“A reasonable-level of anxiety is a sign that you take investing seriously and are on guard against complacency and overconfidence. Meanwhile, too much anxiety is a sign that you’re investing in a way that just doesn’t suit you.” Daniel Grioli, Market Fox

You’ve probably seen a variation of a risk questionnaire that frames various market outcomes. Heck, you might even have completed a few.

Are you comfortable with a loss of -5%?

“Yes.”

What would you do if the market dropped another -10%? Buy more?

“Yes.”

What did you do in 2008 when the S&P 500 dropped -37%? Stay the course?

“Yes.”

Easy peasy. The answers to these questions offer varying degrees of relevance ranging from useful to worthless. The missing ingredient from our risk questionnaire is a heavy dose of human emotion.

In other words, how are you going to respond when investing gets hard?

As the great Mike Tyson said, “Everyone has a plan until they get punched in the face.”

Facing real losses, our Q&A might look like this:

Are you comfortable with a loss of -5%?

“Yes, but what the heck is going on?”

What would you do if the market dropped another -10%?

“Call my advisor and demand we do something to minimize losses.”

What did you really do in 2008 when the S&P 500 dropped -37%?

“Sold everything and vowed to shun stocks for my remaining years on Earth.”

The above scenarios are a bit tongue and cheek, but there’s truth in them.

We can say we’re comfortable with risk, but until we lose real money we don’t know how we will react. Additionally, risk appetite can change depending on our circumstance or stage in life. For example, a risk-seeking person during their working years might have a different risk appetite as they approach retirement.

Having realistic expectations about how we react in the face of losses takes a good deal of self-awareness.

The following behaviors may indicate you aren’t ready to deal with the next market downturn:

Feel like you’re behind and need to catch up

Check your account on a daily basis

Feel compelled to do something

Jumping in and out of the market (making large tactical decisions regularly)

Constantly comparing your situation to others

Letting recent market events influence your behavior

Love gains when times are good, but hate losses during poor markets

Unrealistic expectations

Have grand proclamations about what the market is going to do over the next week, month, or year

Scouring financial news because (insert here) makes you nervous

On the other hand, pat yourself on the back if you exhibit the proper behaviors:

Understand the range of potential outcomes

Err on the side of doing nothing

Check investments once in awhile

Accept that negative years (losses) are part of investing

Have a margin of safety within your plan that allows for inevitable market losses

These reference points might help you build the correct the portfolio and manage your emotions during the next market downturn.

Understand your range of potential outcomes in the short-term (we use 6 months). It’s hard to stick to a long-term investment plan if you don’t understand the potential short-term outcomes.

Develop a rules-based investment approach. We are not advocating doing nothing when economic or market circumstances change. It’s fine to act, but take human emotion out of the equation. Don’t underestimate the negative influence that sensationalist financial news and social media can have. Develop rules or triggers that allow you to reduce risk or put cash to work (we followed our own advice and created a rules-based investment process).

Stress test the portfolio. How would your current portfolio have performed in 2008? Are you really fine with a -25% loss? Be honest with yourself.

Find out if you need to take risk. Run a financial planning scenario using a 100% fixed income portfolio. If it’s successful, you don’t need to seek risk to realize a favorable outcome. You can ratchet up risk as you see fit, but knowing you have a margin of safety without relying on stock market returns can offer peace of mind.

Have realistic expectations. Achieving outsized gains without ever taking losses isn’t realistic.

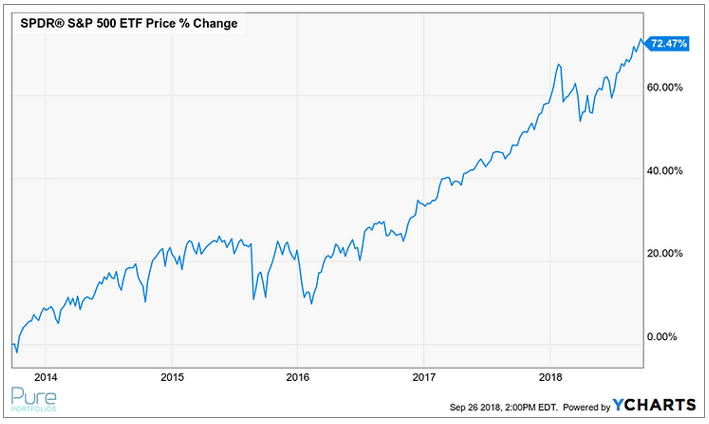

You can’t have this…

The above graph shows the S&P 500 price appreciation for the last 5 years.

Without this…

The above graph shows the S&P 500 price change from 10/1/2007 to 3/16/2009.

Are you invested incorrectly?