The health and wellness gurus will tell you that they meditate for two hours, exercise, and eat egg whites all before 6am.

I check my email first thing when I get up. Probably not the best for optimizing my mental state, but it’s part of my routine.

Perusing my inbox, one email subject line jumped out at me.

IS INFLATION COMING?????????

ALL CAPS (text equivalent of shouting) and aggressive use of punctuation.

Nicely done.

Which wholesaler is trying to sell Pure Portfolios their latest product to protect against “sure to come inflation.” They are trying to hook me by creating a sense of urgency, like inflation is a forgone conclusion.

Much to my surprise, the message was from a prospective client. Now I was really impressed. What brilliant and seductive messaging…

IS INFLATION COMING????????

I would counter the above question with another question, how much time do you have?

Inflation is a complex topic with several layers. We can define inflation as aggregate price increases of good and services. The levers that influence inflation are economic activity, money supply, and the velocity of money.

We will be focusing on systemic inflation rather than “one-off” inflation i.e. a supply chain gets mucked up and meat prices go higher.

The popular narrative seems to be inflation must be coming because the government is “printing” so much money. That could be true, but complex systems are not that simple.

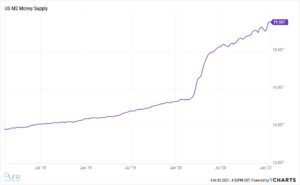

Source: Ycharts

The above graph shows the explosion of M2 money supply over the past year. Increases in the money supply can be associated with stimulative monetary policy meant to encourage consumption and growth. Historically, increases in the money supply have been associated with inflation, but…

The second part of the inflation equation is the velocity of money.

Let’s say I give you $100,000. You put it under your mattress. The velocity of money would be zero. The money changes hands once.

Let’s say I give you $100,000. You buy a new fully loaded 2021 Cadillac Escalade. The Cadillac dealership owner buys a new MasterCraft speed boat. The MasterCraft salesperson remodels his outdoor living area to include a full bar, three big screen TVs, and a new pool. The velocity of money would be much higher. The money changes hands several times.

As a general rule, in bad times the velocity of money falls as people hunker down in the face of uncertainty. In good times, the velocity of money can rise as people gain confidence in future economic prosperity.

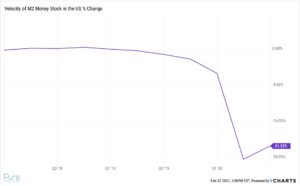

Source: YCharts

The above graph shows the velocity of money (M2 money supply). While the supply of money has increased, it’s not flowing through the economy. People are hunkering down i.e. paying off debt and/or saving for a rainy day.

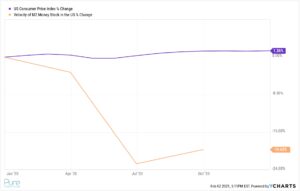

Add it all up: increasing money supply with a falling velocity of money, and you get relatively benign inflation (purple line below)…

Source: Ycharts

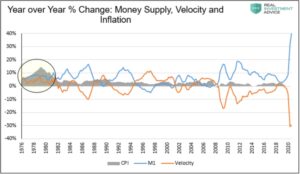

The below provides greater context of how the relationship between money supply, velocity of money, and inflation have evolved through time.

Source: Real Investment Advice

The above chart provides a historical look at the relationship between inflation measured by the Consumer Price Index (gray), money supply (blue), and the velocity of money (orange). Post 2008, increases in the money supply, are met with similar drops in the velocity of money. Despite highly accommodative monetary policy since the Financial Crisis, inflation hasn’t really come to fruition because the money is not making its way through the economy (velocity of money).

Notice the highly inflationary period in the late 1970s (above graph). Money supply and velocity of money started to move higher together. In other words, more money that was quickly changing hands in the economy which lead to higher prices.

That’s enough to make your head spin. Money supply. Velocity of money. Not exactly easy concepts to wrap your head around.

Let’s introduce the inflation common sense test. When someone is banging the table predicting imminent inflation, ponder these questions…

- What business has the pricing power to jack up prices without losing customers?

- Is technology and innovation making goods and services cheaper or more expensive?

- Some countries have been running aggressive monetary policies for decades. Japan comes to mind. Why has inflation been elusive?

- With unemployment still relatively high and many small businesses shuttered or operating at limited capacity, where is demand going to come from?

- If inflation was coming, one could expect longer-term bond yields to adjust higher. Why are bond yields still low?

- Could personal experiences shape the way one views inflation? I have yet to meet a person under 40 that is predicting inflation. This makes sense because virtually their entire adult life has seen little inflation. Conversely, older people might recall the ugly inflationary periods in the 70’s and early 80’s, fearing a repeat.

One can make a valid argument there are currently pockets of inflation in asset prices such as real estate and financial (stocks). However, the arrival of systemic inflation is neither a certainty or improbable. Consumer confidence can change quickly which impacts the velocity of money. We do acknowledge that central banks and governments around the world are playing a dangerous game of cat and mouse (it’s not just the U.S.).

In our opinion, it’s tough to envision inflation moving meaningfully higher in the short-term. Longer-term, there are likely many unintended consequences from both the pandemic and ensuing policy responses that will be challenging to understand.