“We have to practice defensive investing, since many of the outcomes are likely to go against us. It’s more important to ensure survival under negative outcomes than it is to guarantee maximum returns under favorable ones.” – Howard Marks, Oaktree Capital

If the equity market is your occasionally sober uncle, the bond market would be your rigid college stats professor. Sometimes their stories overlap and the pieces fit. Other times, your tipsy uncle and the stats professor are miles apart.

At this moment, the two are screaming at each other in wild disagreement.

Your uncle, working on his sixth Coors Light before noon, points to the S&P 500 racing 32% higher from March lows as a sign economic activity has likely bottomed out.

The professor counters that U.S. Treasury yields have barely budged from their early March lows. Surely, yields would be headed higher if we were on a path back to pre-pandemic growth.

Both your uncle and the professor make a reasonable case. Who is right?

Source: Bespoke Investment Group

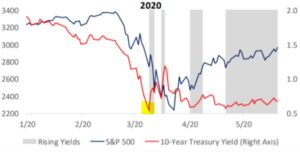

The above chart shows the U.S. 10-year yield falling like a rock in early March. Despite a ravenous equity market rally, the 10-year yield has remained stubbornly low.

Furthermore, it seems the U.S. Treasury market sniffed out the pending trouble in the equity market solidifying its forecasting merit.

Source: Bespoke Investment Group

The above chart shows the 10-Year Treasury yield (red) and the S&P 500 (blue) in 2020. You can see several instances of the 10-Year yield falling, preempting an S&P 500 drop. The divergence between the two starting in early May should give investors pause.

Looking with a broader lens, we examine the interaction between the U.S. 10-Year Treasury vs. the S&P 500 over the past 10 years. Despite popular narratives to the contrary, rising bond yields have been very good for U.S. equity market returns.

Source: Bespoke Investment Group

The above chart shows the S&P 500 (blue) and the U.S. 10-Year Treasury (red). The light gray columns indicate periods of rising yields. You can see rising yields are strongly correlated to S&P 500 gains, which makes the latest equity spike higher all the more confounding.

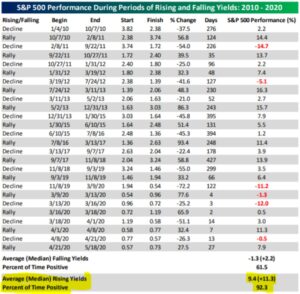

The below table captures the same period, but categorizes each period of rising and falling yields…

Source: Bespoke Investment Group

The key takeaway from the above table is the dramatic divergence of returns between rising and falling yields. During periods of rising yields (highlighted yellow), the S&P 500 was positive 92.3% of the time with an average return of 9.4%. Don’t let your friends tell you rising yields are bad for the stock market!

Experienced investors often associate rising yields with rampant inflation and economic hardship. This was true 30+ years ago, but in the era of zero interest rate policy, rising yields are often associated with a return to normalcy. The modern cycle has seen lower rates associated with economic stress. In the current environment, we would prefer to see rising yields validate the move higher in equity markets.

We understand the Federal Reserve is buying up U.S. Treasury bonds in an effort to keep borrowing costs low and stimulate economic activity, but the widening divergence between the S&P 500 and U.S. 10-year is worrisome. Are we to believe our drunk uncle or the rigid professor?