“Returns expectations are simply too high. It means that many will face a shortfall when they come to realize their investments in the future as they have relied too heavily on returns to meet their objectives.”– Keith Wade, Schroaders Chief Economist.

We were shocked to review the 2017 Schroader’s Global Investor Study which outlined return expectations for retail investors. The return expectations were for a broad portfolio of investments over the next five years. You can read the user-friendly report here.

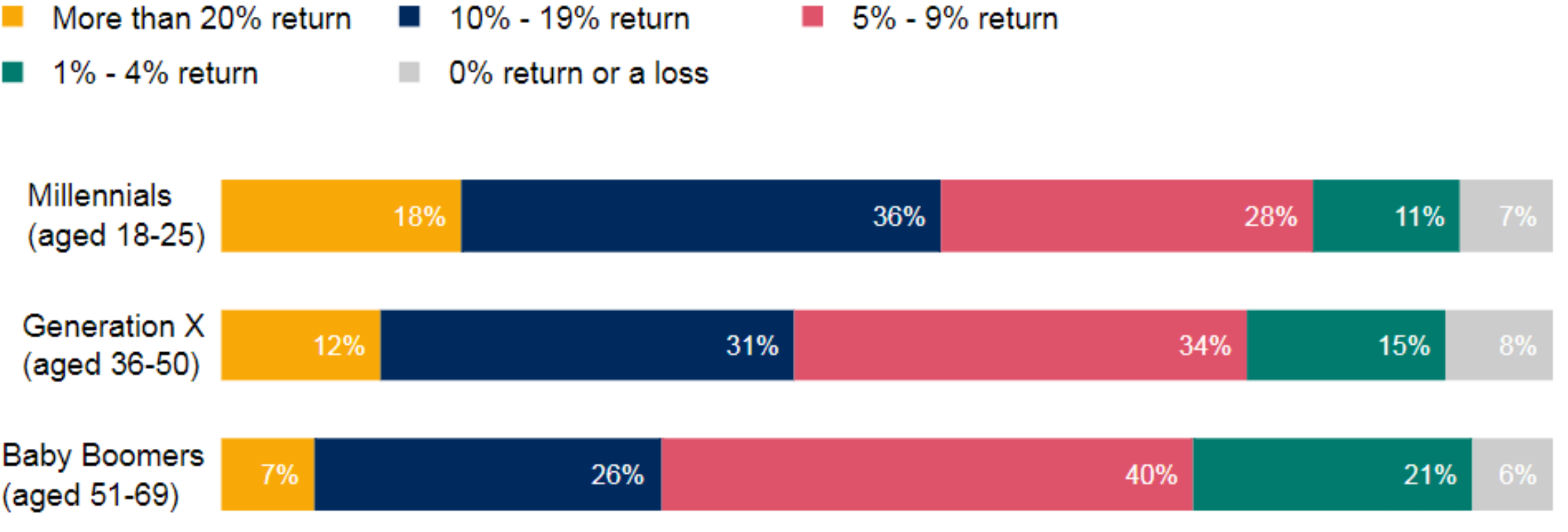

Source: Schroader Investment Management North America

Millennials were the most optimistic demographic, with 18% of survey participants expecting annual returns of more than 20%. Let me repeat that, young people expect their returns to exceed 20% per year. Gen X’ers were a little less delusional, but not by much with 12% expecting annual returns of more than 20%. Boomers were more grounded in reality, however, ~33% of those surveyed expect annual returns of greater than 10%.

