“Anyway you calculate it, inflation is WAY above the Fed’s target because of high demand.” Cullen Roche, Discipline Funds

The Fed will attempt to kill inflation by increasing interest rates in March.

The intensity and frequency are up for debate, but it’s clear that the pandemic “easy money” policies are no longer appropriate.

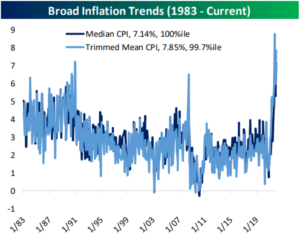

With an inflation backdrop only rivaled by the early 80’s, who can argue with higher interest rates?

Source: Bespoke Investment Group

The above graph shows broad inflation trends from 1983 – February 2022.

The idea is that higher interest rates will pump the brakes on economic activity, thus quelling inflation.

Will it work? Maybe, maybe not.

We’ve seen the usual culprits of increasing prices…

Supply chain bottlenecks

Skyrocketing transportation costs

Low interest rates (cheap money)

Easy access to capital

Higher employment wages

Fiscal stimulus, including PPP loans

The above has caused inflation, from monthly rents to gas prices and used cars…

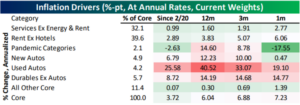

Source: Bespoke Investment Group

The above chart breaks down annualized rates of inflation by category. The red squares show dramatically rising prices. The green squares show moderating or falling prices.

However, we believe the overarching cause of inflation is simple, yet it’s hardly talked about.

Americans are buying more stuff than ever.

Consider that ~70% of United States GDP comes from people buying goods and services.

It’s no surprise to see increasing prices when you combine supply bottlenecks and ravenous consumer spending…

Source: FRED Economic Data, St. Louis Federal Reserve

The above graph shows Personal Consumption Expenditures racing past pre-pandemic levels.

Goldman Sachs (hat tip to Collen Roche for sharing) backed out supply chain constraints and came to the same conclusion, record consumer demand is fanning the inflation fire.

Source: Goldman Sachs, Cullen Roche Twitter

Will higher interest rates pump the brakes on consumer spending? You could make the case that higher borrowing costs could reduce consumer spending.

In our opinion, inflation would normalize if we all bought less stuff.