“I’m hard-pressed to recall when any sort of bubble was accurately identified in real-time on the cover of a major media publication. If anything, the opposite is true.”– Barry Ritholtz, Founder of Ritholtz Wealth Management.

It’s cringe worthy to hear everything under the sun called a bubble. The term “bubble”is used to describe an asset that is completely detached from reality. Euphoria, emotion, fast money, fear of missing out (FOMO), and human greed are all symptoms of an actual bubble.

Unfortunately, casually tossing around the word bubble has never been more popular. Here we are, 10 years since the financial crisis and emotional scars are still flaring up. The media should be shamed for sensationalizing bubbles.

In our estimation, virtually every major asset class has been called a bubble during the past 5 or 6 years:

The stock market is a bubble. The below headline is from Forbes 10/8/2013:

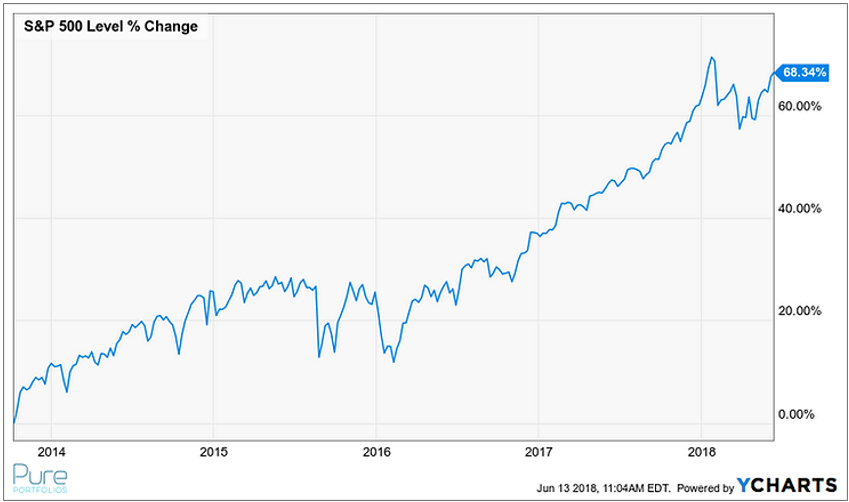

Meanwhile, the S&P 500 has done this since the “massive bubble” call:

S&P 500 price change from 10/8/2013 to 6/12/2018.

Bonds are in a bubble. Here’s a gem from CNN Money 01/16/2013:

Bond yields have ticked a bit higher, but hardly anything out of the ordinary. Especially since the Fed has been increasing its short-term benchmark rate:

U.S. 10-year Treasury yield 1/16/2013 to 06/12/2018.

Bitcoin is a bubble. Another solid call from CNN Money 04/12/2013:

We won’t get into the merits of Bitcoin, rather provide another example of the obsession with calling everything a bubble. Of course, Bitcoin went parabolic since the ill-fated call.

Bitcoin price movement from 04/12/2013 – 06/12/2018.

Real estate is a bubble. The below headline is from Forbes 03/25/2013:

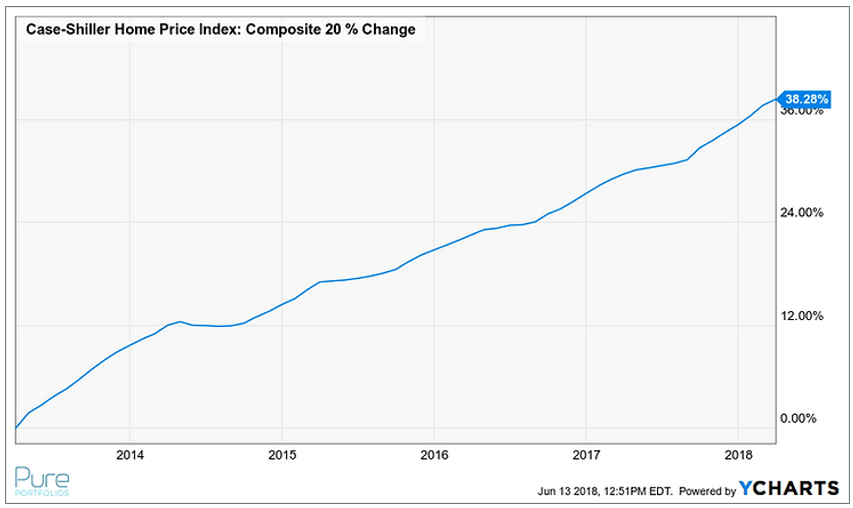

Real estate continues to appreciate fueled by lack of supply, low interest rates, and a stable economic environment.

Case-Shiller 20-City Composite from 03/25/2013 to 06/12/2018.

Our collection of spectacular headlines have not aged well.

Calling everything that moves upward a bubble might be good for web traffic, but that’s about it. The media likes to play to human emotion, which is drawn to fear or outright disaster.

The fear-mongering media has not only been wrong, but their proclamations have been expensive to those adhering to their warnings. In our opinion, holding extreme views about anything can cause distortion to reality. History has proven that erring on the side of optimism has been rewarded.

Our Twitter friend and fellow blogger Josh Brown said it nicely:

“106,000 or so flights take off and land every single day, almost always without incident. That’s why it’s news when one doesn’t.”

Financial markets are the same way. Most days are boring and nothing notable happens. We need spectacular predictions to spice things up. The danger is, the novice or inexperienced investor can act on fear or emotion and make a grave mistake.

You can counter-act the bubble talk by being selective where you consume financial media (see Less Obvious Mistakes), ignoring extreme views, and having a plan and sticking to it.

There’s a bubble in using the word bubble to describe anything that moves higher.