“I’m going off the rails of the crazy train.” – Ozzy Osbourne

Bitcoin (BTC) started as an obscure experiment. The polarizing digital asset has barreled its way through bubbles, regulatory hurdles, and bouts of extreme volatility to emerge as a legit store of value.

Bitcoin was once dismissed as fad, Ponzi scheme, and a tool for speculators and criminals.

It’s now sitting at the grown-ups’ table of global finance.

The idea of a decentralized, unregulated currency with no intrinsic value sounded like financial black magic. Fast forward to 2025, major asset managers like Blackrock & J.P. Morgan are on board the crazy train. Sovereign wealth funds are allocating to BTC, and the SEC has finally greenlit Bitcoin ETFs. Central banks hold or are considering holding BTC on their balance sheet. Companies are operating BTC Treasuries to maintain purchasing power of their idle reserves.

How did Bitcoin go from being the punchline to a legitimate asset class worthy of institutional investors?

The answer is out of control government spending, perpetual government deficits, and the debasement of paper (fiat) currency.

We highlight pivotal moments in BTC’s history and why the crazy train could be in the early stages…

The Most Successful ETF Launch in History

The U.S. approved the first spot Bitcoin ETFs (exchange traded funds) in January 2024, marking a turning point: 11 ETFs launched, including offerings from BlackRock, Fidelity, ARK‑21Shares, iShares, Bitwise, and others.

Retail investors could now click a few buttons via Schwab or Fidelity and buy BTC like they were buying Apple or Amazon. This opened a flood of liquidity into BTC; the equation was simple, fixed supply of Bitcoin, increased demand = price appreciation.

The result was the most successful exchange traded fund (ETF) launch in history…

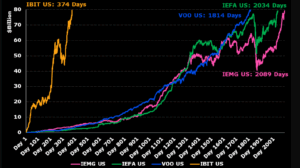

Source: Bloomberg, Eric Balchunas

The above chart shows Blackrock’s Bitcoin ETF (ticker IBIT, orange) vs. other popular equity ETFs, VOO (S&P 500, blue), IEFA (international stocks, green), IEMG (emerging markets, pink). It took ~5 years for these popular ETFs to reach $80 billion in assets under management. Bitcoin took about a year to reach $80 billion. Some analysts expect IBIT to reach $100 billion by the end of 2025.

Bitcoin Government Reserves

On March 6, 2025, President Trump signed an executive order establishing a U.S. Strategic Bitcoin Reserve (SBR). The U.S. government holds an estimated 200,000+ BTC.

El Salvador was the earliest adopter of sovereign BTC holdings making the digital asset a legal tender back in 2021. The country currently holds over 6,100 BTC, valued around $550–600 million.

Indonesia is discussing whether BTC mining could serve as a national reserve strategy aligned with economic growth goals. If Indonesia has success mining and owning BTC, other Asian countries could follow.

Brazil is set to hold a parliamentary hearing on August 20, 2025, where lawmakers will debate legislation proposing allocation of up to 5% of national treasury assets into Bitcoin (~$15 billion based on Feb 2025 reserves).

Poland views Bitcoin as a diversification and innovation strategy.

Czech Republic is reportedly evaluating up to 5% of national reserves in BTC.

Russia also received official proposals after government officials publicly praised BTC’s role in reducing reliance on the U.S. Dollar and the wild fluctuations of the Ruble.

Japan, through its Government Pension Investment Fund, has expressed interest in exploring a BTC allocation.

Fidelity Digital Assets projects the trend to continue with central banks and sovereign wealth funds establishing strategic Bitcoin positions in 2025 & 2026, furthering Bitcoin’s adoption globally.

A few years ago, if one would have said sovereign nations would be lining up to buy BTC in 2025, the person might of been laughed out of the room.

Smart People are Changing Their Tune

Being able to change one’s mind is a sign of intelligence. There have been some heavy hitters in the investment space changing their tune on the merits of Bitcoin…

Ray Dalio

Ray has been sounding the alarm on U.S. debt levels in recent years. He used to recommend 1–2% allocation to Bitcoin. Dalio now recommends up to 15% in a mix of BTC and gold, citing serious concerns over U.S. fiscal policy and currency debasement.

Jamie Dimon

Dimon, the respected CEO of J.P. Morgan Chase, has long called Bitcoin a “fraud,” “pet rock,” and even compared BTC to the tulip mania bubble of the 1700’s. J.P. Morgan quietly facilitated Bitcoin exposure for clients through ETFs.

J.P. Morgan reportedly plans to let clients borrow against Bitcoin holdings, a move industry insiders believe could reshape BTC’s role in financing and wealth management

Rick Edelman

Rick Edelman is the owner of Edelman Financial Engines, one of the largest independent investment advisors in the country. Rick has been a BTC champion for several years, some might even call him an early adopter. Recently, Rick caused a splash proclaiming investors should allocate anywhere from 10%-40% in Bitcoin.

In our opinion, Rick’s suggested allocation is excessive, but it shows the conviction that some have in Bitcoin’s future role in the modern investment portfolio.

Why Should Investors Care About Bitcoin?

In my opinion, Bitcoin is not going anywhere.

I also concede BTC is not for every investor, there are good reasons NOT to own Bitcoin as well (perhaps a topic for a future post). Bitcoin is volatile, confusing, and still an emerging asset class.

However, Bitcoin’s trajectory in 2025 is less about retail hype and more about widespread adoption. BTC’s path into easily accessible ETFs, government balance sheets, and institutional portfolios suggests it is evolving into a core financial asset—not just for speculative traders but for long-term investors.

I’m often asked what’s going to change in the next month, quarter, or year. This is the wrong question. A humble, savvy investor can potentially gain an advantage by asking what’s NOT going to change over the next 5-10 years.

It’s not a stretch to proclaim countries are going to keep deficit spending and paper currencies will continue to lose value. In that environment, it could make sense to own assets that represent sound money principles. In my opinion, Bitcoin could have a tailwind at its back for the foreseeable future.

If you have questions about Bitcoin’s role in a modern investment portfolio, shoot us a note insight@pureportfolios.com

For further reading…