“The investment industry has long offered clients fees that have nothing to do with performance. That’s changing, but not nearly fast enough.” – Jason Zweig, Author and WSJ Columnist

“You’re crazy. That’s never going to work. I just don’t see it. It’s too confusing. You can’t control the market.”

These are a few of the comments we heard upon rolling our unique fee structure at the launch of Pure Portfolios in 2016. The feedback was primarily from peers, former colleagues, and traditional advisors. Veteran advisors entrenched in their careers had even stronger negative opinions.

**Good…that means we’re on to something**

The only comment we thought was fair is that we cannot control the market (nor can anyone else). This is true. However, we can control our behaviors. We wanted a fee structure that encouraged investment ideas, improved our investment process, optimized portfolios for risk & return, increased fee transparency, and most importantly, made us monetarily responsible for client outcomes.

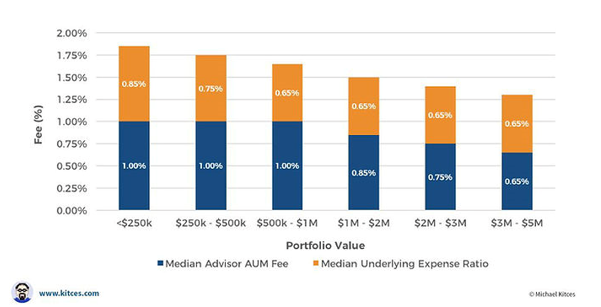

The current fee structure prevalent with the majority of advisors is a fixed percentage of assets under management (1% or greater per year is common). Not surprisingly, a static or fixed fee structure can encourage the wrong behavior: asset gathering. Good performance? 1%. Bad performance? 1%. Can’t tell what your performance is? 1%.

The above graphic shows median advisor “all-in” cost of investing by portfolio size.

The good news for investors is the tide is starting to shift. The smartest pools of capital on Earth realize it doesn’t make sense to pay up for the promise of outperformance. Investors want investment managers to put their money where their mouth is.

A recent study by Capgemini, a global leader in consulting, technology, and digital transformation recently published a study on the top trends in wealth management.

Capgemini outlined evolution of fee models due to client demands, regulatory mandates, and competitive pressure. In other words, client discomfort with fee levels and rising demand for transparency are encouraging performance-based models.

Other trends and highlights from Capgemini:

- As seen in the 2016 World Wealth Report, 28.1% of high net worth individuals (HNWI) would ideally want to pay fees by performance, about 10 percentage points more than the 18% of HNWIs who currently pay by performance.

- While 30.1% of HNWI pay based on percentage of assets, only 23.6% say they would prefer to do so in an ideal world.

- Preference for the pay for performance model cuts across almost all wealth segments and was especially popular among ultra wealthy.Firms which are now adapting to client demand and competitive pressure by designing better fee models include Fidelity, Vanguard, Janus, Allianz Bernstein, and USAA (more on this later).

- The share of fees as a percentage of assets is destined to go down, though not completely, but fees by performance and by module (pay for services rendered) will likely be the most popular models in the near future.

Large, forward thinking incumbents agree that something needs to change:

Mega Asset Manager Fidelity Announces Move to Performance-linked Funds

“It’s a challenge the industry can no longer duck and has to tackle head on. In short, we are going to put our money where our mouth is.” – Brian Conroy, Fidelity International

Vanguard Utilizes Performance-based Fees

Vanguard uses a performance-based, fulcrum fee arrangement that enables the firm to negotiate fee schedules with advisors at levels well below industry averages. This fee structure aligns manager and investor interests by directly correlating manager compensation with performance against a benchmark over a trailing 36-month or 60-month period.

Janus Ties Fees to Performance

“You are paying for performance,” said Shelley Peterson, a Janus spokeswoman. “If a fund underperforms a passive index, you should pay less.”

World’s Largest Pension Fund Reforms Fee Structure

More impactful still, Japan’s Government Pension Investment Fund (GPIF), among the biggest pension funds in the world, announced on March 2018 that they were revamping the fee structure for their investment managers.

The reasons for the shift aren’t surprising.

“Our external asset managers have tended to focus on getting more assets from GPIF and to avoid taking appropriate risks required to achieve their target alpha. – GPIF spokesperson

“By introducing the new fee structure, we would like to build a win-win relationship between GPIF and external asset managers.” – GPIF spokesperson.

“It seems unrealistic for the financial outcome for the fund management industry to be unrelated to the financial outcome for investors.” Andrew McNally, CEO of Equitile

Closing Thoughts

What does this have to do with client-facing investment firms like Pure Portfolios? For starters, we do not use any third-party active strategies or mutual funds. We do all the investing in-house, therefore, it makes sense to have a cleaner, more fair fee structure. In addition, we do not take extra fees for upside performance. This addresses the concern of excessive risk taking that could take place if a manager is rewarded for upside performance.

If you’re paying a fixed 1% fee, understand you are incentivizing the wrong behavior. It’s a numbers game for the establishment advisor. Assets * 1% fee = revenue. Daily activity centers around capturing new assets. There is nothing that encourages financial advisors to improve their investment process, seek tactical opportunities, efficiently structure portfolios, or most importantly, tie compensation to your outcome.

Pure Portfolios is trying to shatter the status quo, and change can’t come soon enough.