“You don’t have to be the biggest to beat the biggest.” – Ross Perot

Raymond owns a small independent advisory firm (RIA) in the Portland area. His clientele consists of mainly retirees from a local energy company. Raymond finds himself in competition with a large bank for a new client. The prospect is close to making a decision and candidly opens up to Raymond about his current dilemma.

“Raymond, your offering is superior in every way. Lower fees, better financial planning capabilities, superior technology, and a cleaner service model. However, I can’t get over the fact you’re such a small firm. I feel more comfort working with a larger, more established financial services company.”

Raymond feels crushed. The prospect admits the offering is superior, but still is leaning towards the large financial institution. Raymond gives me a call to explain the situation.

Where Raymond sees frustration, I see an opportunity…

“The prospect’s concerns are actually quite common. We’ve run into that a little bit with our business. But there’s one thing you’re missing.”

Raymond eagerly cuts me off, “What am I missing?”

“Large financial institutions, big banks, mega brokers, publicly traded investment managers, year after year, are by far the most fined corporations on the planet. They have a proven track record of taking advantage of their customers.”

I emailed Raymond the following evidence to share with his prospect.

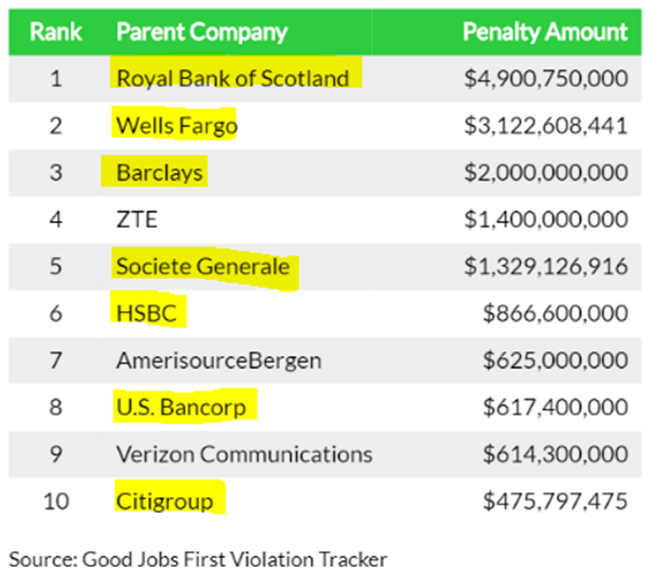

The above graphic is from Good Job First Violation Tracker, which tallies corporate misconduct to help consumers make better decisions. For the calendar year 2018, seven out of ten of the most fined corporations were large banks.

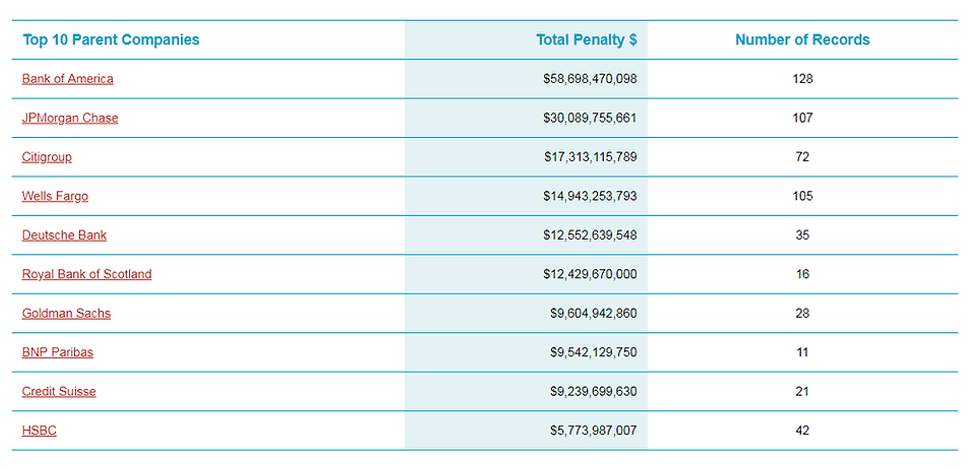

This isn’t just a 2018 problem either. According to the Violation Tracker database, since 2000, financial institutions have been fined over $233 billion dollars!

Source: Good Jobs First Violation Tracker

The above graphic shows cumulative fines since 2000 for financial services companies.

While the above numbers are staggering and occur over almost two decades, there are plenty of good people at these financial institutions that want to do right by their clients. The problem is a systemic misalignment of incentives. For example, the issues with the U.S. healthcare system stem from the blurred lines between profit and patient outcomes. The same failure exists within much of the financial services industry. How do you balance maximizing profits while doing right by clients? Time and again, the answer is there is no balance. Profit wins every time.

“Hey Raymond, ask your prospect if his money is really safer at a profit-driven bank.”

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com