“I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.” – Charlie Munger

There has been much commotion about the evils of stock buybacks. The prevailing theory is rather than pay workers a fair wage, invest in research and development (R&D), or undertake capital investment, corporations buy back shares to enrich shareholders and management.

The idea that stock buybacks are bad has been picking up steam on Capitol Hill. We aim to take an objective look at capital allocation options for corporations and different ways to return capital to shareholders. While buybacks might be easy targets for criticism, we come to the conclusion they are likely a consequence of historically low interest rates.

The concept of stock buybacks is often misunderstood because it’s a relatively new phenomenon. The SEC reversed course in 1982 making it legal for companies to purchase their own shares. The practice really started to pick up during the booming 1990s. In 2006, for the first time ever, aggregate stock buybacks surpassed dividends as the primary method to return capital to shareholders (the timing was not ideal as the market crashed in 2008, but that’s another story).

Assuming a business is profitable, management is faced with a capital allocation decision…

Make investments that earn more than the cost of capital. Some examples include, buy another company (M&A), develop new products or technology (R&D), purchase a new plant or equipment (capital investment), organic growth (hiring), entering a new market, etc.

or;

Return capital to shareholders.

In essence, management is asking themselves, “how can we deploy our excess cash to generate the best outcome for our business and shareholders?”

Source: Morningstar

Source: Morningstar

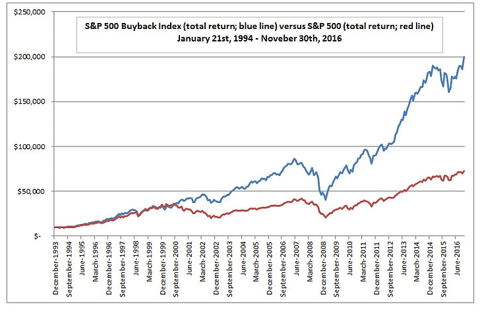

The above graph shows the S&P 500 Buyback Index vs. S&P 500 (1993 to mid-2016). How management allocates capital can reap huge rewards for shareholders. Buybacks are simply an arrow in the quiver. Look no further than Warren Buffett, who has long held the belief that stock buybacks are often the best use of corporate capital.

It should be noted, corporate share repurchases are one method for returning capital to shareholders. There are other methods, one of which is widely accepted as a sound principle of corporate stability: paying dividends (another is reducing debt which we will ignore for now). It’s almost impossible imagine a political upheaval over a company paying dividends, but that’s precisely what’s happening with stock repurchases.

Let’s look at the most common rationale why a company would buy back its own stock:

- Strong conviction the shares are undervalued by the market

- Lack of attractive investment opportunities

- Tax efficient way to return capital to shareholders

Not all buybacks are the same. Each corporation has a different set of capital needs, investment opportunities, and management initiatives. Some buybacks are done for the wrong reasons, or ill-timed, the most common being the tendency for management to buyback stock at elevated valuations.

In our opinion, the boom of corporate buybacks is a symptom of low interest rates. The interest rate backdrop is making share buybacks more attractive for corporations. Companies can borrow money cheaply and repurchase shares. It wouldn’t make much sense to borrow money at elevated interest rates and buyback shares. During the 1980s, companies allocated capital back to shareholders just like today, but it might have been in the form of paying down high interest debt.

The methods change depending on the economic landscape, but the spirit of capital allocation decisions remain the same. Public companies have a duty to maximize shareholder value.