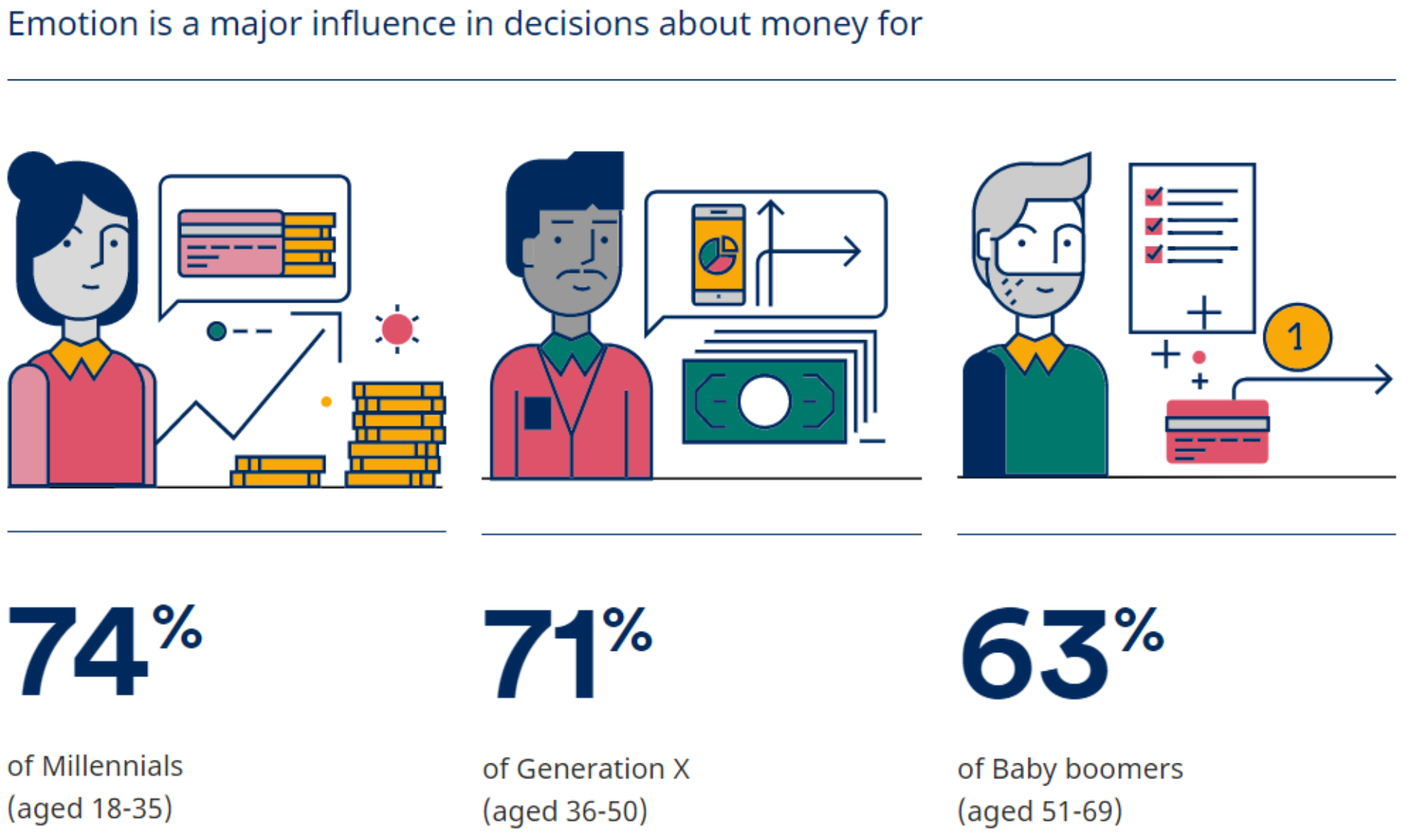

Source: Schroader Investment Management North America

It’s no secret people are emotional about money. It gives us the freedom and flexibility to do what we enjoy. However, head in the clouds return expectations charged up with emotion is a recipe for disaster. 20% return expectation + realized returns of negative 15% + irrational decisions = Powder Keg.

