“You must pay taxes. But there’s no law that says you gotta leave a tip.” – Morgan Stanley

Most investors are familiar with the basic principles of asset allocation. However, asset location is often understated or neglected altogether. The gist of asset location is placing assets which are subject to high tax rates in tax-deferred accounts (IRAs, 401ks) and those with low tax rates in taxable accounts.

Sound confusing? We will run through a hypothetical example and share the most common mistakes that investors make that unnecessarily increase their tax bill.

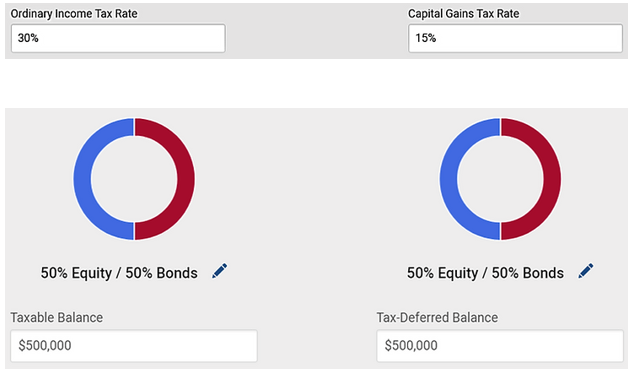

Our buddy Cecil is a new retiree. He has ~$1 million in investable assets evenly split between his IRA and taxable brokerage account. After running through Riskalyze, Cecil finds out his ideal asset allocation is a balanced mix of 50% stocks/50% bonds.

For planning purposes, Cecil’s ordinary income tax rate is 30%.

Source: LifeYield

In the taxable account, Cecil could potentially pay tax on bond interest income. Qualified dividends and long-term capital gains would be taxed at 15%.

Source: LifeYield

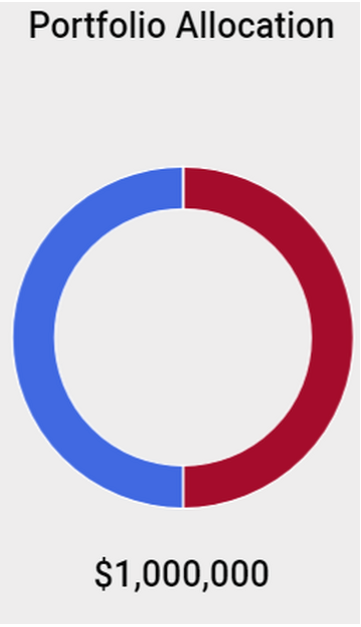

Cecil’s total investable assets total $1 million, evenly split between his taxable brokerage account and IRA.

Source: LifeYield

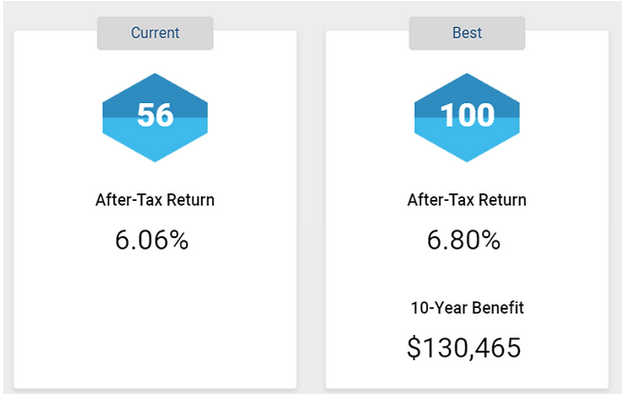

Is this approach tax efficient? Not so much. We assign a tax efficiency score of 56 to Cecil’s portfolio. The tax efficiency score is much like a credit score, but instead of measuring creditworthiness, we are evaluating the tax efficiency of Cecil’s portfolio. The higher the score, the better positioned to minimize taxes and accumulate more money.

Using realistic capital market assumptions, we project Cecil’s portfolio in its current form to produce an annualized after-tax return of ~6.06%. However, with a few tweaks, we can optimize his asset location adding ~0.75% in tax alpha per year. The estimated 10-year benefit of $130,465 will stay in Cecil’s portfolio rather than going to Uncle Sam!

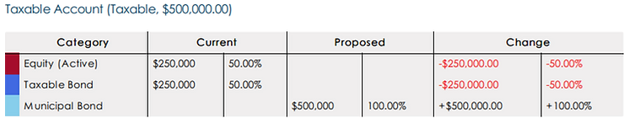

To achieve the maximum tax efficiency score of 100, the taxable account allocation will move to 100% municipal (tax-free) bonds.

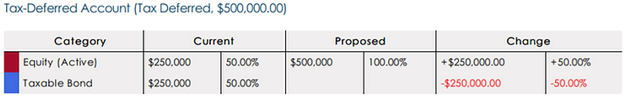

Conversely, Cecil’s IRA is now 100% equities. Note: Cecil’s overall asset allocation of 50% stocks/50% bonds still holds, however, the asset location has completely shifted to maximize tax efficiency.

You are paying unnecessary taxes if you:

Own Active Mutual Funds within a Taxable Account – A mutual fund manager buying and selling securities trying to beat a benchmark doesn’t care about your personal tax situation. In addition, you have zero control on the timing of capital gains.

Focus on Dividend Income in a Taxable Account – Dividend investing is a popular strategy especially among retirees, but it’s also horribly tax-inefficient. You can read more about the tax drag of dividends here.

Scatter Accounts – Multiple advisors, 401k’s from previous employers, evaluating investments in silos (mental accounting) make it darn near impossible to manage tax efficiency.

Trade with Excessive Turnover – Excessive trading, especially those triggering short-term capital gains, can be a steep hill to climb to make it worthwhile.

Investing is hard. As evidence-based investors, if we can focus on what works and things we can control, i.e. investment cost, tax efficiency, financial planning, and avoiding emotional decisions, our chances of a favorable outcome increase.

If you have a mix of taxable and tax-deferred accounts, your asset location could be a major drag on your after-tax returns.