I was sipping on a watered-down passion fruit iced tea waiting for my 1 o’clock to arrive. I had never met the person face to face so I had a watchful eye on the comers and goers at the local Starbucks. Complicating things was the “private” table I selected, back in the corner, underneath a bellowing music speaker. Amidst the coffeehouse pop music, I overheard the following conversation between two middle-aged gentlemen:

“Listen, just copy me. I’m loading up on Amazon stock with my free cash. The holidays are coming and the stock should double or triple.”

I perked up and tried to lean in for a better listen without coming off as a weirdo. My appointment arrived and I couldn’t catch the rest of the exchange. I quickly scribbled a note in my journal to revisit the bold proclamation.

Look, I like Amazon (AMZN) as much as the next person. We own it in Pure’s individual stock model (for a much different reason than you’d think). I own AMZN personally. My family buys stuff off of Amazon every week. But double or triple? Pump the brakes. The law of large numbers would make that literally impossible. And it’s not just AMZN; you could substitute any large tech empire (Apple, Google, Microsoft, etc.) and you get the same delusional beliefs about future return prospects.

Let’s do some basic math.

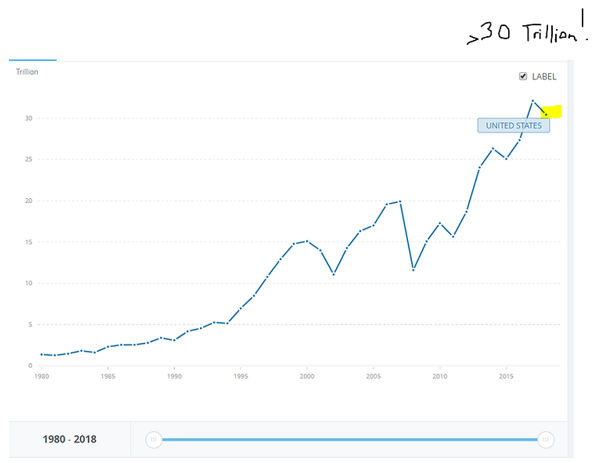

Source: World Bank

The above graph shows the total market cap of the U.S. equity market as of 12/2018. The total value of all public companies in the U.S. is north of $30 trillion.

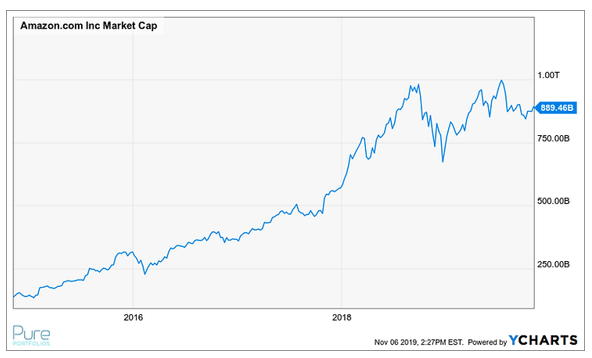

The above graph shows the market value of AMZN as of 11/6/2019. With a market cap of almost $900 billion, AMZN is one of the largest corporations in the world. As of this writing, Apple (AAPL) and Microsoft (MSFT) are both hovering around a $1 trillion market cap.

Based on today’s valuations, AMZN is just shy of 3% of the total value of the entire U.S. equity market. The basic premise of the law of large numbers is that the bigger something gets, the harder it is to keep growing. This doesn’t mean that AMZN, AAPL, or MSFT can’t produce some nice returns for investors, but their sheer size relative to the U.S. equity market probably means we can forget about year-over-year triple-bagger returns (3x).

You can make a strong case that the annualized return of ~35.45% for AMZN, since its IPO, won’t be repeated as you run into the size issue. At that rate of growth, AMZN would become an unrealistic percentage of the U.S. stock market (and likely attract even more antitrust attention).

Even AMZN detractors can appreciate the amazing success of the company. If you’re buying or holding the stock, that’s great, but our Starbucks friend shouldn’t pretend to have some hidden insight into one of the most recognizable brands on the planet. The next “big thing” out there is likely unknown, unproven, illiquid, and much, much smaller than today’s technology behemoths.

A similar parallel can be drawn using a broad asset class view. Investors that are less optimistic on the future prospects for U.S. stocks point to the size of domestic markets relative to global markets:

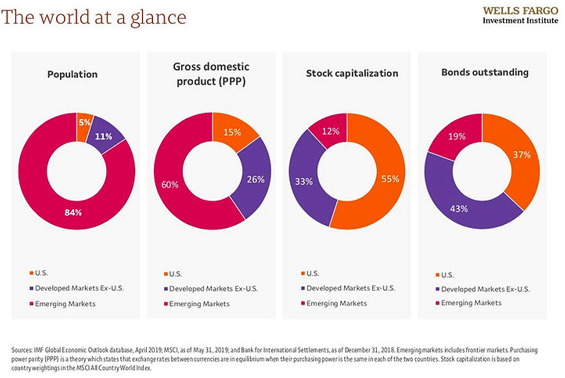

Source: Wells Fargo

The above graphic shows the U.S. percentage of global stock market capitalization (third illustration). At 55%, it is often argued that the prospects for future U.S. equity appreciation are muted, partly due to the law of large numbers. Conversely, emerging markets account for just 12% of global market capitalization and have a decent runway for future growth.

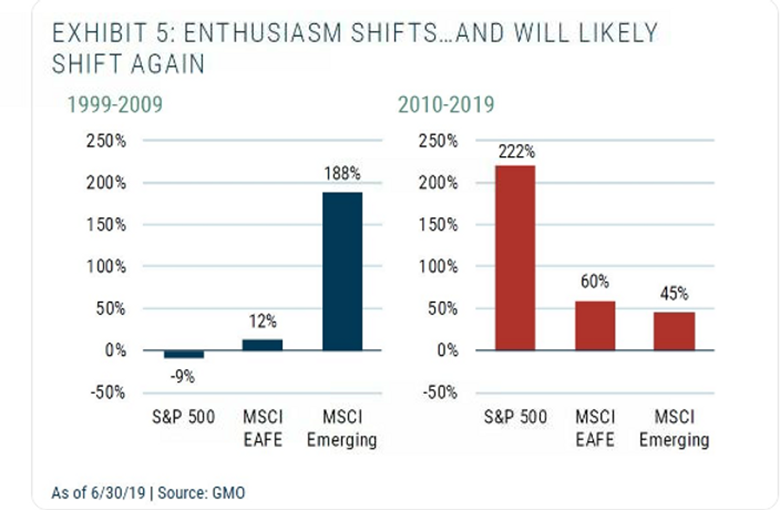

Source: GMO, Meb Faber Tweet

The above graph shows returns for the S&P 500, MSCI EAFE (international developed), and MSCI Emerging Markets for the two preceding decades. U.S. large cap stocks are very much in favor, but investors extrapolating recent performance into the future could be disappointed.

The takeaway is that you can like a company or market very much, however, future return expectations must be grounded in reality. In the case of our AMZN savant, or a perma-optimistic U.S. investor, sometimes the math doesn’t add up.

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com