I was perusing my LinkedIn feed when a particular post caught my eye.

For the record, I have no clue who Mark A. Smith is. I don’t know if he’s the nicest guy on the planet or an angry man. Nor do I know how he ended up on my feed. But his message grabbed me (his language of “dead to me” might be a bit over the top), both as a human being and professional investor.

On the human side, I’m sick of bad corporate actors that run their business poorly, treat their customers and employees like garbage, but are quick to ask for government handouts. I wrote the following on 3/26/2020:

I find it troubling that many industries (airlines, cruise ships, casinos, aerospace) are on the brink of collapse after a month of business disruption. The C-suite needs to reexamine how they allocate capital. Borrowing money to pay dividends and buyback shares at all-time market highs was a disaster. Hopefully, this will encourage a more prudent approach to managing debt, returning capital to shareholders, and shoring up corporate balance sheets. The era of maximizing shareholder value, regardless of the human or community cost, is over.

In fairness to the management of poorly run corporations, the government encourages excessive risk-taking by bailing out companies on the brink of insolvency. This conundrum is called moral hazard.

As an investor, there are traditional ESG* metrics that are widely accepted: How does the company manage environmental risk? How are employees treated? Is the company’s board of directors diverse? These are just a few examples.

*ESG is an acronym for Environmental, Social, and Governance which is a set of criteria that helps investors evaluate a company based on values rather than making money at any cost. The popularity of ESG investing was already in full force prior to COVID-19. In our opinion, the trend will accelerate as investors grow weary of habitual bad actors and poorly run businesses.

All of the traditional ESG metrics are well and good. But what Mark A. Smith is getting to is does the company in question pass the smell test? I can’t shake the notion that many corporations operate their ESG initiatives much like a political PR campaign, sunshine and rainbows at the front door, but will do anything for a buck when no one is watching. I’d rather watch what they do, not what they say.

For example, I was doing some research about top holdings of popular ESG themed exchange traded funds (ETFs). Much to my amazement, the strategies were littered with mega banks. In this case, the banks passed the ESG screens as good corporate stewards, but certainly didn’t pass the common sense test.

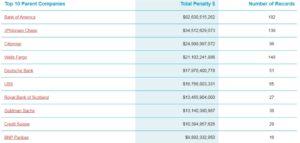

Consider since 2000, major banks have been fined over $315 billion dollars! That’s good for for first place among all major industries (it’s not even close).

Source: Violation Tracker

The above graph shows the most fined banks since 2000. The offenses occur year-in, year-out spanning mortgage abuse, toxic security abuse, investor protection violations, consumer protection violations, wage violations, benefit plan violations, employment discrimination, etc.

When you break it down, this is hardly what you would expect from a top ESG holding. Therein lies the problem; there has to be a common sense component to ESG allocation, rather than a rigid set of metrics. The question is how far do you take it?

Does it start and stop with how you allocate your investment capital? Does it reach what type of companies you personally do business with? In other words, can you be a pure ESG investor, while giving your personal business to poor corporate actors?

I don’t have all the answers, but I do believe the post-COVID world will reward prudently run companies that took care of their employees and communities during a difficult time. Running a profitable business and being an authentic corporate citizen are not mutually exclusive.

To find out how Pure Portfolios defines ESG or impact investing, click here.