“The past wasn’t as good as you remember. The present isn’t as bad as you think. The future will be better than you anticipate.” Morgan Housel, The Collaborative Fund

The popular saying, “under-promise, over deliver” is a play on expectations.

Promise the world and come up short, people aren’t going to be happy.

Promise nothing and deliver a pleasant surprise, people are going to be thrilled.

Steven Hawking, when asked why he’s in a good mood despite not being able to walk famously said…

“When one’s expectations are reduced to zero, one really appreciates everything one does have.”

It seems our perception of anything, either good or bad, is highly dependent on our initial expectations.

In our April Market Commentary video, I was asked how stocks could go up in a recession.

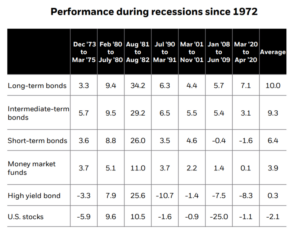

Source: Morningstar, Blackrock

The above graph shows asset class performance during every recession since 1972. During the early 80’s (left columns), the U.S. was mired in two recessions, however, U.S. stocks (bottom row) achieved ~10% return during the economic slowdown.

How is that possible?

It comes down to expectations.

Back in the early 80’s, inflation was raging. Paul Volcker, the Fed Chairman, was super aggressive in raising interest rates to slowdown rising prices. Everyone thought things would get worse. It was going to be impossible to stop the runaway inflation train.

But, inflation did subside. The Fed started cutting rates. The world didn’t end.

Expectations were grim. Things turned out to be less bad. Stocks ripped higher.

It can work the other way too. Back in the 2007, the Fed was on record stating the sub-prime mortgage issues wouldn’t affect the U.S. economy…

“We believe the effect of the troubles in the subprime sector on the broader housing market will be limited and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.” – Ben Bernanke, former Fed Chairman (Source: CNBC).

Expectations called for a minor hiccup. The U.S. banking system ended up imploding. Stocks tanked and we saw the worst economic crisis since the Great Depression.

Which brings us to today.

What is the consensus expectation?

- Everyone is expecting a recession. Investor bearish sentiment is at record levels. The financial media is having a field day with pessimistic storylines. My inbox is flooded with “world is ending” narratives.

- We are on record stating if everyone is expecting a recession, it might be inherently less intense. After all, risk is what’s left over after you’ve thought of everything.

- We could very well get a recession, but the market reaction is going to be a function of initial expectations.

Those that understand markets and human psychology will be better prepared for whatever happens next.

We want to hear from you! Drop us a line at insight@pureportfolios.com.