“I didn’t learn anything. I already knew I wasn’t supposed to do that.” – Stanley Drunkenmiller, after losing $3 billion dollars on tech stocks.

The year was 2000. Tech stocks were going crazy. Investors were printing money. Any company could slap a “.com” at the end of their name and skyrocket higher (even if they didn’t have any revenue).

It was too easy. The definition of irrational exuberance.

Stanley Druckenmiller, one of the greatest investors of all-time, thought the landscape was pure madness…

“January of 2000 I go into George Soros’s office and I’d say I’m selling all the tech stocks, selling everything. This is crazy at 104 times earnings. This is nuts. We’re going to step aside and wait for the fat pitch. I mean their little account is up like 50% on the year. I think Quantum was up 7%. It’s just sitting there.”

Mr. Druckenmiller was referring to another small hedge fund in town that was heavily invested in tech stocks. His own fund, Quantum, was doing nothing while everyone else was making money.

Against his better judgement, even the great Stanley Druckenmiller couldn’t help himself…

“Around March 2000 I could feel it coming. I just – I had to play. I couldn’t help myself. Three times during the same week I pick up a phone, don’t do it. Don’t do it. Anyway, I pick up the phone finally. I think I missed the top by an hour. I bought $6 billion worth of tech stocks. In six weeks, I had lost $3 billion in that one play.”

A journalist later asked Mr. Druckenmiller what he learned from the experience. His response is priceless…

“I didn’t learn anything. I already knew that I wasn’t supposed to do that. I was just an emotional basket case and couldn’t help myself. So, maybe I learned not to do it again, but I already knew that.”

The emotional pull of watching those around you get rich, even in an unsustainable bubble, is hard to ignore, even for revered professional investors.

What does future performance look like for hot investment themes?

In my opinion, the best way to capture the data is to look at funds that have gone way up in a calendar year (100%+) and future performance.

The results aren’t pretty.

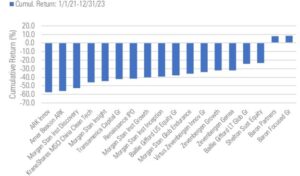

Source: Morningstar, Jeffrey Ptak

The above chart shows the cumulative return of 18 funds that were up >100% in 2020. The data captures the following three years of returns for the hottest investment funds; themes included COVID economy stocks, innovation, clean technology, initial public offerings (IPO). Most investors got hammered chasing the best performing funds.

The phenomenon isn’t limited to the past few years. According to Morningstar’s Jeffrey Ptak, of the 123 funds to have gained 100% or more in a calendar year since 1990, only 24 earned a positive return in the three years that followed.

That’s a hit rate of less than 20%.

Fast forward to today, there’s a whiff of euphoria around Artificial Intelligence.

Many investors are paying up for anything related to AI, drawing parallels to other hot investment themes from recent years.

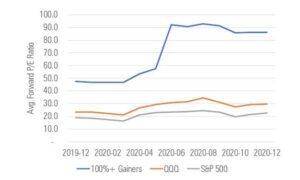

Let’s go back to the forward price-to-earnings ratios from the 100% gainer stocks funds from the chart above…

Source: Morningstar

The above graph shows the average forward price to earnings ratio (P/E) for the 100% gainer stock funds in the first chart (2019 – 2020). The higher the ratio, the more expensive the stocks within the fund. The highflyers were trading at a massive premium relative to the S&P 500 and Nasdaq (QQQ). Some analysts worry that AI-themed stocks are following a similar frothy path; higher valuation today could equal lower future returns.

How can we use history to make better investment decisions?

A few observations…

- Even professional investors can get sucked into the hype and do things they know they shouldn’t do.

- Watching your neighbors, friends, and peers get rich in the latest investment fad can be deeply uncomfortable.

- Sticking to a boring, long-term investment plan can seem like you’re leaving money on the table.

- The best performing funds, themes, and trends seem to have trouble replicating outstanding performance.

- There is evidence to suggest that high flying themes can come crashing back down, leaving performance chasing investors with heavy losses.

- There is a relationship between paying up for a stock, fund, or theme and potentially lower future returns.

I’m not proclaiming AI is a bubble. Many of the mega-cap technology companies are making billions of dollars per quarter. AI is an impressive and revolutionary technology that reminds many of the internet boom.

However, I wouldn’t get over your skis chasing AI stocks at these levels. Be mindful of position sizing. Don’t get emotionally attached to any one stock or theme. Paying nosebleed valuations for anything usually doesn’t end well.

Heed the lessons of Mr. Drunkenmiller, “I knew I wasn’t supposed to do that.”