“It’s really hard to make an argument for mutual funds in a taxable investment account.” – Meb Faber, Cambria Funds

It’s easy to rail against the mutual fund industry for high fees and poor performance (we have here and here). However, this is not another active vs. passive debate (which should be reframed as high-cost vs. low-cost investing, but that’s a different conversation).

In the spirit of tax season, we wanted to highlight the ugly capital gains mutual fund companies are spewing upon their investors.

Note: This very real tax bill only applies if your mutual funds are outside of retirement accounts (401k, IRAs, Roth, etc.).

In 2018, mutual fund investors were hit with the anti evidence-based triple whammy; negative returns, high fund expenses, and large tax bills in the form of capital gains.

Not exactly a recipe for success (see How to Drive Your Portfolio into the Ground).

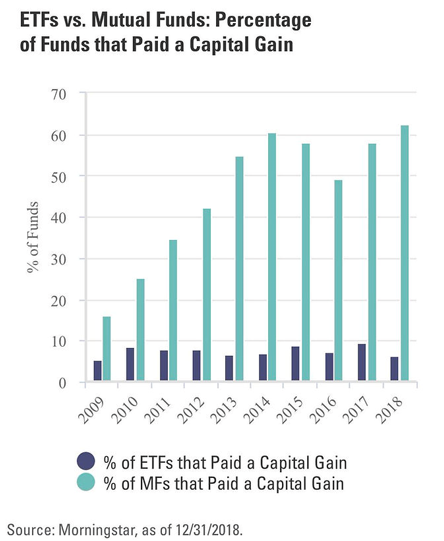

Source: Morningstar

The above graph shows over 60% of mutual funds distributed capital gains. How would you like to lose money and pay a hefty tax bill? Not much fun.

To clarify, we aren’t talking about selling a position at a gain and paying the taxes. That makes perfect sense to rational human beings.

We are talking about doing absolutely nothing and getting hit with a tax bill that you have no control over.

In a year the market makes money, investors often don’t notice capital gains, or simply chalk them up as the cost of doing business. This is nonsense.

So let’s say your 1099-DIV comes in the mail or you pull it up on your advisor’s or mutual fund company’s website. What should you look for? There are two types egregious offenses:

Short-term capital gains. Subject to Ordinary Federal income tax + State tax*

Long-term capital gains. Subject to 15% or 20% Federal tax + State tax

*Most states tax capital gains, although there are nine that do not.

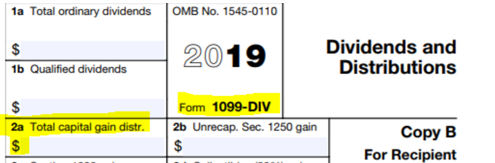

Source: IRS Website

The above graphic shows a blank 1099-DIV form that reports taxable investment income and capital gains to the IRS. You will find total capital gains info in box 2a.

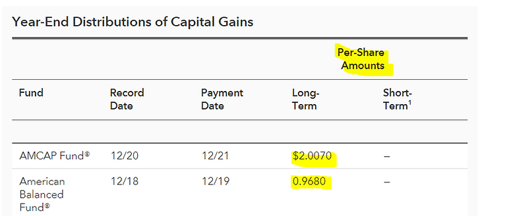

If you don’t want to dig through tax documents, most mutual fund companies publish a list of estimated capital gains distributions. The below is from American Funds for 2018:

Source: American Funds

The above graphic shows long-term distributions for two American Funds. If you owned 1,000 shares of the AMCAP Fund, you would be saddled with ~$2,000 of capital gains!

According to a February 1st Barron’s article, taxes shave off more than 2.5% (on average) of pre-tax returns. When you consider the average equity mutual fund expense ratio is 1.25% this is a steep hill to climb. For example, let’s say your U.S. Large Cap fund posted a return of -4.4% last year (pretty much in-line with the S&P 500). After fund expenses and capital gains taxes, your actual net return is a very ugly -8.15%! This doesn’t even include your advisor’s fee.

The only thing that matters is the your net return, after fees and taxes.

Give yourself the best chance at a favorable outcome. Don’t own mutual funds in a taxable account. Be wary of taxable income being spun off of your investments, including bond interest and dividends.

If this makes you angry or makes no sense, we are in your camp. The good news is it doesn’t have to be this way. With a little tweaking, you can own an evidence-based tax efficient portfolio. As Morgan Stanley used to say “You must pay taxes. But there’s no law that says you gotta leave a tip.”