In the early years of the smartphone, it was quite common to carry a personal cell and a work cell. Eventually, we wised up at the ridiculousness of carrying two phones. New applications made it possible to merge our personal and business lines into one phone.

What a blessing and a curse.

Saturday texts from Mom get upended with work-related messages.

It was Friday night, the below text came from a colleague:

“Pretty unbelievable that every asset class we own except real estate is at or close to 5 yr or all-time high. That doesn’t happen that often. Good time for patience.”

We are conditioned as investors to “buy low and sell high.” Frothy markets aren’t to be messed with. Plugging in cash at all-time highs, only to see the market tank is an investor’s worst nightmare. Humans hate losses much more than we enjoy gains (known as loss aversion bias).

We take the above as gospel, but do these beliefs hold any merit?

Should you approach all-time highs (ATH) with apprehension?

What are future return prospects when the market is at all-time highs? Could investing at all-time highs (gulp) even be a savvy investment approach?

We examine the S&P 500’s future returns from all-time highs.

It turns out, record highs occur more often than you think.

The S&P 500 hit 33 record highs in 2020.

The S&P 500 hit 19 record highs in 2019.

The S&P starts 2018 hitting all-time highs every day.

Source: Ycharts

The above graph shows the S&P 500 index over the past 5 years. The thick line shows periods where the S&P hit record highs. Between 2019 & 2020, the S&P hit a new record high 52 times!

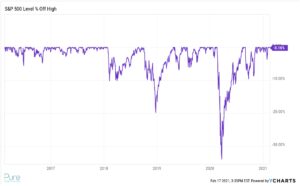

Source: Ycharts

The above graph shows the S&P 500 percent off of all-time highs over the past 5 years. In Spring 2020, we were almost 40% from record highs. As of 2/17/21, the index is 0.16% from its all-time high.

Meb Faber, Founder of Cambria Investments, argues investing at record highs isn’t a good idea, but rather a great one.

Inspired by Twitter, Meb ran a backtest of investing in a global stock index only at all-time highs (ATHs); if the stock index was below ATHs, you would sell and invest in government bonds.

Source: Meb Faber Research

The above graph shows the “buy at all-time high system” (green) vs. buy and hold (blue) strategy. The return profiles of the two strategies are similar, but the drawdowns and risk metrics for the buy at ATH system are superior. You can see this visually, the green line is much less erratic than the blue line.

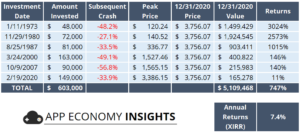

App Economy Insights via the investing website Seeking Alpha tells the story of Amy, the unluckiest investor of all-time, who invested her cash at every market top since 1970, the results were nothing short of amazing.

Source: App Economy Insights

The above chart shows the unfortunate timing of Amy, who invested cash in the S&P 500 right before every significant market crash since 1973. Despite Amy’s awful timing, she was still about to generate significant wealth, turning her $603,000 initial investment into ~$5,100,000 over the next 47 years. The power of compounding can smooth out even the worst timing decisions.

We are not advocating any of the above strategies nor are the results likely to be repeated. The message is that all-time highs shouldn’t be feared. It’s quite normal for a healthy market to make new highs. The financial media makes a big deal out of record highs, but it sounds more spectacular than it is. Would you view anything else as extraordinary if it happened 52x over the past two years? Probably not.

In practice, we see people take irrational action based on record highs. Sitting on a pile of cash waiting for an all-clear signal to invest. Selling equities to “lock in profits” because markets made a new high. That might seem like logical behavior, but history is not on your side.

If your time horizon is long enough, evidence would support investing the cash.

If you’re retired or need the invested funds in the near-term, a more measured approach to putting cash to work might be prudent, however, you could argue a 100% equity portfolio wouldn’t be appropriate anyway.

Better still, build a portfolio that reflects the way you feel about risk. Making large bets because the market is at all-time highs seldom works out.