We recently stumbled across a tongue and cheek article that decoded real estate agent listing language. For example, describing a property as “cozy” within a large city really means “come purchase our walk-in closet.”

The investment management business is full of similar buzzwords and phrases that make for a tidy story, but are literally rubbish. The following quotes are some of the phrases, claims, and statements of the Story-Based Advisor, followed by our translation, and what an Evidence-Based Advisor would add to the conversation.

“We predict the S&P 500 will have a 5% pullback this fall and hit 2,800 next year”

Translation: We really have no clue, but it’s better to sound smart and offer an absolute answer. Also, we always predict an appreciating market. Client’s don’t like to hear negative projections.

Evidence-Based Advisor: This is our range of outcomes and how we’re managing risk in portfolios.

“It’s a stock picker’s market”

Translation: We get crushed by the index every year. If I keep regurgitating this narrative, the client will look past my insistence on hiring mutual fund managers that fail annually.

Evidence-Based Advisor: Every market is a stock-picker’s market. Can you pick the right stocks?

“We expect active managers to outperform passive next year”

Translation: We must justify what we’re doing. Our story-based approach is centered on the promise of outperformance. I hope they don’t look at our track record and net of fee performance.

Evidence-Based Advisor: History is not on their side. According the S&P’s mid-2017 SPIVA Report Card, over the past 5 years 82% of U.S. Large Cap managers failed to beat the S&P 500. The percentage is even worse for U.S. mid & small cap stocks.

“Indexing performs well in up markets. Active performs better in down markets”

Translation: We have nothing to back that up, but it sounds damn good.

Evidence-Based Advisor: Another fictitious claim. Direct from the SPIVA 2008 Report Cardsummary, the belief that bear markets favor active management is a myth. A majority of active funds in 8/9 domestic equity style boxes were outperformed by indices in the negative markets of 2008. The bear market of 2000 to 2002 showed similar outcomes.

Source: S&P Global

“If the Fed raises interest rates, bonds will get crushed”

Translation: That’s what everyone else is saying so it must be true. I would rather be wrong with the herd than have a “rogue” forecast.

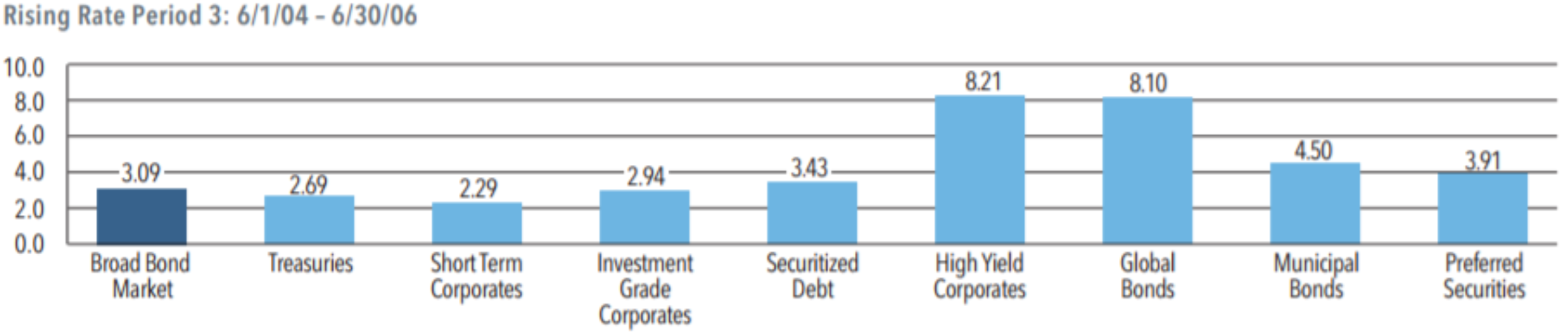

Evidence-Based Advisor: The last Fed interest rate increase cycle was June 2004 – 2006 (~24 months). The Fed raised rates 17 times for a total interest rate increase of 4.25%. See the below fixed income returns*:

Source: Nuveen

*We are not saying positive fixed income returns will persist during this rate cycle. However, fixed income is a complex asset class with many return drivers. You can read our previous post “What Actually Happens During a Fed Hiking Cycle.”

The Story-Based Advisor is selling a delusion either from ignorance or greed to justify their existence. They often believe they have a special talent to select active mutual funds or third-party managers. The Story-Based Advisor makes things more complicated, follows the herd, and has little incentive to challenge a model that has been extremely lucrative for their firms and themselves.

The Evidence-Based Advisor has principles that are grounded in reality. They acknowledge that investing is difficult and focus on the things within their control i.e. tax efficiency, asset location, financial planning, all-in cost of investing, and sound portfolio construction/management. The Evidence-Based Advisor is constantly looking for ways to simplify, deliver exceptional service, and improve client outcomes.

Don’t let a good story derail your plan.