“The flow of money into ETFs doesn’t represent some mad rush to a specific asset class or sector; it’s simply a change in formats to access the same thing.” – Eric Balchunas Analyst, Bloomberg Intelligence.

We have noticed increased media coverage on the proliferation of Exchange-Traded Funds (ETFs), often with misinformation to prop up fledgling stock-pickers (Cramer hates ETFs). The framing of the argument usually debates the merits of active vs. passive, but this is short-sighted and incorrect. We set out to clear the air on ETFs, both pros and cons, and why the traction of ETFs is a positive for investors (ETF price wars).

What is an ETF?

ETFs have similar structure to mutual funds in that they’re managed, regulated, and traded on an exchange. However, ETFs offer a few unique features that make them attractive for investors.

An ETF, or exchange traded fund, is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. ETFs experience price changes throughout the day as they are bought and sold. ETFs typically have higher daily liquidity and lower fees than mutual fund shares, making them an attractive alternative for individual investors. Source: Investopedia.

Growth of ETFs

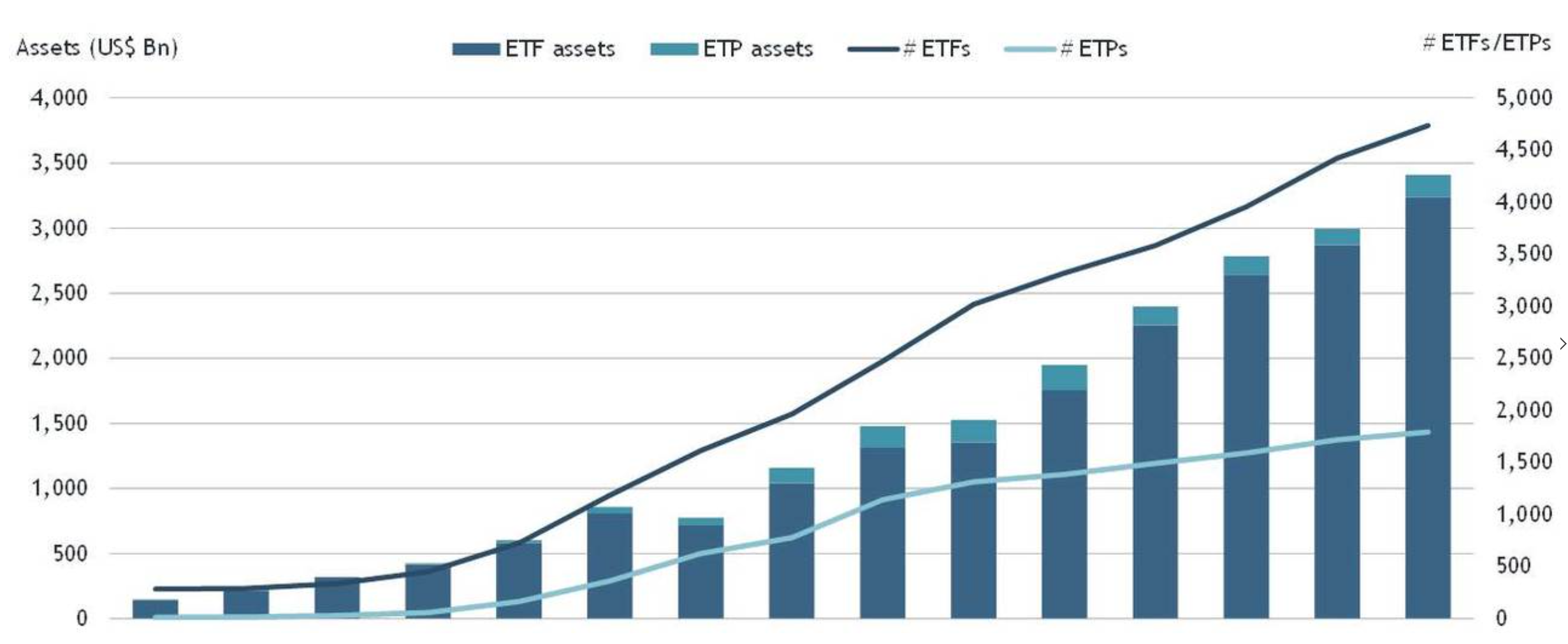

Source: ValueWalk. Data as of 9/30/2016.

