We are conditioned to sock away money for retirement ASAP.

You should save at least 10% of your income.

By the time you’re 30, you should have 1x annual salary saved for retirement.

By the time you’re 50, you should…blah, blah, blah.

There are many hard and fast rules, mental shortcuts, and overused analogies to describe delaying consumption today for the promise of a better tomorrow.

For most people, their employer’s 401k plan is the most readily available vehicle to start saving for retirement.

What if your 401k plan is a flaming dumpster fire?

We’ve outlined a list of potential red flags, some obvious, some not so obvious.

The investment menu is either too large or too small

1,000 fund options to choose from is too many. Five is too few. A mix of funds including major asset classes (foreign, small companies, bonds etc.) and styles (growth & value) should be covered. 20 to 30 funds, give or take, is about right.

Insurance company administers your plan

Insurance companies and their “financial representatives” are notoriously bad actors not only in the 401k space, but the individual investor space as well. Look no further than the plethora of class-action suits related to 401k plans.

I Googled “life insurance 401k lawsuit” and my computer almost blew up.

According to Camarda Wealth Advisory Group, misconduct is more likely to occur when professionals are: male, dually registered with both fiduciary and non-fiduciary sales licenses, or licensed to sell life insurance products.

Bunch of 1% fee mutual funds and target-date funds

It’s one thing if you’re paying for advice and getting it, but many 401(k) participants are paying up in the form of excessive mutual fund expenses, and getting nothing in return (even worse, they’re getting lower net of fee returns year after year).

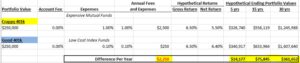

The above spreadsheet shows the annual fee drag of expensive mutual funds (yellow) vs. low-cost index funds (blue). For a sample $250,000 portfolio, (assuming a gross return of 6.50% per year), the difference in real money over 30 years is ~$361,000!

The plan needs to have low-cost options available. End of story.

Having no clue what you own due to exotic fund names

Can’t tell the breakdown of stocks & bonds in the below portfolio?

50% Lifepath Dynamo 2040 Target Date

20% Discover New Perspectives Fund

20% Total Return Fund

10% Income Enhancer 5000

Don’t feel bad, we can’t either.

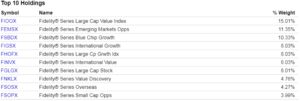

Not getting basic asset allocation guidance

The below 401k allocation is very similar to one we recently reviewed for a potential client. It’s obvious the 401k participant wasn’t getting any asset allocation advice. For example, target-date funds are an “all or nothing” solution. The target date fund actually owned her other funds within the target date umbrella (basically accidentally owning the funds twice, once directly and again through the target-date fund).

Source: Ycharts

The above is a snapshot of the top holdings for the Fidelity Advisor Freedom Blend 2060 Fund. Target date funds often own many of the mutual funds available in a plan. A participant could unknowingly own each fund directly and the target date fund, causing exposure redundancies and a more risky portfolio than intended.

Furthermore, some target-date funds have been subject to litigation due to excessive fees, self-dealing, and being more aggressively allocated than disclosed. Often times, 401(k) participants had no clue what they owned.

Some Broker shows up and spews nonsense you can’t understand

Fancy suit.

Fast talker.

Heavy on financial jargon.

Answers questions vaguely or gives non-answers.

They show up just enough not to get fired.

You learn nothing or leave the engagement more confused than ever.

If even a few of the above are true, you work with a salesperson masquerading as a trusted advisor.

You can do something about it, but depending on company size, it might take some time & effort.

- Inquire within your HR department the last time the 401k plan went to market for alternative solutions (referred to as a “request for proposal” or RFP).

- Insist low-cost funds are added to the investment menu (this is probably the quickest fix).

- Ask to see the breakdown of the “all-in” employee cost of the plan. How does this compare to other 401k plans of similar size?

In our opinion, everyone should have access to a simple, balanced, and cost-efficient 401k plan.