White-hot inflation.

Rising interest rates.

Tanking bond prices.

The popular consensus is that investors should abandon their bond allocation.

It’s a tidy narrative but deserves a more thorough analysis.

We examine how bonds have held up vs. other asset classes during previous periods of high inflation and Fed tightening.

- Poor bond returns can lead to higher bond returns.

- Bonds can offer the savvy investor flexibility.

- Bonds are a contractual obligation between borrower and lender.

Bonds vs. the World

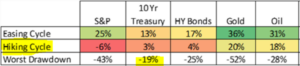

Bonds do not operate in a vacuum. We need to look at the opportunity set of asset classes and how they perform during periods of high inflation and Fed tightening cycles.

What better period than the inflationary 70’s and early 80’s?

*Hat tip to our friends at Verdad Capital for the wonderful data set. I would encourage signing up for their newsletter.*

Source: Bloomberg, Robert Shiller data, Morningstar SBBI datasets, Verdad Capital

The above graphic shows asset class returns from 1970-1982. Annualized inflation during the period was running a shade below 9% per year. The U.S. 10-year Treasury bond offered positive returns and shallower drawdowns vs. equities (S&P 500).

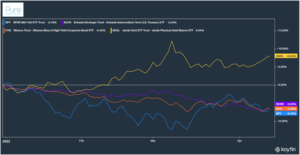

For comparison, we can see how the S&P 500, U.S. Intermediate Treasuries, high-yield, and gold stack up year-to-date (as of 4/13/22).

Source: Pure Portfolios, Koyfin

The above graph shows year-to-date (YTD) returns for the S&P 500 (blue), intermediate term U.S. Treasuries (purple), high-yield bonds (orange), and gold (yellow). While absolute returns are similar between the S&P 500 and bonds, the S&P experienced much steeper drawdowns than both intermediate Treasuries and high-yield bonds.

We concede the sample size is small, but it’s an interesting exercise to compare the previous data set (1970-1982) to the current environment.

Beaten Down & Out of Favor

Poor returns can be a precursor to better returns.

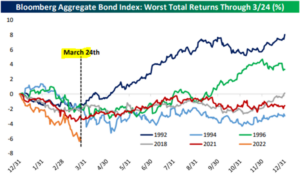

In our March commentary video, we highlighted the worst total returns for the Bloomberg Aggregate Bond Index, followed by returns for the rest of the year…

Source: Bespoke Investment Group

The above graph shows the journey for the Bloomberg Aggregate Bond Index after poor starts to the year (since 1992). With the exception of 1994, returns were higher across the board. We aren’t predicting that this plays out in 2022, but it’s worth noting.

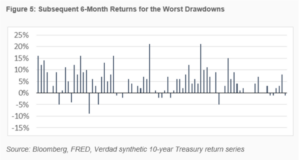

Verdad Capital had similar findings. The current 10-year Treasury drawdown is the 5th worst in their data set (1954-2022).

The below graph shows subsequent returns for the 10-year Treasury after the worst drawdowns…

There are exceptions, but future returns have had a positive bias after steep drawdowns in U.S. 10-year Treasury bonds.

Flexibility

The global bond market offers opportunities across type, maturity, credit quality, fixed vs. variable interest, etc.

For example, we can invest in government bonds, investment-grade corporates, high-yield, municipal, preferred, floating-rate, convertible, etc. across a wide range of maturities, issuers, and repayment terms.

Let’s say an investor has a mix of short and intermediate-term bonds.

Bond yields tick higher.

Short-term bonds mature.

The investor reinvests at higher yields and enjoys the extra interest income.

A popular argument against bonds over the last decade has been low yields. As bond yields adjust higher, there will be opportunities for astute investors to clip higher coupon payments.

In general, higher bond yields are a good thing for savers (and bad for borrowers).

The World’s Oldest Contract

Let’s not forget that bonds are a modern form of one of the oldest contracts on Earth, an agreement between borrower and lender.

If you’ve invested in government bonds, investment-grade corporates, or AAA/AA-rated municipals, you’ve signed a contract with a reputable counterparty. You’ll receive principal + interest over the term of the bond.

It’s true the price will fluctuate (sometimes wildly), but as long as you hold until maturity (and the issuer stays solvent), you should receive par value and interest along the way.

Bond mutual funds and ETFs can be impacted by fund flows (money coming in and going out). However, this price action usually normalizes as the funds hold hundreds (or more) of individual bonds that have maturity dates.

——————————————————————————————————————————-

It’s easy to get sucked into the narrative of “bonds are bad due to inflation and rising rates.”

Empirical evidence would suggest changes in Fed policy, elevated inflation, and aggressive tightening cycles can be challenging for all asset classes.

To summarize, in inflationary and tighter monetary policy environments…

- Bonds hold up relatively well vs. other asset classes.

- Poor bond returns can lead to higher bond returns.

- Bonds offer the savvy investor flexibility to take advantage of higher bond yields.

- Bonds are contractual obligations to return principal and interest to the lender (investor).

For more on bond positioning, please reach out to insight@pureportfolios.com