There are currently ~4,500 ETF offerings approaching ~$4 trillion in assets. While ETFs have continued to gain market share from expensive and underperforming mutual funds, it’s still very much an “active” world (Amazon Treatment Coming To Wealth Management).

Why We Like ETFs

Cost – the embedded link shows the “world’s cheapest” all-ETF portfolio. It comes in a whopping 6 basis points or $60 for every $100,000 invested. Historically, a similar mutual fund allocation would have cost >1% per year or $1,000 for every $100,000 invested.

Tax Efficiency – since ETFs are simply tracking an index or strategy, portfolio turnover (trading) is minimal. This leads to much lower, if any, capital gains distributions for ETF holders.

Transparency – ETFs have daily holdings disclosures. You can see what the ETF owns with a click of a button. Mutual funds are only required to disclose their holdings every 90 days.

Intra-Day Trading – ETFs trade just like individual stocks. You can see exactly what price you received when buying/selling the ETF. Mutual funds price once at the end of day. A buyer/seller of a mutual fund at market-open must wait until the next day to find the execution price.

Minimal Tracking Error – aside from certain niche asset classes, ETFs track their underlying indexes well. For example, an S&P 500 ETF will have virtually the same performance as the S&P 500 index. Some exceptions exist in less liquid and efficient markets (commodities, emerging markets, etc.).

Growth of ETF Offerings – the explosive growth of ETF offerings covers every corner of the market. This allows an active investor to express their views of the world at a fraction of the cost.

Potential Pitfalls of Using ETFs

Leveraged/Inverse ETFs – dubbed financial weapons of mass destruction these ETFs are for pure speculation. The SEC just approved a 4x tracking ETF. This means for every 10% move in the underlying index the ETF will track 4x. For example, a -10% move would result in a -40% loss for the ETF.

Maze of Solutions – the growth of available ETF solutions is a blessing and a curse. Not all ETFs are created equal and can be misused if in the wrong hands. In fact, many fund companies are creating exotic solutions to see what sticks.

ETFs Not Tracking Underlying Investments – we wrote about Commodity ETFs deviating substantially from the underlying assets. See our previous blog post on “The Commodity ETF Trap.”

Wide Range of Expense Ratios – ETFs tracking the same index can give investors the same exposure, but have much different expenses. For example, iShares Core S&P Value ETF (IVSV) has an expense ratio of .05% (5 basis points). While iShares S&P 500 Value ETF has an expense ratio of .18% (18 basis points). Both track the exact same index, but one costs >3x as much!

