“We will all feel pain in the next recession or stock market drop, but what can we do now to mitigate the damage?” – Pure Blog, September 2019.

Back in the fall of 2019, seemingly everyone was asking a variation of the same question. When is the next recession going to come? Rather than spinning the forecasting roulette wheel, we focused on optimizing what we can control.

- Minimizing damage is more practical and less intensive than playing the market oracle.

- Avoid operating in the extremes (either too pessimistic or too optimistic) and get your financial house in order before an event happens.

Unfortunately, these boring answers fall on deaf ears, especially when the S&P 500 was screaming higher and the economy humming along.

Fast forward to May 2020 and the above advice looks pretty good in hindsight.

It’s never too late to make positive changes. Here are some tools you can use to help minimize the damage and shore up your personal balance sheet, without placing a trade.

This has nothing to do with investment strategy. This is clipping the low-hanging fruit which takes minimal effort and can yield a huge payoff.

Refinance – If you anticipate being laid off or suffer a loss of income, get going now. Rates have dropped, but lenders are tightening the purse strings given the economic uncertainty. We prefer using an online lender; the rates are better and the process is more efficient than a brick and mortar bank.

Get Rid of Credit Card Debt – Interest rates are at zero again, but credit card rates are still in the high teens or worse. There are many online personal loan options that allow you to consolidate credit card debt into one fixed rate loan at a much lower rate. Marcus, Prosper, and Sofi are a good place to start (not an endorsement, do you own research to find the best personal loan for your circumstance).

Roth Conversion – Conversions are offered up by financial advisors and media as a no-brainer. We encourage investors to do your homework first. You shouldn’t insist on doing a Roth conversion because Barron’s magazine said so. Where are taxes owed going to come from? Does the conversion push you into a higher tax bracket? Does it positively impact the financial plan?

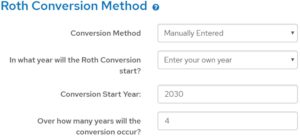

Here’s a rough example of a Roth conversion layered within a financial plan…

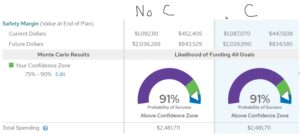

After entering the inputs for the conversion, we can run the current plan (no conversion) alongside the proposed plan (with conversion):

Source: MoneyGuidePro

The above chart shows ‘no conversion’ plan in the left column. The ‘converted’ plan is in the right column. The impact of the conversion is minimal on paper, but keep in mind post conversion returns will have an impact on the end result. If you knew the market would scream higher for the next 50+ years, you would convert every dime and never pay taxes again on your investment gains.

Get Your Estate Plan Dialed – If there ever was a catalyst to get moving on an estate plan, COVID-19 was it. We can help organize & store important documents, outline how you want assets to flow, and provide end of life resource through our partnership with Everplans (every Pure client has access to a free membership). We also have a network of flat-fee estate planning attorneys to help with drafting documents.

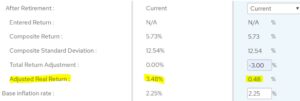

Rerun Your Financial Plan – It’s an understatement that the pandemic has affected many peoples’ finances. You should update your financial plan for any loss of income, change in retirement dates, lower portfolio values, etc. We run ‘what-if scenarios’ side by side to show lower future returns, higher expenses, lower income, to see if a plan is favorable or if we need to make adjustments to keep our clients on track.

Worried about lower future returns? We can model how your plan holds up during a prolonged period of lower returns (right column):

Forced into an early retirement and need to tap Social Security sooner? We can model how the plan is impacted by taking SS at full retirement age vs. age 70:

Source: MoneyGuidePro

Unwind Concentrated Positions – This is a great time to reduce low cost basis individual stock holdings and mutual funds. It’s virtually impossible to tax-loss harvest when the market is up year after year. For better or worse, tax-loss trading is back!

Emergency Fund – The COVID-19-fueled sell-off was a good reminder there is always a place for cash on your personal balance sheet; both to cushion against losing a job or reduction in income, but as a weapon to pounce on investment opportunities.

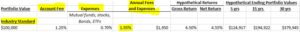

Fee & Tax Check-up on Your Portfolio – Have a conversation with your advisor about fees, expenses, and tax-drag (reference your 2019 1099 tax document). According to a Cerulli study, 42% of folks have no clue what they’re paying for financial advice or they think it’s free. If you can’t tell what you’re paying, we have an easy-to-use spreadsheet to help you break down your all-in cost of investing.

The above snippet shows the account fee + expense ratios of the mutual funds/ETFs. Don’t want to run the numbers? We can give you a rough estimate of what you’re paying and if your advisor is a fiduciary (or not) by looking at a statement.

The above planning tips don’t require a crystal ball or some magnificent investment call. Being proactively sensible beats prognosticating what happens next. Most everyone will feel financial pain in a global pandemic that shuts the economy down. Our focus should be on minimizing damage and focusing on what we can control.