“If you mix your politics with your investment decisions, you’re making a big mistake.” – Warren Buffett, Berkshire Hathaway

Benjamin Franklin famously stated, “Nothing is certain except death and taxes.”

Over the next year, I could confidently state, “Nothing is certain except folks predicting the 2024 presidential election will tank the market.”

In fact, it’s starting already.

Selfishly, my motivation for writing this blog a full year ahead of the election is to share (and reshare) how markets have performed during presidential election years.

We don’t advocate mixing politics and investing, but if you can’t help yourself, at least you’ll have a historical perspective.

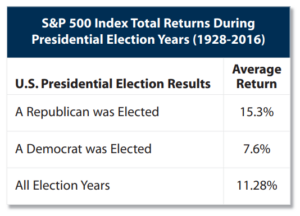

S&P 500 Returns During Presidential Election Years

Source: Morningstar, Ibbotson Associates, Morgan Stanley

The above graphic shows S&P 500 total returns during presidential election years (1928 -2016). The average return during all election years is 11.28%.

There have been 23 presidential elections since the S&P 500’s inception. According to Morgan Stanley…

- 19 of 23 years (83%) provided a positive return.

- When a Democrat was in office and a new Democrat was elected, the total return for the year averaged 11%.

- When a Democrat was in office and a Republican was elected, the total return for the year averaged 12.9%.

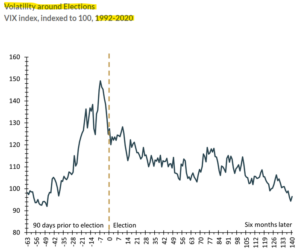

Expect Volatility Prior to the Election

Source: Investopedia

The above graph shows the VIX index, a popular measure of market volatility, before and after presidential elections (1992 – 2020). Volatility tends to spike 60 – 80 days prior to the election. Post-election, volatility normalizes lower. The market might act a bit squirrely prior to election day, but eventually returns to normal levels of volatility once the outcome is known.

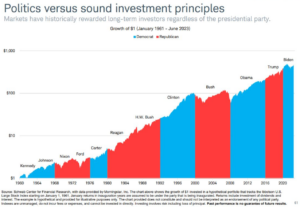

Markets Don’t Care About Anyone’s Politics

Source: Schwab, Morningstar

The above chart shows the Ibbotson U.S. Large Stock Index returns by every President from January 1961 – June 2023. In short, the market doesn’t care about anyone’s politics.

You’ve probably heard, “if X candidate gets elected, the market is going to tank.”

The truth is an elected President is one variable in a complex system of thousands of variables (think interest rates, corporate earnings, trade, inflation, etc. to name a few). It would be a mistake to assume you can draw clear cause & effect between the President and potential market outcome.

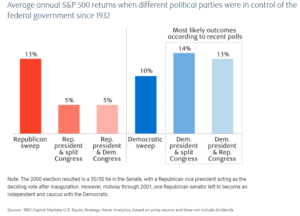

Don’t Forget about Congress

Source: RBC Capital Markets

The above chart shows average annual S&P 500 returns by political party in the White House & Congress (since 1932, ignore the “most likely outcomes according to recent polls”). Regardless of whichever combination you can dream up, S&P 500 returns have been pretty good.

We recognize history doesn’t exactly repeat itself, but it often rhymes (hat tip Mark Twain). Here is what we believe to be true about politics, elections, and investing…

- It’s tough to convince someone that lives and breathes politics that presidential elections do not matter.

- You can’t isolate the impact of an election. That assumes that every other variable in the global economy is fixed, which is not realistic.

- Politics is loaded with emotion. Emotion and investing do not mix.

- Even if you know the election outcome, it doesn’t mean the market is going to react the way you think it should.

People tend to overstate the impact of sitting and newly elected Presidents. They receive too much blame when things go bad and too much praise when things go well.

Neither is likely true.