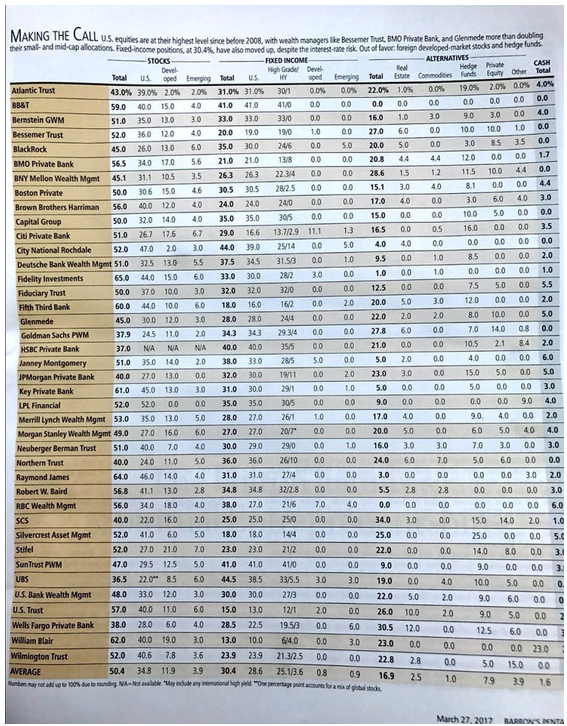

The return of market volatility has increased the interest in alternative asset classes. A quick rundown of Barron’s You Make the Call publication shows private banks, brokers, and investment firms recommend a sizable allocation to alternatives:

Source: Barron’s

The above snapshot is from 2017. You can see the average recommended allocation to alternatives by large money managers is ~17% (third bolded number in the last row).

The story goes something like, “Stock markets are overvalued and bond yields are rising. Alternative investments will help generate uncorrelated returns and reduce risk.”

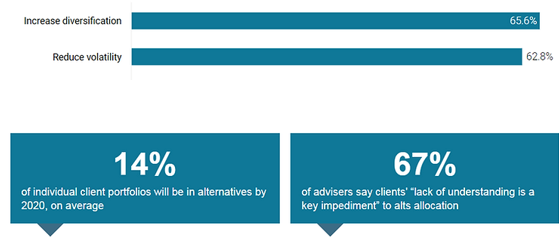

We are seeing more stories like this pop up: “Alternatives by the Numbers,” which makes the case that advisors’ interest in allocating to alternatives in client portfolios is rising.

Source: InvestmentNews

The above graphic claims 67% of advisors say clients’ “lack of understanding is a key impediment” to allocating to alternatives. We would argue the majority of advisors don’t understand alternatives either.

It seems big money managers like alternatives, and advisors plan on adding or introducing them to investor portfolios. The next question is, what is an alternative investment?

According to our friends at Investopedia:

“An alternative investment is an asset that is not one of the conventional investment types, such as stocks, bonds and cash. Most alternative investment assets are held by institutional investors or accredited, high-net-worth individuals because of the complex natures and limited regulations of the investments. Alternative investments include private equity, hedge funds, managed futures, real estate, commodities and derivatives contracts.”

A more simple definition of alternatives: If you can’t explain it in 60 seconds or if it doesn’t convert to cash (liquidity) within a few business days than it’s likely an alternative.

In recent years, the Wall Street machine has packaged alternative-like strategies into mutual funds and exchange traded funds (ETFs). The opportunity to bring higher fee alternative investments to the masses was too good to pass up.

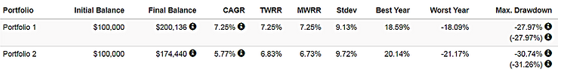

We decided to run a 10 year back-test of two portfolios* (June 2008 – April 2018). Portfolio #1 (below) includes two holdings, 60% S&P 500 (SPY) and 40% Barclays US Aggregate Bond Index (AGG):

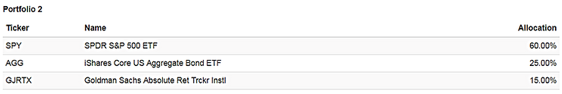

Portfolio #2 (below) also holds the SPY and AGG exchange traded funds, but we added a mutual fund that tracks a hedge fund index (15% weight):

June 2008 – April 2018

From an initial investment amount of $100,000, Portfolio #1 was worth ~$25,000 more and had lower risk metrics as measured by standard deviation. In addition, Portfolio #2 has a bigger max drawdown (loss) than our simple portfolio of stocks and bonds. So much for alternatives reducing risk and softening the downside.

What about the recent period of volatility in February 2018 – April 2018?

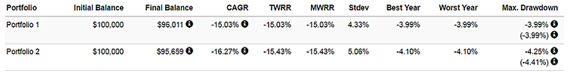

February 2018 – April 2018

During the most recent period, Portfolio #1 outperformed, taking less risk, with a lower max drawdown.

If you’re being pitched by your advisor to add alternative investments, or currently own them in your portfolio, ask your advisor a simple question: Do you own any alternatives yourself?

This may prompt an awkward pause or deflection.

Financial author Nassim Nicholas Taleb couldn’t have said it better:

“People ask me my forecast for the economy when they should be asking me what I have in my portfolio. Don’t make pronouncements on what could happen in the future if you’re immune from the consequences. In French, they use the same word for wallet and portfolio.”

For the record, we aren’t attacking the Yale Endowment model that has access to the top hedge fund managers in the world. We are illustrating the pitfalls of investing 10% or more of your investable assets in obscure, expensive mutual funds that are unproven at best and a dumpster fire at worst.

For argument’s sake, let’s say alternative mutual funds do add value. Can you or your advisor choose the winning funds ahead of time? History says you can’t and those that try are almost guaranteed to fail.

Remember, simple beats complex. For the first time in the past 9 years, due to increased interest rates, cash and short-term bonds offer a viable option to hedge risk.

For additional reading on the costly world of alternatives, check out:

Hedging Equities with Equites?

Award for Biggest Bust of 2016

*The portfolios shown herein are for illustrative purposes only