“I was going to be a sales person representing that I managed the portfolio. I couldn’t live with that.” – Former Portfolio Manager at a large private bank

Do you ever get the feeling your advisor is so busy they completely neglect your portfolio? If you answered “yes”, you are not alone. We have received a variation of “how often do you look at my portfolio?” many times from new clients. Continuing our theme of answering the questions our clients and prospective clients ask, we thought showcasing our ongoing portfolio management process would be enlightening.

There’s a general sense from investors that their portfolio might get lost in the shuffle, remain stale, or altogether be neglected. We can see why this perception exists. Your advisor might work for a large institution with a heavy emphasis on sales. On the opposite end, your advisor might work for a smaller firm that seems stretched for resources. Worse yet, your current advisor is neglecting your portfolio.

In reality, managing portfolios can be a time-intensive process without the proper technology. Can you imagine manually scrubbing thousands of accounts to make sure the allocations are correct? Fortunately, the enterprising advisor that embraces financial technology can optimize portfolios by a click of a mouse.

Starting from the top, every Pure Portfolios client account has specific asset class targets. For example, a moderate risk investor might have a 15% target allocation to U.S. Large Cap stocks. We set asset class ranges to let us know if we are out of tolerance. Our goal is to ensure our conservative investor doesn’t wildly deviate from the target allocation. In practice, a 15% target allocation for U.S. Large Cap stocks might have a +/- 3% tolerance range. This means U.S. Large Cap stocks would be allowed to float within a range of 12-18%. Anything outside of our acceptable range would trigger an alert and we would adjust the allocation back to the target weight of 15%.

Through our portfolio management partner Orion, a simple click of “Check Tolerance” allows us to screen for accounts that have drifted from their targets.

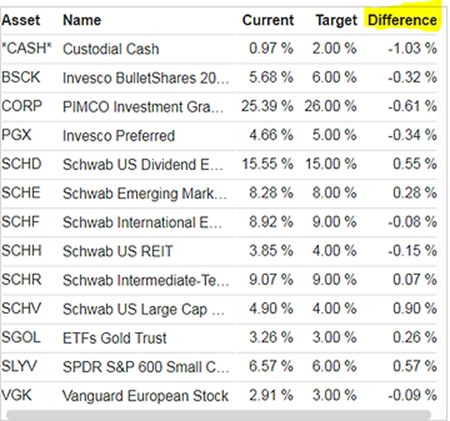

Once we have a list of potential accounts that are out of tolerance, we can dig a bit deeper:

The above graphic shows the individual holdings, current portfolio weights, target weights, and the difference. In this example, the client is almost right in-line with the target allocation.

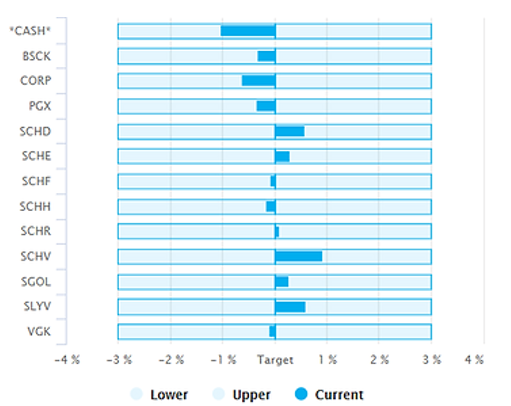

The above bar chart is a graphical version of the same client account. Anything within the outlined blue bars would be in compliance. The filled blue bars to the left of the target indicate a slight underweight while blue bars to the right indicate a slight overweight.

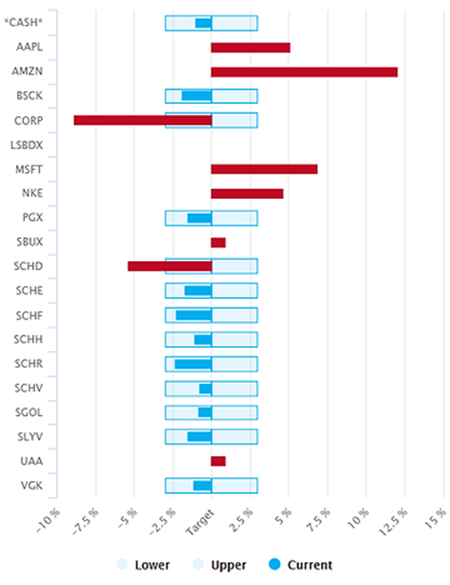

What about a portfolio that’s out of line?

Conversely, this is what an out of policy account looks like. The red bars indicate an outside holding or breach of a target allocation. We would rebalance the portfolio to move it back in-line with the target allocation. In this case, the client wanted to hold on to a few outside stock positions.

Let’s say we spot an account that is out of tolerance and needs attention. We are all set to rebalance, but we need to be mindful of triggering capital gains. After all, as evidence-based investors, we care about after-tax returns.

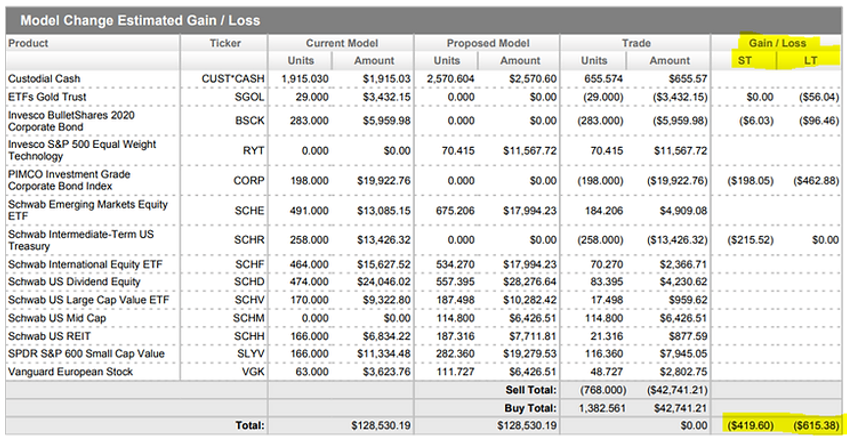

With a click of a mouse we can run an estimated tax report showing our current model allocation, proposed allocation, and the breakdown of short-term & long-term capital gains.

The entire process of screening accounts for review, checking for asset classes that are out of tolerance, and modeling estimated capital gains liability takes less than two minutes.

Being an independent firm, all we do is manage portfolios, service our clients, and write content. Since we offer fees tied to client outcomes, we have a direct incentive to ensure our portfolios are optimized and our process is streamlined.

If you work with a large, profit-center advisor, a few headwinds are working against you: a) they receive a fixed percentage of assets under management, usually 1%, regardless of investment outcome, b) sales goals, conference calls, middle managers, and corporate bureaucrats are a huge distraction.

You would do well to understand their process for managing outside portfolio holdings, asset class drift, cash positions, and tax-efficient rebalancing.