, it would be naïve not to acknowledge the pockets of froth that have developed in certain corners of the market. We don’t often use the term “bubble,” but when we do it might refer to the below industries, sectors, and asset classes…

Let’s define “bubble” courtesy of our friends at Investopedia…

A bubble is an economic cycle that is characterized by the rapid escalation of market value, particularly in the price of assets. This fast inflation is followed by a quick decrease in value, or a contraction, that is sometimes referred to as a “crash” or a “bubble burst.” Typically, a bubble is created by a surge in asset prices that is driven by exuberant market behavior.

Electric Vehicles

Research Affiliates just published a wonderful article of the “big market delusion” going on in the electric vehicle space (I would encourage anyone with interest in EV to read it). The premise is that auto manufacturing is capital intensive and highly competitive. Not all of the EV companies are going to be winners, but the industry is trading as though they will all be thriving businesses. Something has to give…

According to Research Affiliates, as of 1/31/21, the combined market value of the eight EV manufacturers reached $1 trillion. This is almost on par with the entire value of traditional auto manufacturers. However, when you compare revenue it’s not even close. The combined EV revenue is a fraction of the traditional players.

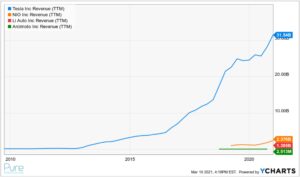

Source: YCharts

The above graph shows the rapid rise of a handful of EV manufacturers in the 4th quarter of 2020.

Source: YCharts

The above graph depicts the trailing 12-month revenue figures for the same EV companies. The basket of stocks are moving up, but they can’t all be winners. Revenues, market share, and profits must follow to justify the lofty valuations. Aside from Tesla, that doesn’t seem to be the case.

Special Purpose Acquisition Company (SPACs)

SPACs have been around for decades, but have recently come into favor as a quick way to raise capital to purchase other companies. Known as “blank check” companies, the organizers of a SPAC will look to buy promising start-ups in a particular niche i.e. technology, manufacturing, automation, or anything else you can think of.

Interestingly enough, a SPAC can sit on investor cash for up to two years and not invest in anything.

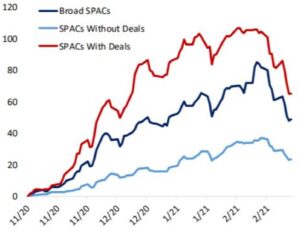

Source: Bespoke Investment Group

The above chart shows SPAC performance since 10/31/20. It didn’t really matter what SPACs invested their capital in, they couldn’t miss in the 4th quarter of 2020. Notice that at the end of January 2021, even the SPACs (light blue line) that hadn’t invested a dime in another company were up almost 40%! Most recently, SPACs have fallen back down to Earth.

The space has become so hot, the SEC just issued a warning to not invest in SPACs based on celebrity endorsement. If that’s not frothy, I don’t know what is.

Hot Money Funds

Cathy Wood, founder of ARK funds, has created a sleeve of ETFs that look to capitalize on emerging technology themes (innovation, genomic revolution, next generation internet to name a few).

She made a huge bet on Tesla and it paid off handsomely, both in return and asset flows.

Source: YCharts

The above chart shows the ascension of the various ARK ETFs since spring 2020.

Source: Bespoke Investment Group

The above chart shows the money-weighted returns for the ARK family of ETFs. You can see investors that piled into the ARK funds fall of 2020 are facing steep losses (yellow highlight).

I personally think what ARK has done is pretty incredible. The unfortunate thing is many investors shovel money into these white hot ETFs after a massive run to the upside. They are often left holding the bag when the inevitable downswing comes. History has proven the best performing funds today are often the worst performing tomorrow.

“Meme” Stocks

The GameStop fiasco was probably the most public example of non-sensical price action in a stock. However, we’ve seen this movie before. Remember the price action in car rental company Hertz? Well, Hertz is now a big fat $0.

The GameStop drama in my opinion is market speculation at best and manipulation/gambling at worst.

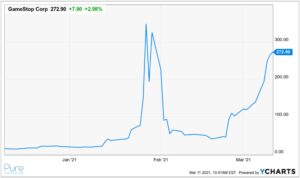

Source: YCharts

The above chart shows the three month price action of GameStop. Sometimes a picture is worth a thousand words.

Private Equity

I was approached by a friend who asked if I would be interested in the latest funding round of a promising financial technology start-up. Normally, this would be an automatic decline, but I was curious about the deal terms and the company. I asked if they had an investor due diligence packet. The response I received was shocking…

“We don’t give out financial information to any investor under $100 million.”

Can you imagine the arrogance of asking for investor funds, but essentially saying “don’t worry about the financials, you’re lucky we’re even considering your capital.”

I might be out of touch with the private equity game, but that seems egregious.

My private equity experience was the inspiration for this post. In my opinion, it seems there are pockets of market froth, but be mindful of labeling everything a bubble.

You might miss a good opportunity.