“You make most of your money in a bear market, you just don’t realize it at the time.” – Shelby Cullom Davis, investor, businessman, former U.S. Ambassador to Switzerland

I just finished an 18-hole round on a sweaty August Saturday.

I sought refuge in the clubhouse. The A/C was working overtime.

“I think it’s a dead-cat bounce. It’s going to get worse. The bottom will come November 2022. I expect a large rally that sputters out summer of 2023.”

Four men sat around the table nodding in agreement. The confident man spewed his market narrative without a shred of possibility he could be wrong.

I’d wager a variation of the same conversation is playing out across bars, airports, and little league bleachers right now.

I cringe when I hear this stuff. In my opinion, trying to top- or bottom-tick stock prices is misguided and dangerous (we took an evidence-based approach outlining historical signs of a market bottom here) .

The last 24 months have played out like a fiction screen play. No one saw anything coming. How about a dose of humility (see “The Brilliance of I Don’t Know“)?

The fact is, investors are horrid at calling inflection points in stock prices.

Inflection points are large changes in market action, i.e. calling the top in stock prices or calling the bottom in stock prices.

When things are bad, we assume they will stay bad forever. When things are good, we assume prosperity will continue forever.

The reality is that things get worse quickly. Humans change their behaviors. Progress is made slowly, and eventually things get better again.

We outline several not-so-obvious inflection points from recent bear markets & recessions.

Equity Markets Sniff Out Recessions, Not the Other Way Around

Recessions are impossible to call in real-time. Heck, we can’t even agree on the definition of a recession anymore.

It’s not uncommon for a recession call to come six months after the actual recession.

Why does this matter?

Many investors tend to draw a straight line between recession calls and stock prices.

Wait for recession call.

Recession officially called.

Investors think stock prices go down.

Recession ends.

Stock prices go up.

It doesn’t work that way…

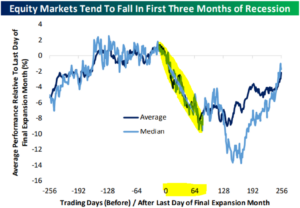

Source: Bespoke Investment Group

The above chart shows S&P 500 performance before and after recessions. The data includes 15 recessions since 1929. On average, equities fall during the first three months of a recession rather than during the entire duration of economic contraction.

Did the recession start at the beginning of May? Perhaps.

If a recession was just getting underway, we would expect equities to fall rather than bouncing off the June low.

Surely, not all recessions are equal. We’ve outlined several recessions that were triggered by an interest rate-raising Fed to snuff out inflation…

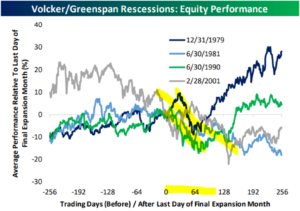

Source: Bespoke Investment Group

The above chart shows four recessionary periods (1979, 1981, 1990, 2001). The trend of equity market declines during the first three months of a recession hold true. The wildcard is equity performance after the initial drop.

Between 1980 & 1982, the market declined by ~27% as the Fed stamped out inflation.

The Fed changed course in August 1982, cutting rates by 0.50%.

This was a massive inflection point that many investors missed. Here’s a headline from the Wall Street Journal’s 8/15/1982 article “Dark Days on Wall Street“…

“In the past two weeks, all the market averages have plunged to new lows as Wall Street, beset by cruel economic news from all sides, has time after time been unable to mount a sustained rally. That is a discouraging omen, an indication that the bottom has not been reached, many securities analysts say, and a sign that even the most steel-willed optimists may be about to throw in their towels.”

The market proceeded to rally ~35% to finish the year, erasing all of the bear market losses.

If we are playing Monday morning QB, we could make a case that the U.S. entered a recession in the spring given the market action…

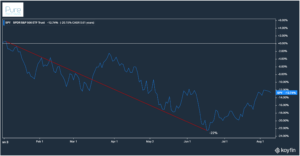

Source: Koyfin, Pure Portfolios

The above chart shows the S&P 500 22% decline to start the year. If a recession was getting underway, we would expect the equity markets to sniff it out and decline. The market is signaling a) recession could have already taken place, b) we are still in a recession, c) no recession in sight.

What’s the takeaway?

• Recessions are nearly impossible to call in real-time

• Stocks tend to fall during the first three months of a recession (data from 15 recessions dating back to 1929)

• Allocation mistakes are made when investors draw neat & tidy lines between economic activity and stock prices (see “Is the Market Unhinged from the Economy?”)

• Trying to call inflection points, market tops or bottoms, is a futile exercise

As you get more experienced as an investor, you learn the best entries are seldom comfortable.