“What a year this week has been.” – unknown

A handful of stocks couldn’t miss.

The pandemic changed the way we did everything overnight.

Obscure companies became mainstream.

Mainstream internet companies became more popular than ever.

Stocks of the obscure and mainstream internet went to the moon.

Source: Koyfin, Pure Portfolios

The above graph shows the stock performance of pandemic darlings from January 2020 to January 2021. Investors were betting with their capital that “doing everything from home” would last for the long-term.

Zoom – work from home

Teladoc Health – virtual doctor visits

Chewy – Amazon for pets

Twitter – everyone offering hot COVID takes

Peloton – gyms will never open back up

The COVID economy and themes that came with it was the “new normal.” Until it wasn’t.

Reality set in when investors realized human behavior doesn’t change overnight.

Source: Koyfin, Pure Portfolios

The above graph shows the stock performance of pandemic darlings over the last six months (as of 2/22/22). The bottom has fallen out of the COVID economy stocks punishing investors that a) were chasing performance b) extrapolated pandemic themes into the future.

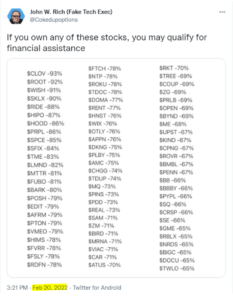

The below is a broader look at darlings of the pandemic and performance from all-time highs (posted on 2/20/22)…

Source: John W. Rich Twitter

Consider this nugget from Bespoke Investment Group on 2/18/22 regarding the technology heavy Nasdaq index…

“The Nasdaq is down 17% from its peak 64 trading days ago. 64 trading days after the pre-COVID peak it was down just 6.4%.”

In my opinion, the above carnage is why the current correction feels so awful. While the broader S&P is down ~9% as of this writing, many investors have done much, much worse.

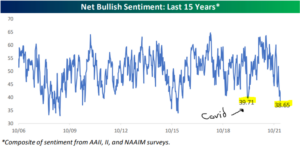

Investor sentiment backs this up.

Believe it or not, bullish sentiment is lower today than it was during the apex of the COVID crash…

Source: Bespoke Investment Group

The above shows a composite of investor sentiment over the past 15 years (higher numbers = optimistic, lower = pessimistic). People feel less optimistic about stocks today than they did during a -37% sell-off!

Think about that, investors feel worse about a ~-9% correction than they did during a -37% market swoon.

Unbelievable.

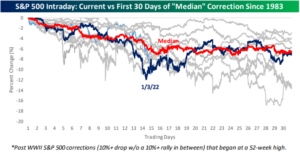

The current correction vs. the first 30 days of a “median” correction are in-line with historical averages (S&P since 1983).

Source: Bespoke Investment Group

The above graph shows the current correction (dark blue), median correction (red), and all corrections (light gray) for the S&P 500 since 1983. The 2022 version was intense over the first 15 trading days, but has leveled off to match the average correction over 30 days. *We define correction as a 10% market drop*

Connecting the dots, here’s where we are at…

- S&P 500 enters correction territory, down ~-9-10%

- Correction is consistent with median corrections for S&P since 1983

- The COVID economy stocks, which include other frothy technology names, have been absolutely pummeled

- Investors feel worse now than they did when the market was down 37%

The current environment is a fascinating example of investor psychology, pain of regret, performance chasing, emotional decision making, and no investment framework jumbled together.

We highlighted pandemic related trends could reverse in our September 2020 post, “The Great Rotation“…

Humans are quick to declare extreme endings. The end of offices. The end of brick and mortar retail. The end of airline travel. Will human behavior change due to the pandemic? Probably.

Post COVID, are we never going to work in offices again, enjoy our favorite restaurant, or travel to our favorite vacation spot? Probably not.

Performance can change quickly. One day, you’re a genius. The next, you feel like an idiot.

Avoid the extremes, i.e. “tech stocks will go up forever,” or, “energy and industrial stocks are worthless.”

Someone recently asked me what I’m watching in financial markets. My answer was simple…

Things that work are no longer working as well.

Things that haven’t worked, are starting to work.

Markets move in cycles. Things go in and out of favor.

In the late 1990s, technology stocks were the rage.

The 2000s, emerging markets crushed.

In the mid 2000s, it was anything tied to housing.

Now it’s big technology stocks.

If you want to learn more about Pure Portfolios’ unique investment approach, click here.

Happy investing!