“Small, seemingly insignificant steps completed consistently over time will create a radical difference.” – Darren Hardy, author of The Compound Effect

Working with friends and family in a business relationship can be a dicey proposition. Some arrangements prosper while others turn into a burning dumpster fire. Feelings can get hurt and relationships damaged. My personal rule is I will offer my professional opinion, but only if approached. I make an effort not to offer unsolicited opinions. Selfishly, my inner circle is a sanctuary to recharge and escape. On the weekends, I’d rather talk about anything under the sun other than investing.

Over the past year, two of my regular golfing buddies asked for my opinion. One was interested in purchasing Bitcoin while the other wanted a second opinion on his investment portfolio.

The Bitcoin conversation went as follows (this was early 2018 when Bitcoin was approaching its peak):

Buddy: Should I buy Bitcoin?

Me: I would wait. Patience will be rewarded. This craziness is unsustainable.

Buddy: I just bought Bitcoin. How can I buy more?

Me: Lol.

Source: YCharts

Bitcoin has had a rough go in 2018. Many investors that chased the runaway appreciation to the top have been crushed.

For my friend seeking a second opinion on his investments, after reviewing the portfolio for fees, expenses, performance, taxes, etc., we had a similar conversation:

Buddy: What do you think of my investment portfolio?

Me: Your broker is charging 1% and hiring a third party to invest the money. The arrangement is costing you 2% per year and the investment approach is tax inefficient.

Buddy: Thanks. I really appreciate you looking at this.

*One Month Later*

Me: What did you end up doing?

Buddy: Nothing.

Me: ?

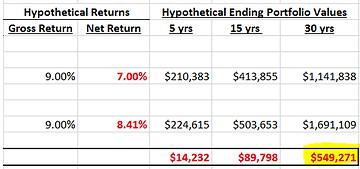

Even with a hypothetical example showing a $549,271 lower portfolio value due to the compounding effect of higher fees, our advice-seeking friend decided to stay the course.

The point of sharing these stories is not to tout my market timing skills (I had no clue what Bitcoin was going to do) or investment expertise, rather it got me thinking…

Why Do Humans Ignore Good Advice?

People Outline Goals, but Fail to Focus on the Process

Does Bill Belichick open Patriots camp with “our goal is to win the Super Bowl” and walk out of the locker room? Of course not. He’s focused on the practice game plan, fundamentals, personnel groupings, etc.

The same should apply to your personal planning & financial goals. If you want to retire early, you should be focused on savings rate, investment costs, financial planning, and maximizing after-tax returns.

Our friends at Farnam Street Blog have a great saying, “Amateurs have a goal. Professionals have a process.”

Change is Uncomfortable

Humans are creatures of habit. We frequent the same coffee shop before work, park in the same spot, say things like “Happy Friday”, etc.

Anchoring to an expensive advisor, brokerage firm, or investment strategy is the path of least resistance in the short-term. In the long-term, staying the course is sub-optimal at best and burying your finances into the ground at worst.

Avoiding Confrontation

We might even acknowledge our approach is broken, but are afraid to rock the boat due to a personal relationship. This could lead to making up arbitrary reasons not to change.

“I know this investment costs me 3% in fees per year, but I need to wait until my brother’s cousin gets married next spring to fill out the transfer paperwork.”

What that person is really doing is punting the difficult conversation of moving on from their financial advisor.

Validation Seeker

Have you ever asked for advice, but are really just looking for affirmation? Internally, we’ve already made a decision and are looking for a trusted person to validate our thought process.

If they disagree or counter with a valid argument, we justify our initial decision by saying things like, “they only know part of the story or here’s what they’re missing.”

Intense Competition for Our Attention

We have discussed the need for information filters to help sort the relevant from the irrelevant. Lack of filters means we are blitzed with an abundance of opportunities, some good and some bad, but without a process for filtering out noise we are likely dismissing information that could help us make better decisions (or avoid making bad decisions).

Personal Biases on How Things Should Work

Our personal experiences are a miniscule sliver in time. However, they shape the way we view the world. My cousin went to a University of Oregon football game at Autzen Stadium wearing “enemy” colors. She proclaimed Duck fans treated her poorly and vowed to never go back. If asked about her experience, she would likely say Duck fans are mean and hostile.

On the other hand, I’ve had wonderful experiences at Autzen Stadium wearing WSU Cougars gear. In either case, our personal experiences framed our view of Duck fans.

You might have a had a bad experience with a certain type of investment and vow to never make the same mistakes again. Your ability to be objective or understand how the investment might add value is clouded by your personal experience which trigger strong or irrational emotions.

What seems like an insignificant detail or a nuisance could lead to a large impact over time. Often times, the line between success and failure is very thin. Remember, small daily decisions can result in big outcomes.