“We should target high dividend payers because bond yields are offering nothing.” – Random investors everywhere.

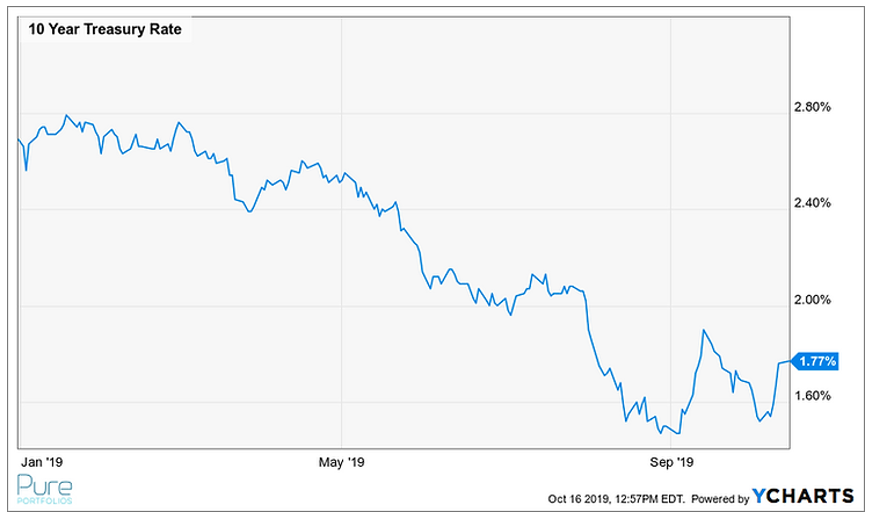

U.S. bond yields have plummeted in 2019 reigniting a search for portfolio income.

The above chart shows the yield for 10-year U.S. Treasury. After a brief run-up in U.S. bond yields, the hunt for portfolio income is back on.

A CBS Marketwatch story highlighted a study from Bank of America calling to “reconsider the role of bonds in your portfolio.” The article cites the number of global stocks (~1,100 companies) that provide dividends above the average yield of global government bonds. That sounds more impressive than it actually is, considering ~$17 trillion in global government debt is negative yielding.

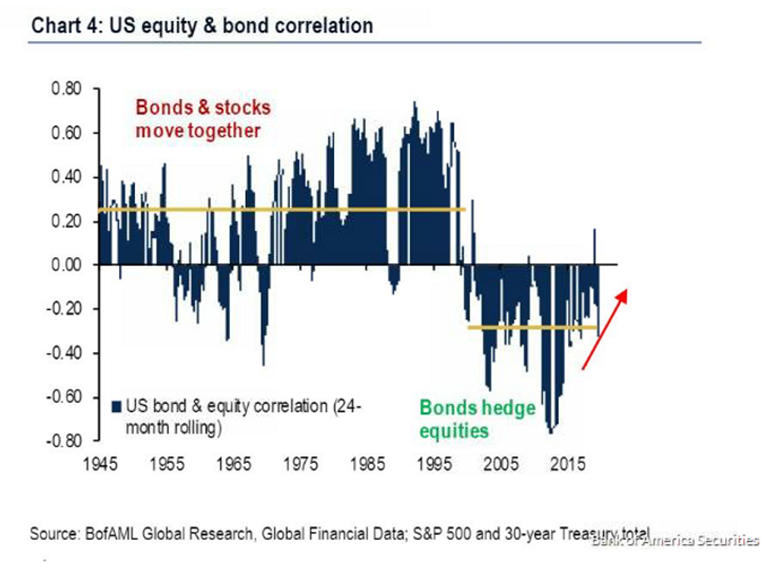

The article goes on to say that the correlation (how two assets move in relation to each other) between bonds and stocks could change rapidly and cause pain for investors.

Source: Bank of America Global Research

The above graph shows stocks and bonds can have periods where they share a low positive correlation (pre-1995). More recently, bonds have acted differently than equities (negative correlation) which is a good thing to reduce portfolio risk, especially during times of market stress. A correlation of 1 implies the assets move exactly together.

The article concludes with the following haymaker:

“Instead of U.S. government debt, the authors advise investors to add more exposure to equities, particularly stocks with high dividend yields in underperforming sectors, including financials, industrials and materials, which can be bought at inexpensive valuations.”

We wonder can high dividend paying stocks serve as a replacement for low yielding bonds?

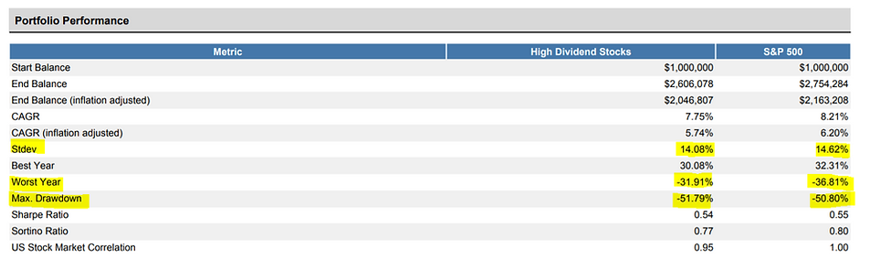

Let’s look at the behavior of the Vanguard High Dividend ETF (ticker VYM), which targets companies (as the name implies) with high dividend yields. We examine the period from December 2006 (VYM’s inception) to September 2019.

Source: PortfolioVizualizer.com

The above chart shows the risk and return profile of a basket of high dividend stocks (left column) and the S&P 500. Would a bond proxy suffer a -31.91% loss in a single year? Probably not. Make no mistake, high dividend stocks would very much participate in a market correction. It doesn’t seem very logical to target a dividend yield of 5% when the underlying stock goes down by 31%. That’s called picking up pennies in front of a steamroller.

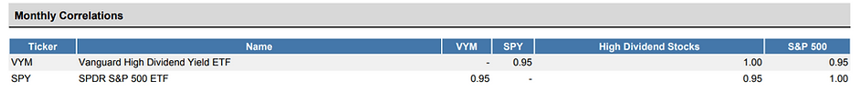

Source: PortfolioVizualizer.com

The above graphic shows nearly a perfect correlation for high dividend stocks and the S&P 500. The most head scratching conclusion from the BofA research is the potential for correlations between bonds and stocks to rise. Why would we trade a low or negative correlation asset (bonds) for a high dividend strategy that is almost perfectly correlated to U.S. equities. No thanks, we’ll take our chances with bonds!

Replacing a core equity position with high dividend paying stocks is perfectly reasonable. That’s an apples to apples trade off. Advocating replacing bonds with high dividend paying stocks and pretending it’s a substitution of equals is a faulty and dangerous conclusion.

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com