Pure Portfolios was recently featured in Citywire’s RIA “My Model Portfolio” series that ran in May’s print version and is live online (soft wall). Citywire provides news, information, and insight for professional advisors and investors around the world.

I discuss our investment philosophy, how we build portfolios, my disdain for advisors that outsource their investment responsibility (but still charge a fee based on assets under management), and how the active vs. passive debate needs to be reframed.

What is your investment philosophy?

We build our strategic asset allocations to fit our risk appetite or range of acceptable outcomes. We want to understand a portfolio’s range of outcomes over a fairly short period of time. This runs counter to the ‘think long-term’ mindset that has been ingrained in a lot of people, but we have found that it’s really hard for an investor to stick to a long-term investment plan if they don’t understand the range of outcomes over the short term. We essentially back into our investment portfolios by building an asset allocation that doesn’t exceed a risk budget for each of our respective models.

We want to remove human bias and ‘gut feeling’ from our investment process. Even professional investors exhibit self-destructive behavior, especially during times of market stress. We have built our investment framework, and any tactical change is subject to our monthly quantitative screens. We want a streamlined, repeatable investment process. Of course, that doesn’t mean we aren’t looking for ways to refine or improve our process.

We believe that an investment strategy should be transparent, easy to explain and tax-efficient. A successful investment program should be hyper-focused on the few things we can control: investment costs, financial planning process, behavior and tax-efficiency.

What models do you offer clients?

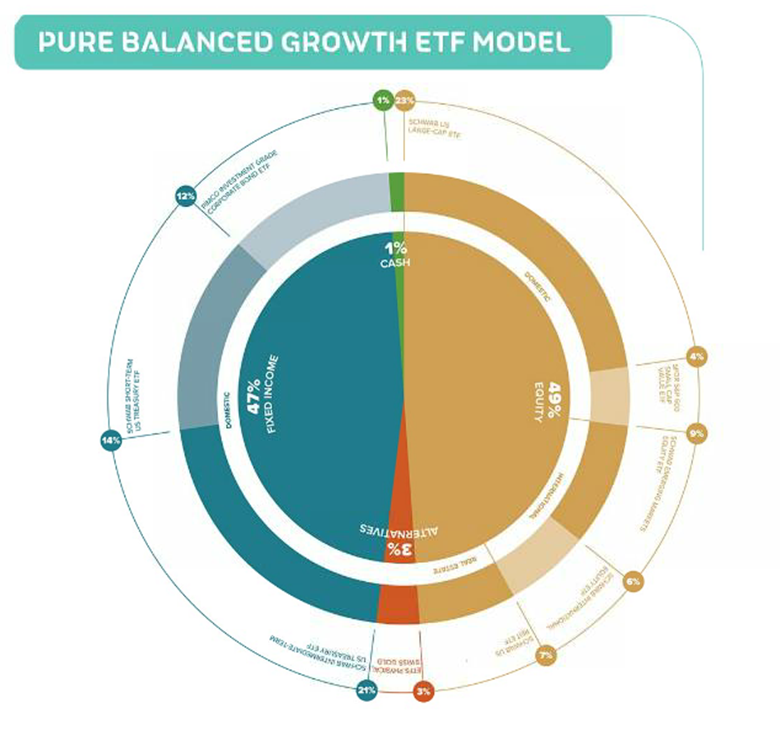

We have five investment models: Fixed Income, Balanced Income, Balanced, Balanced Growth and All Equity. Each has a strategic or static asset allocation that is subject to our monthly quantitative (rules-based) screens. This is a fancy way of saying that we use hard and fast rules to overweight or underweight a particular asset class. Historically, investment managers have made decisions based on a bunch of suits sitting around the chief investment officer guessing what they think will happen next. We don’t want our personal biases, investment experience or mood that day to influence our investment process.

How do you view manager selection?

To be honest, I cannot believe people still invest this way. We are evidence-based investors, which we define as pursuing whatever works relentlessly. For example, if I’m looking at the evidence, it’s very clear that paying up for active management for the promise of outperformance hasn’t worked.

According to the latest 2018 SPIVA report card, over the past 15 years, 88.97% of US domestic mutual funds have underperformed their benchmarks. And even if an active manager happens to outperform in a given year, it’s almost impossible to maintain that outperformance over the next five-year cycle (0.91% have managed it in US large caps, and 0% for US mid and small caps).

This isn’t my opinion nor am I making this up out of thin air. It’s what has actually happened. Active managers need to start doing their job better, reduce their fees or come up with a new business model. I suspect the solution will be a combination of all three.

What types of clients do you work with?

Primarily individual households. Half of our clients are younger professionals with families, and the other half are retirees. We recently built out an Impact Investing suite of ETF models. We are excited to offer a platform that allows our clients to use their capital to reflect their personal values and beliefs.

We don’t have a minimum, and we believe that objective advice should be available to everyone, not just high-net-worth households. We write our own educational blog and make it available on our website.

How do you use active and passive funds?

I think this argument needs to be rephrased as high-cost versus low-cost investing. The truth is that unless an investor owns the global market, we are all active investors. For example, the decision to invest in an Israeli technology ETF is very much an active decision, but we are simply choosing to own the underlying assets via a low-cost, tax-efficient umbrella.

Are there any managers you have high conviction in?

We don’t invest a dime in third-party investment managers. Think about it – one of the main reasons why people hire a financial advisor is to invest their assets for them. Advisors who use third-party managers (active mutual funds, SMAs, turnkey asset management programs and so on) are essentially outsourcing their investment responsibility. Clients end up paying another layer of fees (an advisor fee, plus third-party annual expenses). To top it off, third-party managers, especially mutual funds, are notoriously tax-inefficient, spewing out capital gains at random. If I were a client, I would be asking why I was paying my advisor a fee based on assets under management when they’re turning around and handing the assets over to someone else.

Any changes in allocations or managers from last year?

We ended up adding to US real estate investment trusts and emerging market equities in January. We also reduced our exposure to corporate bonds, shifting into US Treasury’s. In our opinion, most corporate bond funds (ETFs and index funds included) own too many borderline credits. In other words, these funds are loaded with lower quality companies that will experience stress or a default if we get a downward movement in the economic cycle.