“You watch…taxes are going to go up and the market will tank.” – I’ve been told this 5x in the past week.

Well, that seems to be an emotional take. Yet, it’s the popular narrative floating around.

Taxes go up, markets will tank. Set your watch to it.

I even had a prospective client open the conversation with “how are you going to protect me from impending tax hikes?”

Let’s break down what we know about the proposed tax increases:

- Increase the top individual income tax rate to 39.6% from 37%. The top bracket is applicable for income over $523,600, or $628,300 for married couples filing jointly.

- Tax capital gains as regular income, 39.6% rate, for households making more than $1 million per year.

- Eliminate step-up basis for gains over $1 million.

That’s the gist of it. We aren’t tax experts, however, we are interested in how increases in capital gains tax rates have historically affected stock market returns.

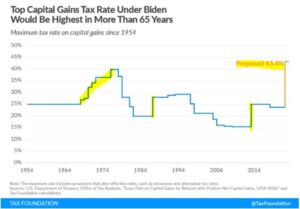

First, here’s a historical look at the top capital gains rate in the U.S.:

Source: Tax Foundation

The above graph shows historical increases and decreases of the maximum capital gains tax rate since 1954. Increases in the capital gains tax are infrequent. The last instance was 2013.

Is there empirical evidence to suggest that an increase in capital gains tax rates negatively affects stock prices? Not so much…

Source: LPL Financial

The above graphic shows four instances of capital gain increases compared to S&P returns three months prior, and three-, six-, and twelve-months post increase. Note that in 1969-1970 the U.S. was mired in a recession. In 1976, the U.S. was emerging from recession with inflation and unemployment a major headwind to economic growth.

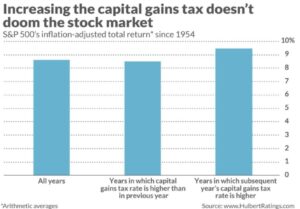

Source: MarketWatch, HulbertRatings.com

The above graph shows annualized S&P 500 returns (as of 1954) for all years, as well as, the year immediately after a cap gains hike (middle bar) and all subsequent years post-hike. Can you see the difference? We can’t either.

Digging a bit deeper, here’s a measured look at what’s going on…

The tax increase is consistent with President Biden’s campaign message. It shouldn’t be a secret.

The increases won’t affect most U.S. taxpayers.

A cap gain increase could change investor behavior in the short-run, for example, selling prior to the increase. This could be offset by an investor hanging on to a position longer thus avoiding the higher cap gains tax. Goldman analysts noted that the wealthiest households sold 1% of their equities when the rate rose in 2013 (source: MarketWatch).

With a miniscule majority in the House and a 50-50 split in the Senate, Democrats have the narrowest possible majority. Nothing will come easily over the next two years and there’s no guarantee that a proposed cap gains increase would pass.

Most stocks in the U.S. are held in qualified accounts that are exempt from capital gains. Leonard E. Burman, a professor of Public Administration and International Affairs at Syracuse University, reports that the percentage of publicly traded U.S. stocks held in taxable accounts has dropped to under 25% from more than 80% over the past 50 years (source: MarketWatch).

Even if the tax rate increase passes, it’s not set in stone. Tax policy is fluid depending on the party in charge.

In our opinion, politics and investing don’t mix. Growth, inflation, interest rates, earnings, matter much more than a tax tweak.