“Everything should be made as simple as possible, but no simpler.” Albert Einstein

The further removed we get from the traditional wealth management machine, the more we realize it doesn’t make much sense. Actually, it makes perfect sense if you understand Wall Street’s goal is to monetize every client relationship to the maximum power. Since openly telling a client to their face you’re going to rip them off doesn’t go over well, sneaky actors often lean on deception, complexity, and jargon to pull the wool over their target’s eyes.

Fortunately, as consumers wise up, there’s been a huge push away from buying stuff they don’t need (broker makes a fat commission) towards fee-based compensation. Generally, this is an improvement from the days of advisors pushing the highest commission product to qualify for a Jamaican vacation. However, the fixed fee gambut comes with its own perils. Below we outline fixed fee trickery we’ve personally witnessed three times over the past month.

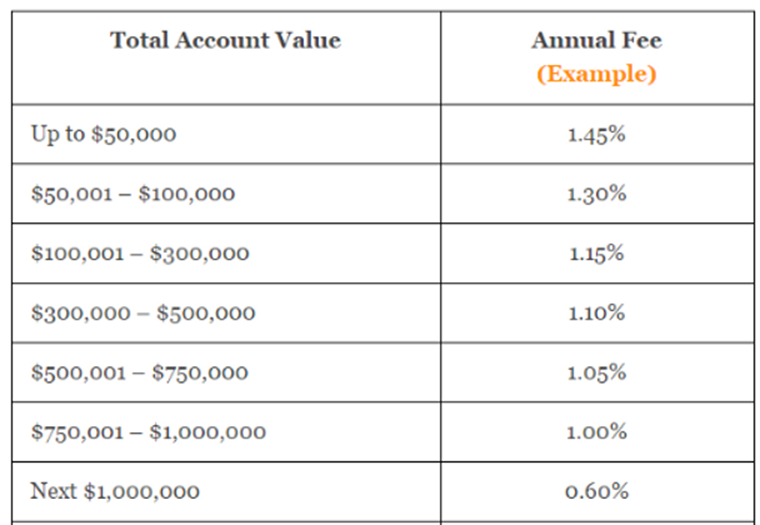

The below graphic is a sample staggered or tiered fee schedule common at financial institutions large and small. Notice how unnecessarily confusing and ridiculous the below schedule would present to the average human.

Source: AdvisoryHQ.com

The above graphic shows a hypothetical investment management fee schedule. Conceptually, paying a lower rate as you expand a business relationship makes sense. Think of going to Costco and buying products in bulk. The same principle applies to financial services, but our industry makes things unnecessarily complicated usually to the detriment of the consumer.

Here’s how the not-so-forthright presentation of fees works in practice.

Let’s say I’m a recent retiree. I have investable assets of $1,100,000 which I’m looking for an advisor to manage. I engage a local firm and they hand over the above fee schedule, and say because I have over one million that I qualify for a lower rate. In the above example, that would mean 0.60%. Not a bad deal, right?

Here’s what’s implicitly represented:

$1,100,000 * 0.60% = $6,600 per year

Here’s the actual fee calculation (pro tip: you shouldn’t need Excel to calculate your advisory fee):

$50,000 * 1.45% = $725

$50,001 – $100,000 * 1.30% = $650

$100,001 – $300,000 * 1.15% = $2,300

$300,001 – $500,000 * 1.10% = $2,200

$500,001 – $750,000 * 1.05% = $2,625

$750,001 – $1,000,000 * 1.00% = $2,500

$1,000,001 – $2,000,000 * 0.60% = $600

Total annual fee = $11,600 per year or 1.05% ($11,600/$1,100,000).

That’s quite a large disconnect between the implied fee rate (0.60%) and what the underlying rate would actually be (1.05%). In dollar terms, there’s a $5,000 ($11,600 – $6,600) difference between what was represented and what the client actually ends up paying.

Since we’re rational human beings, common sense wins the day. In the above example, Pure Portfolios fee would be $1,100,000 * .80% = $8,800 per year.

More sensible still, after working in the fixed 1% world, we decided our compensation should be based on our client’s investment results. Learn more about our innovative, client-centric fee structure here and here.

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com