“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” – Satoshi Nakamoto, mysterious inventor of Bitcoin.

I am not a Bitcoin expert, enthusiast, or naysayer. I’ve avoided writing about Bitcoin because I feel grossly underqualified to have an opinion. I’ve personally owned small amounts of Bitcoin over the past five or six years, mainly out of curiosity of how it works.

I’m writing about Bitcoin now because a) I’m being asked about it more than ever, and b) I believe Bitcoin (BTC) may become a staple of retail investment portfolios in the near future.

I believe Bitcoin is neither an undesirable currency only used to fund illicit activities nor the savior from evil central bankers that blow bubble after bubble through manipulating paper or “fiat” currencies.

The truth probably lies somewhere in between.

Here’s a loose history of BTC.

Bitcoin was launched in 2009 by the mysterious and anonymous Satoshi Nakamoto. The idea behind BTC was to provide a quicker and more efficient way to move currency, outside of a traditional centralized network of banks, financial institutions, etc.

BTC is not backed by any government. There are no physical coins. Bitcoin is created, traded, exchanged, and stored on a ledger system, known as blockchain.

In layman’s terms, BTC is a currency that a bureaucrat, government, or traditional financial institution can’t mess with. I describe BTC as a bet against the establishment financial system.

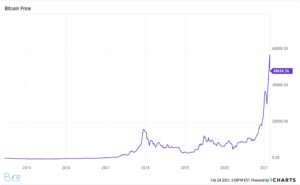

Source: YCharts

The above graph shows the price of Bitcoin (BTC) since 2014. The currency has gone parabolic the past few years attracting interest from institutional and retail investors, as well as government regulators.

Bitcoin reminds me a bit of Tesla, in that it’s a very polarizing asset. I know smart people that are all-in on the prospects of BTC. I know smart people that wouldn’t touch BTC with a ten-foot pole.

Here’s what the BTC enthusiasts will tell you:

- The government cannot debase, manipulate, or mess with BTC. There is a fixed supply of 21 million coins.

- BTC operates on a decentralized network meaning no single entity, like the Federal Reserve, has control over Bitcoin. Rather, transactions are verified by public ledger that everyone has access to.

- You can transfer BTC almost instantly with much lower transaction fees than a traditional bank. There are no overdraft fees, banks withholding your money, charging to use your money, or any of the myriad of issues dealing with a modern day bank.

- Institutional investors are starting to adopt BTC as a legitimate investment. U.S. exchanges have launched Bitcoin futures contracts. Companies, from Tesla, Square, and PayPal have bought BTC as an alternative to holding cash. The Toronto Stock Exchange just launched two ETFs that directly own Bitcoin. Coinbase, the largest U.S. based cryptocurrency exchange, is rumored to have the biggest IPO since Facebook.

- Some of the smartest minds in the world are working on blockchain related projects, including legacy Wall Street firms (watch what they do, not what they say).

Here’s what the BTC pessimists will tell you:

- Bitcoin is going to zero. It’s a ponzi scheme.

- There’s no physical asset, cash flow, or entity behind the currency.

- Bitcoin is used to fund illicit activity, including money laundering, terrorism, and the drug trade.

- It’s the wild west from a regulatory standpoint. Thieves can hack exchanges and individual wallets. BTC investors can lose private keys (see the amazing story of a guy who can’t access $140mm worth of BTC), or send BTC to the wrong place often with little to no recourse.

- Bitcoin can be confusing for someone not versed in technology. Digital wallets, private keys, cold storage, etc. can be overwhelming.

- Mining BTC is incredibly energy intensive. It’s been said that BTC miners use more power than the entire country of Argentina.

- Despite claims that BTC can be a diversifying asset, it still can move unpredictably and quite violently. It’s fair to say the history of BTC is rather limited, especially how it moves in relation to other financial assets.

We spoke to an investor with a sizable position in BTC and ultimately decided his traditional investable assets (stocks, bonds) should be positioned more conservatively to offset the risk of his growing BTC position.

In my opinion, BTC will eventually become part of a mainstream retail investment portfolio. U.S. investors can currently buy Grayscale BTC Trust (ticker GBTC), but it’s incredibly expensive to own at ~2% per year. U.S. regulators have shot down several attempts to register a U.S. based BTC ETF. There are several more pending filing. The SEC seems to be dragging its feet because there’s no easy framework for regulation.

I would like to see BTC used for its original utility. Buying stuff, transfer of money, frictionless way to move money across borders.

In its current form, BTC seems more a vehicle to speculate, trade, and make money, which only works if someone is willing to pay more than you for BTC.

What’s the future of Bitcoin? The truth probably lies somewhere between the enthusiasts and pessimists.