“Historically, investors overestimate the impact of political parties, Presidents, and legislation. Even if one was to correctly forecast a political outcome, markets seldom react in a predictable manner.” – Pure Portfolios’ blog, May 2017

As of this writing (11/9/22), party control in Congress is up in the air as mid-term elections are too close to call.

What does the mid-term election outcome mean for markets?

It’s a common question and common fallacy.

The world doesn’t freeze to isolate the impact of the U.S. mid-term elections.

Commodities trade.

Currencies fluctuate.

Central banks talk.

War rages on.

Companies report earnings.

In complex systems, variables are constantly changing. There is no black & white.

Mental shortcuts that humans rely on to explain the world can result in incorrect conclusions.

However, we can study history to understand the impact (or lack thereof) of previous mid-term election cycles and financial markets.

The results might surprise you.

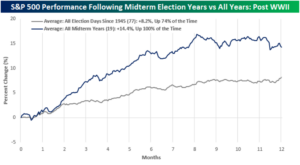

Source: Bespoke Investment Group

The above graph shows average S&P 500 returns in the year following mid-term elections (dark blue, post-WWII). The S&P 500’s average performance is a gain of 14.4% with positive returns 100% of the time. Not too shabby!

You might say, “well that doesn’t capture what’s going on now.”

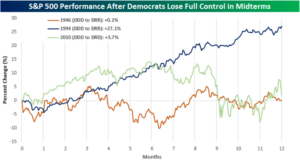

Let’s look at the same data set (post-WWII) with a sitting Democratic president and Congress, that flips one or both chambers of Congress from D to R.

Source: Bespoke Investment Group

The above chart shows S&P 500 performance in the three mid-term cycles (post-WII) when Democrats lost full control of Congress at mid-terms. With the exception of 1994, the other two instances were a non-event.

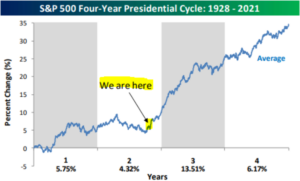

Zooming out, year three of a Presidential election cycle has been pretty good for equities…

Source: Bespoke Investment Group

The above chart shows the average S&P 500 returns (1928-2021) during a four-year Presidential cycle. If historical trends hold, future returns could surprise to the upside.

In general, people place too much blame on politicians when market returns are poor.

People place too much praise on politicians when market returns are great.

An NBA referee can have an impact on the outcome of a game, but throughout a season, players determine who wins and loses.

A politician or President can influence policy, but throughout their multi-year term, market participants, capital allocators, and investors determine winners and losers.

For further reading, check out “The Danger of Mixing Politics and Investing.“