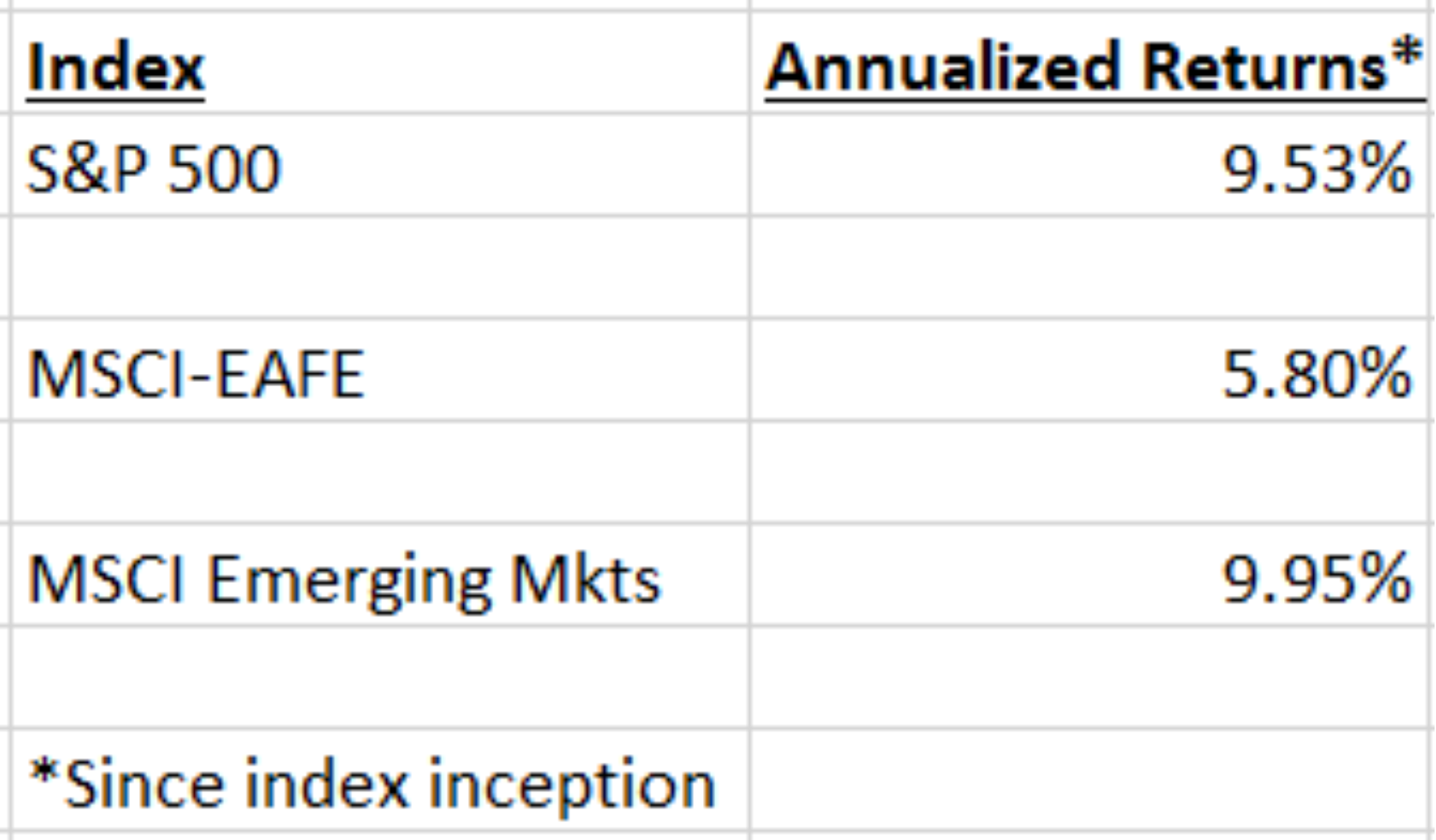

For context, the above shows historical returns for the S&P 500, MSCI-EAFE, and MSCI Emerging Markets indexes since inception (1928 for S&P, 1987 for MSCI-EAFE, 2000 for MSCI Emerging Markets). The disconnect between expectations and historical returns is remarkable.

Source: LCG Associates

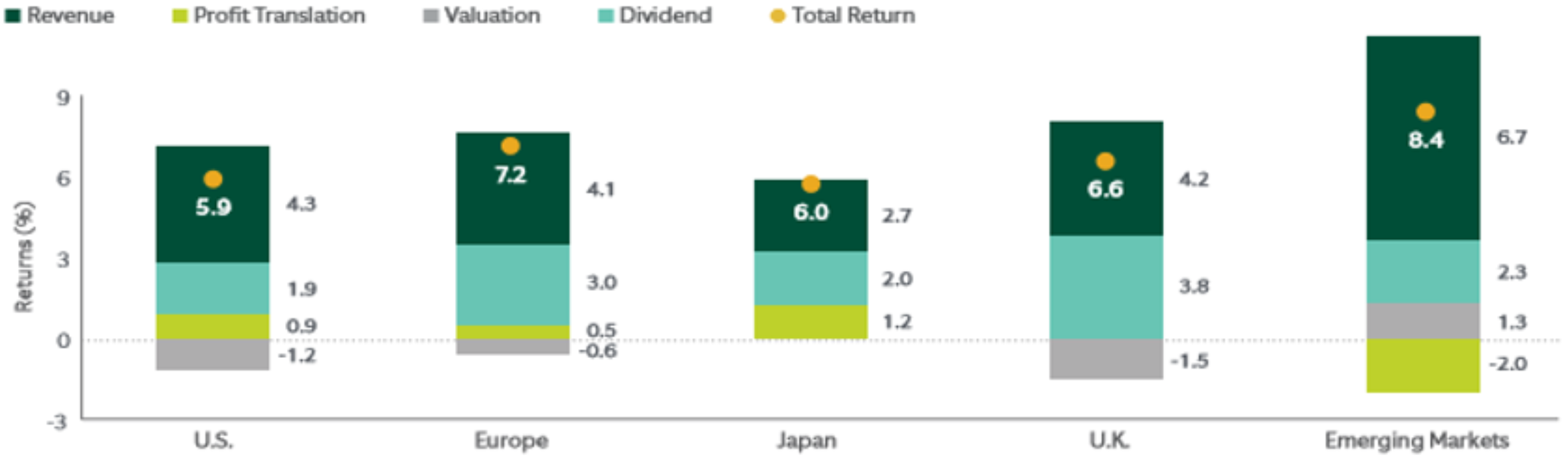

The above graph is from our Q3 Market Commentary. It outlines professional investors’ return expectations for global equity markets over the next five years. The lower future return expectations (yellow dot) are a primary function of higher current valuations (read more on Valuation).

We attribute the disconnect between investor expectations and reality to the knowledge gap that exists. People, especially millennials & Gen X’ers, need financial education. Fortunately, there are more resources than ever for investors to learn the fundamentals of making sound financial decisions.

Advisors can do their part by modeling realistic return assumptions. It’s not helpful to model only historical returns when running wealth projections. Future returns, with outcomes stressed for prolonged periods of flat or negative returns, give investors a margin of safety and encourage saving.

Our guidance for young people: Don’t rely on market returns to bail you out. Focus on what you can control which is your savings rate. If you happen to generate those miracle market returns, you’ll have more than enough to pursue your passions.