“The world changes. This is the biggest problem in markets.” – Bill Miller, former chairmen of Legg Mason Capital Management

T. Rowe Price, founder of the Baltimore-based investment firm that bears his name, wrote an essay in 1937 titled, “Change – the Investor’s Only Certainty.”

The world was on the doorstep of WWII. Many investors were attempting to assess Adolf Hitler’s intentions.

Price wrote, “Germany will acquire territory, preferably through peaceful means.”

Two years later, Hitler invaded Poland, plunging the world into six years of war. Everything changed, but not in ways that Price or anyone else could predict. (source: “Richer, Wiser, Happier” by William Green).

On Friday, April 12th 2024, global financial markets were anticipating a Iranian strike on Israel.

Major U.S. indices retreated ~1.5%.

Over the weekend that followed, Iran launched an attack on Israel.

As of this writing, markets are skittish on a potential Israeli response.

How do markets react to unpredictable and random geopolitical events?

It’s complicated.

Ryan Detrick, Chief Market Strategist at Carson Group, shared historical stock returns after major geopolitical events…

Source: Ryan Detrick, Carson Group

The above chart shows S&P 500 returns for one, three, six, and 12 months following major geopolitical events. The bottom of the chart compares average, median, and percentage of the time higher vs. all years (1950 – 2023). Across average & median returns, there is evidence to suggest geopolitical events are followed by lower S&P 500 returns.

While average returns are lower following major geopolitical events, the market returns for individual events are all over the place.

For example…

On 2/24/22 Russia invaded Ukraine. The S&P 500 was ~6% higher one month later.

On 8/2/1990, Iraq invaded Kuwait. The S&P 500 was ~8% lower one month later.

How can investors protect their portfolio against random geopolitical events?

Historically, gold, U.S. Treasuries, and the U.S. Dollar have been safe-haven assets.

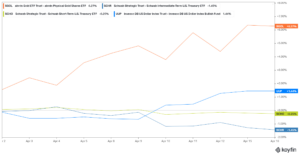

Source: Koyfin

The above chart shows the percentage change in Gold (SGOL, orange), U.S. Dollar (UUP, blue), short-term U.S. Treasuries (SCHO, green), and intermediate U.S. Treasuries (SCHR, aqua blue) from April 2, 2024 to April 16th, 2024. It would seem investors sought refuge in Gold & the U.S. Dollar in anticipation of an Iranian attack. For context, the Dow Jones Industrial Ave. was down ~3.5% during the same time frame.

We should note often safe-haven assets move higher before an event happens. This might run counter to how most investors think, i.e. a geopolitical event happens and then we should seek safe-haven assets. Unfortunately, in most cases it’s too late. The umbrella is needed before it starts raining.

What can we learn from market returns and previous geopolitical events?

- Geopolitical events often come out of the blue. This is consistent with our belief that what derails markets is seldom what people are talking about.

- While average returns are lower following major geopolitical events, the market returns for individual events are all over the place.

- Trying to predict how markets react to geopolitical events is darn near impossible.

- Events that impact supply chains, transportation, oil/energy prices, food supply, and the global financial system seem to have the most impact on market returns.

- Gold, U.S. Treasuries, and the U.S, Dollar have typically held up well during global conflicts.

In my opinion, most geopolitical events are non-tradable. If you’re freaking out about what could happen to your portfolio, it’s a strong sign you’re taking too much risk.