Mental shortcuts or heuristics are used to make quick decisions, either because of time constraints or to simplify a complex problem.

The further away a topic is from our sphere of understanding, the more likely we are to use a mental shortcut.

We use heuristics throughout the day and don’t even realize it.

Here’s a real-life example…

My wife and I are planning a trip to San Diego this summer. It’s our first trip away from the kids. We started to look at hotel options. What area would be ideal for beach access, restaurants, biking, walking, etc.? We solicited input from friends and researched online. I quickly realized the due diligence was taking up too much time. I ended up hastily booking a place near Mission Beach. Done is better than perfect.

Textbook mental shortcut.

The 4% rule might be the ultimate retirement mental shortcut.

The 4% rule states a retiree can safely withdraw 4% of their portfolio each year and not run out of money. Seems like a good rule of thumb; after all, retirement planning is complex.

“Live off the interest” and “I don’t want to invade principal” are all rooted in the idea of the 4% rule.

There’s one problem, the 4% rule was created during a period of much higher interest rates and bond yields.

Source: YCharts

The above chart shows the steady fall of the U.S. 10-year Treasury bond yield. In 1995, a $1,000,000 portfolio invested in U.S. 10-year Treasury bonds would produce $75,000 in annual income. In 2021, the same portfolio would produce ~$11,800 per year. When people say current Fed policy punishes savers, this is what they’re talking about.

I could argue anchoring to the old “live off the interest” mentality can lead to a dangerous misallocation of assets. An investor is much more likely to be blinded by yield, even ignoring an underlying asset that’s garbage.

With a shift in focus and optimizing the things we can control, a good retirement outcome is well within reach. Here is what a retiree in the “new normal” of 0% interest rates and low bond yields should focus on:

Cash Flow Analysis

How much do you need to take from your portfolio on an annual basis? The equation would look something like this…

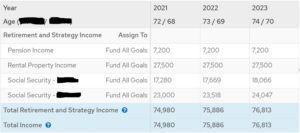

Tally up income NOT tied to financial markets i.e. Social Security, pension income, rental property income, part-time employment, etc.

Source: MoneyGuide Pro

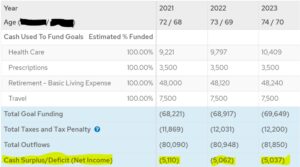

Subtract expenses and taxes.

Source: MoneyGuide Pro

If you end up with a positive number, congrats! You do not need your investment portfolio to supplement your retirement plan.

If the number is negative, that’s how much you need to take from your investable assets each year to fill the gap.

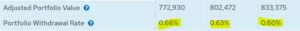

You can then calculate your portfolio withdrawal rate (distribution/portfolio value = withdrawal rate).

Source: American Association of Retired Persons (AARP).

It is important to note that the withdrawal rate should be adjusted over time, as market conditions change and you draw money from your portfolio.

Your goal is to have a sustainable withdrawal rate so that your assets last the length of retirement.

Once you have a rough approximation of the “the gap,” you can begin to plan for how you’re going to make it all work (depending on where you’re at on the retirement spectrum).

Quit Fixating on Portfolio Income

People are convinced they need portfolio income. They are operating off of an obsolete playbook. In 2021, there’s not a risk-free way to generate meaningful portfolio income. An investor is forced to take risk, which they might not fully understand.

Consider two portfolios, A & B.

Portfolio A

$1,000,000 with 5% yield or $50,000 per year in income

Let’s say at the end of one year the portfolio is worth $900,000.

Portfolio B

$1,000,000 with 0% yield or nothing in annual income.

At the end of one year, this portfolio has appreciated to $1,100,000.

The investor that places an irrational premium on income would likely choose portfolio A.

Shift your mindset to total returns. Capital Appreciation + Income = Total Return. That’s what really matters.

Save More or Decrease Expenses

If you’re about to retire or are already retired and the amount needed from your portfolio is not sustainable, you have two options. Save more and/or cut expenses.

The pre-retiree might work an extra year.

A retired person might find a part-time passion hobby gig.

A retiree should take a meticulous look at their core expenses to trim down the excess. More drastic options could be downsizing their primary residence, and/or moving from a not-so-retirement-friendly state to a lower cost of living location.

Savings rate and expenses are two hugely impactful levers that are often glossed over. If a plan is unfavorable, this is the first place to look.

Don’t Anchor to Weird Stuff

You’ve run cash flow analysis to find your gap. Make sure what you’re taking out is sustainable and grounded in reality. I’ve seen retirement plans go off the rails because a person was convinced that taking out $7,000 per month was what they needed to survive. It turned out, they really only needed $1,500 per month from their portfolio. They ended up anchoring to $7,000 per month because that’s roughly what their employment income used to be. The result was a depleted investment portfolio and higher tax bracket from the distributions.

Be Mindful of Fund Expenses

The interest rate complex is challenging enough. Don’t make it worse by overpaying for something you can get at a fraction of the cost.

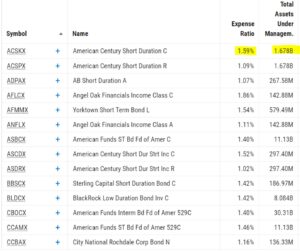

Source: YCharts

The above chart shows short-term bond funds with expense ratios over 1%, and fund assets under management greater than $100 million. The fund at the top (highlighted) has a distribution yield of 0.51% and an expense ratio of 1.59%. Add to that any management fees charged by a financial advisor and you’re likely paying well over 2%. Notice the billions of dollars that are invested in these wealth siphoning funds.

- Ditch the 4% rule as a mental shortcut. It’s time to adjust for the new reality of next to nothing interest rates.

- Find your gap – the difference between income (not tied to financial markets) and expenses (including taxes).

- Reprogram yourself to value total returns ahead of income. Optimize the things you can control i.e. your savings rate, expenses, getting rid of costly mutual funds.

For further reading on investing in a 0% world, check out…

Generating Income in a 0% World

Investing in a Zero Rate Environment