“I’ve been crushing it in the stock market this year. I’m up 45%.”– Random Dude

How many times have you heard a family member, colleague, or neighbor brag about their investment returns? How did it make you feel? If you’re like most of us, you’re probably wondering if you should be doing something different or leaving outsized returns on the table. However, your braggadocios friend is leaving out one important detail about that handsome return. The risk that was taken to generate that outsized performance. We call it naked performance and it’s meaningless. Worse yet, for many investors and the advisors that serve them, naked performance is all they’ve ever known.

“You can only see who’s swimming naked when the tide is low.”– Warren Buffett

What Mr. Buffett is really saying, is that appreciating markets can make anyone look like a genius. Those outsized returns turn into devastating losses when the market cycle turns.

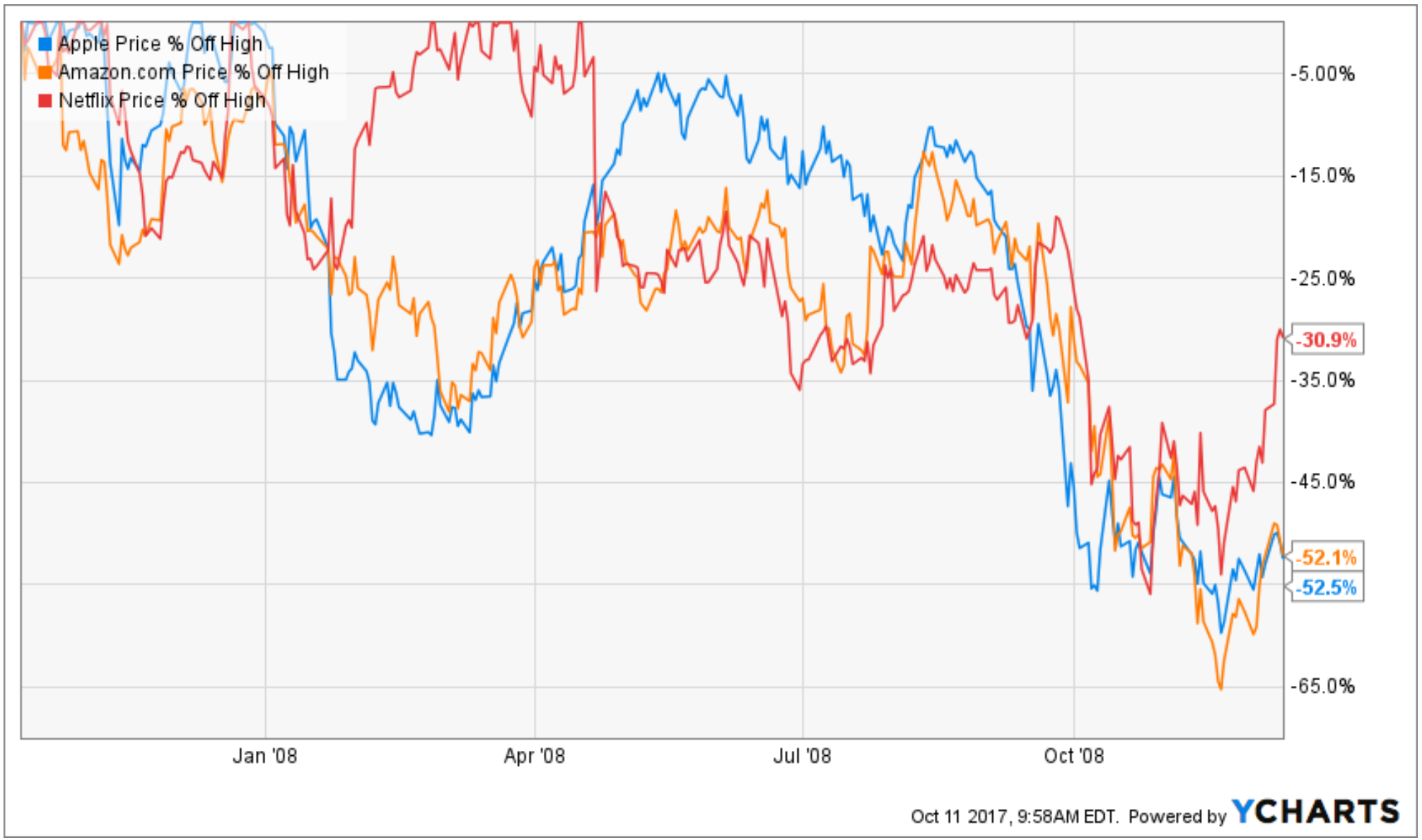

Apple, Amazon, and Netflix are beloved by investors. Those that piled into the popular stocks back in 2007 were rewarded with punishing drawdowns during the financial crisis. Don’t mistake a bull market for genius.

To further drive home the fallacy of naked performance, let’s take a hypothetical look at two investors that each need a total return of ~2% this year (2017):

2017 Year-to-date Results (1/1/2017 – 10/10/2017)

Orange Investor #1: 2.22%

Blue Investor #2: 2.13%

If I’m evaluating (naked) performance for the two securities, the returns look very similar and meet our return objective. Nothing to see here, right? Wrong. Adding a chart of the return path over the 12-month period tells a different story.

In a vacuum, Investor #1’s (orange line) approach is superior in every way. The orange portfolio delivered returns without much movement in the underlying asset. Investor #2 (blue line) found out that their allocation was wildly inefficient (took on added risk that they did not receive compensation for). The above is a simplistic exercise, but highlights that quoting performance without measuring risk is worthless and potentially dangerous.

Action Item: If you’re working with an advisor, ask to see the Sharpe Ratio of your portfolio. The ratio measures return adjusted for risk. The higher the Sharpe Ratio, the more efficient the portfolio.

Make sure you or your advisor are evaluating investment success or failure based on sound portfolio management principles. Don’t assume your portfolio is being managed appropriately just because the market is up. Understand the risk return relationship and the range of potential outcomes based on how you’re invested. When the next pullback happens, you’ll be glad you did.