“Zero rates aren’t a new normal; they’re just normal in Japan.” – Verdad Capital

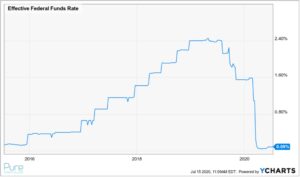

That didn’t last long. After four years of “normalizing” rates from 2016 to 2019, the Fed has moved to the zero bound once again.

Source: Ycharts

The above chart shows the effective Fed Funds rate since 2016. According to market rate expectations and forward guidance from the Fed, it looks like interest rates will be zero for the foreseeable future.

We have warned interest rates will be lower for longer than most expect, but the current developments go beyond our pessimistic views on rising rates.

If rates are low for the coming years, how can we position portfolios for a 0% world?

Fortunately, we don’t have to guess. Our friends in Japan have had zero percent interest rates and paltry government bond yields for 20+ years.

Source: Ycharts

The above graph shows 1-Month LIBOR in Japanese Yen (blue) and 10-year Japanese Government bonds (orange). Post 2000, both have remained stubbornly low.

What about Japanese equity markets during the same period?

Source: Ycharts

The above chart shows the MSCI Japan index since 2000. Japanese equity investors have had a rough go of it.

A quick primer on the rise and fall of Japan’s economy:

From 1985 to 1990 Japan experienced a perfect storm of prosperity. The Yen became stronger, making foreign assets cheaper to Japanese investors. The Bank of Japan cut interest rates in half. Japanese corporations were flush with cash due to the country’s manufacturing export boom. Japanese banks began lending to investors and speculators who bought up property, stocks, and foreign assets. Rising asset prices fueled more speculative loans.

No one paid much attention to fundamentals, how loans would be repaid, credit quality, or underwriting. The following devastation shaped the risk appetite for future generations. Japan still hasn’t fully recovered.

We’re not saying this is going to happen in the U.S. Different economies, governments, and demographics, but it would be foolish to ignore some of the potential implications from a zero percent investment landscape.

Our friends at Verdad Capital published a great piece on how various asset classes fared during Japan’s run of zero interest rates. Here are the takeaways mixed with our own observations…

Despite low starting yields of ~1.4%, bonds returned 1-2% per year

This is consistent with our research “Are Low Yields a Good Reason to Shun Bonds?”

Going forward, investors would do well to think about fixed income in terms of risk reduction as opposed to a primary income generator. Look no further than how U.S. Treasuries held up during the COVID market sell-off in March 2020.

Volatility went through the roof

History has shown that periods of low volatility often lead to periods of high volatility. We pointed this out in “Stability Breeds Instability.” The idea is, as people feel good about current economic prospects they tend to consume, take on debt, speculate. The risk-seeking behavior can create imbalances or excess, leading to economic instability.

That’s precisely what happened leading up to the last 20 years of high volatility in Japan. U.S. investors experienced a golden decade from 2010-2019. Are we due for a more disruptive period? If 2020 is a sign of things to come, the answer is a resounding “yes.”

Monetary policy fatigue

We are hypothesizing, but it would seem Japanese investors have monetary policy fatigue. How many times can a central bank pledge to keep rates low to boost growth? Heck, the Japanese government actually purchases stocks outright and it hasn’t resulted much in the way of outsized gains (although Japanese markets have stabilized since 2010). Eventually, the novelty of an accommodative central bank will wear off. This hasn’t yet happened in the U.S. The Fed still very much has influence over financial markets (don’t fight the Fed!), but it’s something to keep an eye on.

Starting valuations matter

The best performing Japanese asset class during the zero interest rate era was small cap value. Not coincidentally, small cap value was the worst performer during the preceding boom period. We’re not saying small cap value is primed to outperform, rather expressing what has worked the last ten years might not work the next ten. Conversely, what’s been beaten down might be tomorrow’s winner.

2020 should be a wake up call for investors. It could be the new normal.

Not sure how to position your portfolio for the 0% rate paradigm? We’re happy to help. Click here to chat.