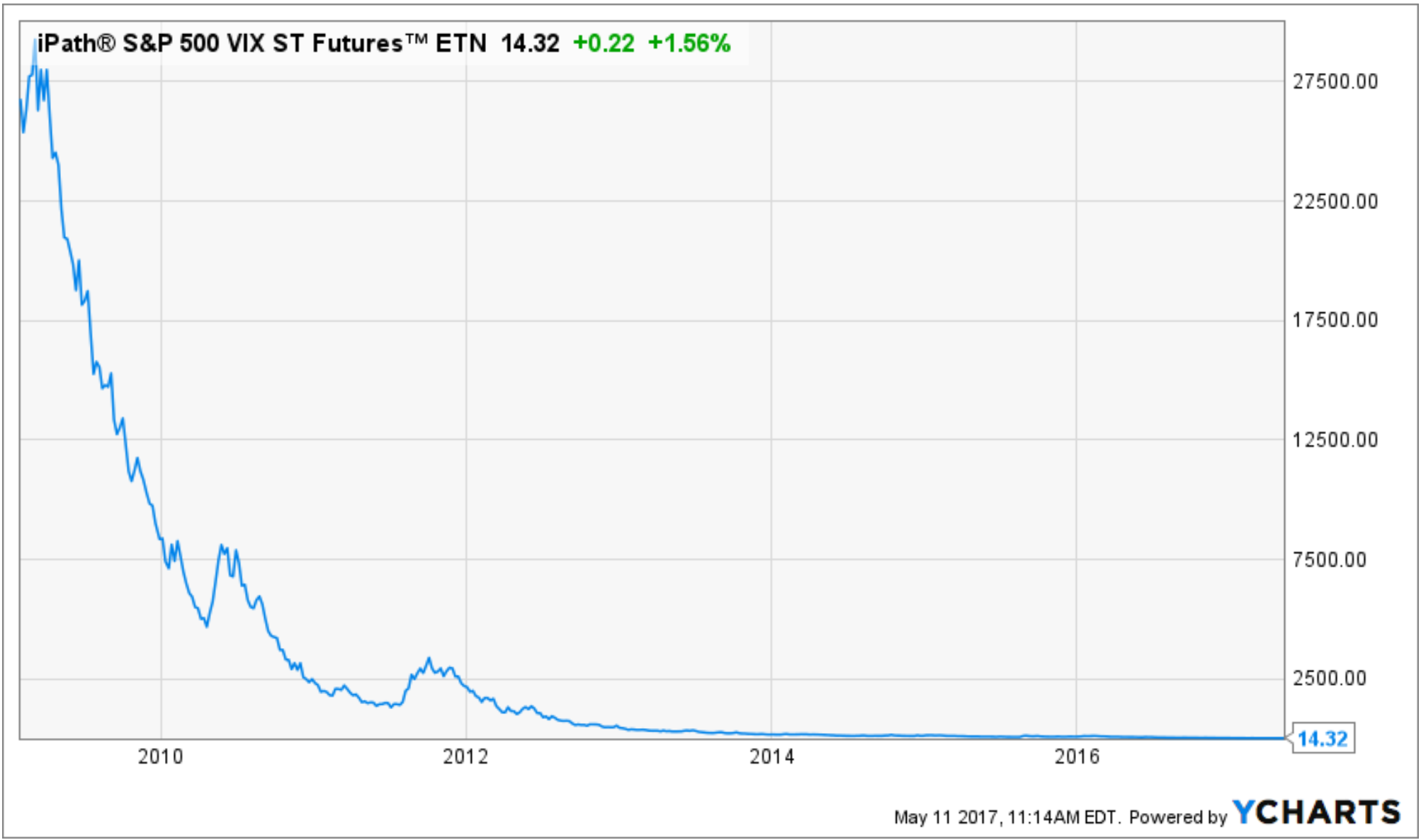

Misuse in Practice – some ETFs are exclusively meant for short-term trading purposes. Unfortunately, many investors end up holding these longer than intended, resulting in a loss. The below is a chart of a short-term volatility ETF. A buy and hold strategy would have been catastrophic.

ETF commissions/spreads (illiquid)– trading costs have come down, especially at client friendly institutions like Schwab* & Fidelity, but investors should be aware of the total cost of a transaction.

Wide Dispersion of Returns – based on the name of the below ETFs, it looks like we are purchasing broad Chinese equity exposure. The actual performance tells a much different story. Investors need to understand what they own.

The rise of ETFs has been a good thing for investors. Lower cost and greater transparency is the future of investment management. For more information on Exchange Traded Funds, Investopedia and ETF.com are great resources.

*Pure Portfolios partners with Charles Schwab & Co. for custodial services of client assets. Through Schwab, Pure clients benefit with access to over 275+ ETFs with $0 cost to trade.