“There are three ways to go broke: “ladies, liquor and leverage”– Warren Buffett, quoting Charlie Munger during a recent CNBC interview.

Warren Buffett recently penned his annual letter to Berkshire Hathaway shareholders. Besides being a world class investor, Buffett has a way with words few can rival. He presents his findings with a dose of humility, while layering in his unique sense of humor. We dug through the 16-page letter so you don’t have to. We highlight our favorite Buffet quotes, lessons, and insights in bold (our comments are below each quote).

“Regarding debt; insane to risk what you have and need in order to obtain what you don’t need.”

Buffett is no fan of excessive leverage. The low interest rate environment has encouraged borrowing, speculation, and consumption. Those extended are skating on thin ice when the cycle turns. We have already seen some concern over higher short-term borrowing costs and bond yields in 2018.

“The less prudence with which others conduct their affairs, the greater prudence with which we must conduct our own.”

As U.S. equity valuations reach lofty levels, fewer attractive investment opportunities exists. Buffett has used a variation of this quote in the past, “Be fearful when others are greedy. Be greedy when others are fearful.”

In practice, Buffett is loading up on U.S. Treasury bills holding ~$116 billion as of 12/31/27 (up from ~$86 billion as of 9/30/2017).

“Don’t ask the barber if you need a haircut.”

When seeking financial advice, don’t expect to receive objective guidance from your sales-driven broker.

“Look at stocks as interests in a business, not a ticker symbol.”

Shares of stock are ownership interests in the underlying business. That’s not to say you shouldn’t be mindful of what price you purchase the business for. For example, we might believe Netflix is a great business, but we are not itching to buy it at 232 times earnings (as of 2/27/18).

“Performance comes, performance goes. Fees never falter.”

We have been asked by prospects if we can guarantee outperformance against their current, higher fee manager (it’s against the law to make such claims). That said, if you give us a 1.50% head start every year, we like our chances!

“Investing is an activity in which consumption today is foregone in an attempt to allow greater consumption at a later date. Risk is the possibility that this objective won’t be attained.”

This is a great way to describe investing and risk. Risk is the least understood principle in investing. It’s tough to convey to someone they are taking too much risk, especially during a surging market. Often, the same old lessons are taught, but to a new crop of students.

When major declines occur, however, they offer extraordinary opportunities to those who are not handicapped by debt. That’s the time to heed these lines from Kipling’s If:

“If you can keep your head when all about you are losing theirs . . .

If you can wait and not be tired by waiting . . .

If you can think – and not make thoughts your aim . . .

If you can trust yourself when all men doubt you…

Yours is the Earth and everything that’s in it.”

Investing is a long game. Patience, discipline, conviction, and keeping your emotions in check are often rewarded.

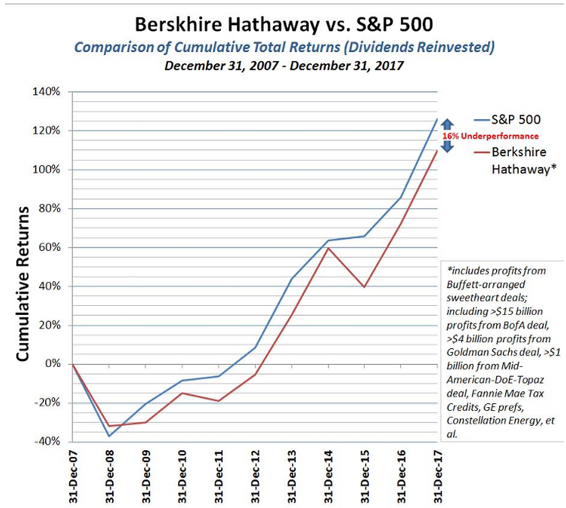

Source: Albert Bridge Capital

Some have said Warren Buffett has lost his touch (which we don’t believe to be true), however, his aversion to technology has hurt returns. Technology is the largest sector in the S&P 500 and has posted outstanding performance the last 10 years.

You can read the full 2017 Berkshire shareholder letter here.